On August 5, HCD shares did not record any matched orders. Taking the closing price of 9,600 VND per share, Mr. Dong’s buy order was valued at an estimated 4.8 billion VND.

On the stock market, the price of HCD shares rose by 50% from the 8,000 VND per share range at the beginning of January to the 12,000 VND per share range at the end of June. Subsequently, the share price of HCD entered a correction phase, bringing the share price back to the 10,000 VND per share range for more than a month, a decrease of 17%.

| Price movement of HCD shares since the beginning of 2024 |

Mr. Nguyen Phuong Dong is a major investor and owner of a large number of shares in Ha Do Group Joint Stock Company (HOSE: HDG), with a value of up to hundreds of billions of VND. According to the writer’s statistics, Mr. Dong currently holds nearly 14.6 million HDG shares, equivalent to 4.77% of the capital.

HCD, formerly known as HCD Metallurgy Joint Stock Company, was established in 2011 and specializes in wholesale of metals and metal ores, production of plastic and synthetic rubber in primary forms, printing, etc. Its headquarters are located in Quang Trung ward, Hai Duong city, Hai Duong province.

HCD Plastic Wood Factory. Photo: HCD

|

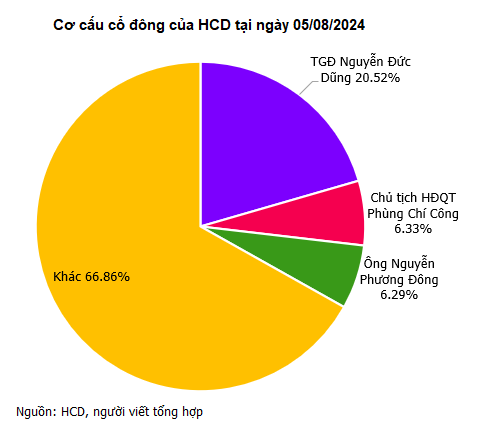

The company’s charter capital is nearly VND 369.6 billion, in which the largest shareholder is General Director Nguyen Duc Dung, holding 20.52%, followed by Chairman of the Board of Directors Phung Chi Cong holding 6.33%, and Mr. Nguyen Phuong Dong holding 6.29%. Notably, Mr. Cong is the brother-in-law of Mr. Dung, and their family currently owns a total of 29.27% of HCD capital.

In terms of business performance, since its first financial report in 2014, HCD’s revenue has consistently exceeded VND 500 billion per year, except for 2014 and 2020 when it fell short of this mark. The company attributed the decline in 2020 to the impact of the COVID-19 pandemic, which caused a significant drop in revenue and a record low net profit of VND 1.4 billion, far below the average profit of VND 25 billion in the previous years.

Post-pandemic, HCD witnessed a strong recovery in the 2021-2023 period, with consistent and stable revenue growth, reaching a peak of VND 913 billion in 2023. The average net profit during this period was over VND 46 billion, with a record high of nearly VND 52 billion in 2023.

| Financial results of HCD from 2014 to 2023 |

In the first six months of 2024, HCD’s net revenue reached nearly VND 419 billion, an 11% decrease compared to the same period last year. However, thanks to a more significant reduction in cost of goods sold, the company’s overall results improved. Ultimately, net income increased by over 37% to nearly VND 23 billion.

For the full year 2024, the company expects to break its profit record, with a net income target of nearly VND 60.8 billion, representing a more than 17% increase compared to 2023. After six months, HCD has achieved just over 37% of its annual profit goal.

In terms of dividend payment history, HCD started paying dividends in 2015 at a rate of 6% in cash (paid at the end of May 2017). Since then, the company has paid dividends intermittently. In the last two years, HCD paid a total dividend of 12% for 2021 (including 5% in cash and 7% in shares) and 10% in shares for 2022. According to the resolutions of the General Meeting of Shareholders, HCD shareholders approved a dividend payment of 13% in shares for the fiscal year 2023.