In their recent report, An Binh Securities (ABS) asserted that despite global unrest, Vietnamese macroeconomic figures remain positive. The PMI sustained an impressive expansionary level of 54.7 for two consecutive months, indicating the manufacturing sector’s remarkable growth rate.

Booming export-import activities and FDI investment, coupled with a weakened US dollar, relieved Vietnam of short-term exchange rate pressure. The State Bank also seized this opportunity to reduce the open market interest rate to support the financial system at the beginning of August. Notably, the SBV refrained from aggressive USD selling interventions, unlike in the previous two months.

The Q2 financial statements of listed companies showcased a robust recovery momentum from the previous quarter. Numerous sectors witnessed substantial profit growth, including Retail, Steel, Securities, Chemicals, and Rubber. Notably, this growth was widespread across various sectors, especially non-financial industries.

In terms of valuation, following the release of Q2 2024 financial results, the VN-Index’s P/E ratio declined from 14.1x at the end of June to 13.8x at the end of July, lower than its 14.14x average over the past year. The expected P/E for the full year 2024 is even lower, as the market’s financial performance is forecasted to continue its recovery in the second half.

Large-cap stocks in the VN30 are currently trading at a P/E of 12.58x, significantly lower than the mid-cap stocks in the VNMID (16.73x) and small-cap stocks in the VNSML (17.38x).

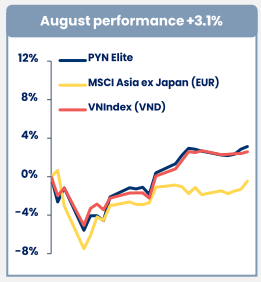

Turning to the stock market performance since late July, Vietnam’s positive macroeconomic landscape has been overshadowed by unfavorable global developments, significantly impacting the world’s stock markets, including Vietnam’s. These factors are anticipated to continue exerting a negative influence on the Vietnamese stock market in the near future.

The market breached the first support level of 1,220-1,240 points in the short-term upward trend. Strong selling pressure pushed the VN-Index into the 1,213-1,266 support zone, confirming a short-term downward trend with a consensus of descending prices and trading volume. ABS forecasts two scenarios for the market in August.

Scenario 1: If, during August, armed conflicts and tensions are resolved and do not escalate, a sideways accumulation pattern is likely to form if the VN-Index holds above the 1,166 mark.

Scenario 2: Conversely, if the weekly closing price fails to maintain the 1,166-point level, the overall market will continue its downward trajectory towards the third support level in the 1,140-1,080 range. These adjustments may occur swiftly and intensely. In such a case, the market’s TTM P/E is expected to become more attractive, falling to the range of 12.6x – 11.9x.

Regarding investment strategy for August, ABS emphasizes the primacy of mid-term risk management. Stock transactions during technical recovery phases should be approached with caution, considering the support levels of both the VN-Index and specific stocks, and awaiting explicit signals confirming the completion of price patterns.