The market faced resistance as it approached the 1,220-point mark, leading to a slight retreat. Average liquidity across the three exchanges increased by 20%, reaching nearly VND 18,800 billion, indicating a rise in supply without causing significant pressure on the market.

At the close, the VN-Index fell 7.56 points (-0.62%) to 1,208.32, and the HNX-Index dropped 1.22 points (-0.54%) to 226.73. The market breadth was negative, with 257 decliners and 161 advancers.

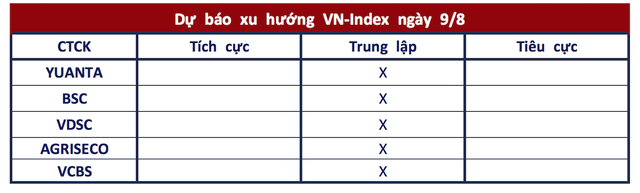

Looking ahead, most securities companies anticipate a continued tug-of-war within the 1,210-1,220 range. Investors are advised to remain cautious about the market’s volatile state and maintain a safe portfolio allocation.

Awaiting Bottom Formation Signals

Yuanta Securities: Investors are waiting for bottom formation signals in the underlying market before increasing their positions.

Continued Tug-of-War in the 1,210-1,220 Range

BSC Securities: The short-term outlook suggests a continued tug-of-war within the 1,210-1,220 range.

Supply Pressure and Downside Risks Remain Latent

VDSC Securities: The market encountered resistance as it neared the 1,220-point level and pulled back. While liquidity increased from the previous session, indicating a rise in supply, it didn’t exert significant pressure on the market. Although capital inflows attempted to support the market around the 200-day moving average and the 1,202-point level, supply has been dominating demand.

The market is expected to maintain its tug-of-war state around current levels in the next session, but supply pressure and downside risks remain latent. Investors are advised to remain cautious, keep a safe portfolio allocation, and consider taking profits or restructuring their portfolios during market recoveries to minimize risks.

Lack of News Leaves Trend Indeterminate

Agriseco Securities: The VN-Index formed a bearish Spinning Top candlestick pattern, indicating investor hesitation after two consecutive recovery sessions. With a continued lack of news, the market trend remains uncertain and will be influenced by international financial markets.

Agriseco maintains its recommendation for investors to hold a high cash position and refrain from aggressive investing. For new investments, focus on leading stocks in the VN30 during sharp market declines.

Accumulation Forms a Solid Support Base in the 1,200-1,220 Area