Illustration

According to preliminary statistics from the General Department of Vietnam Customs, the country’s gasoline exports in June 2024 reached over 123,000 tons, valued at nearly $100 million, a decrease of nearly 40% in both volume and value compared to the previous month.

Cumulative exports in the first six months of the year exceeded 1.15 million tons, with a turnover of more than $961 million, up 1% in volume and 2.6% in value.

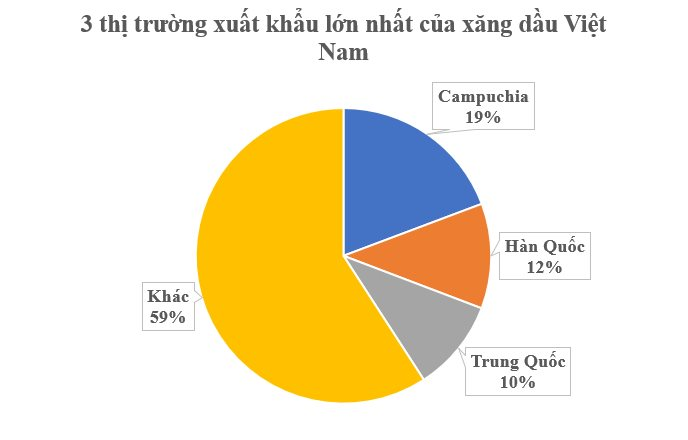

In terms of market, Cambodia was the largest importer of Vietnamese gasoline in the first half, with over 222,000 tons, worth more than $183 million, down 29% in volume and 31.1% in value compared to the same period last year.

South Korea was the second-largest market, with imports of over 132,000 tons of gasoline, equivalent to more than $120 million, up 39% in volume and 33% in value.

China was the third-largest importer of Vietnamese gasoline, accounting for over 10% of the country’s total export volume. In the first six months, Vietnam exported over 116,000 tons to China, with a turnover of over $108 million, up 36% in volume and 35% in value compared to the same period last year.

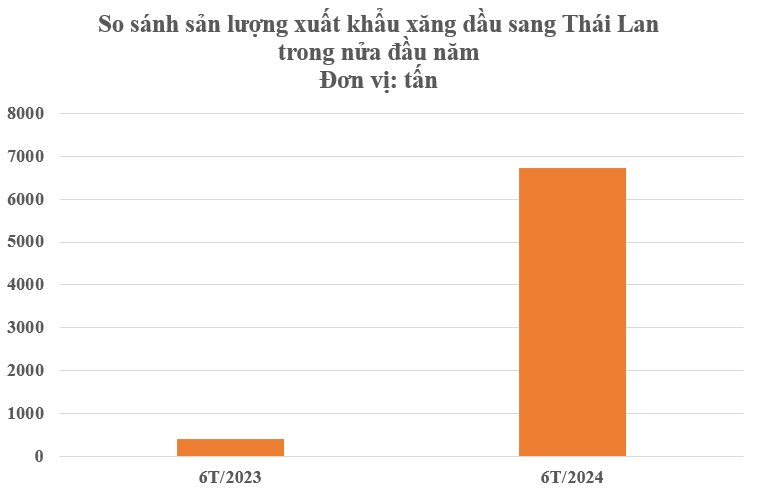

Notably, Thailand is becoming the market with the strongest growth in imports of Vietnamese gasoline in the first half of the year. Specifically, the country imported 6,741 tons of gasoline from Vietnam in the first six months of 2024, compared to only 402 tons in the same period last year, an increase of 1,576%. Export turnover exceeded $6 million, up 1,379% year-on-year.

Although Thailand witnessed the strongest growth, it accounted for less than 1% of Vietnam’s total exports to all markets.

Vietnam currently has two oil refineries, Dung Quat and Nghi Son, which supply 10-13 million cubic meters or tons of gasoline and oil products annually. These two refineries currently supply about 70% of the domestic demand for gasoline and oil, with Nghi Son accounting for about 35%, sometimes up to 40%.

In the global market, Russia has repeatedly banned the export of gasoline and diesel since the end of 2023. However, Moscow lifted this ban in November of the same year. According to the Russian Ministry of Energy, during the two months of the temporary measure, the domestic market experienced a surplus of fuel, and wholesale gasoline and diesel prices on the exchange decreased significantly.

On February 26, Russia continued to approve a ban on gasoline exports for six months, starting from March 1, 2024. These temporary bans by Russia may negatively impact the global market amid concerns about supply, as US refining activities decline and fuel transportation becomes more challenging due to tensions in the Red Sea region.

In 2024, the total minimum gasoline and diesel sources that the Ministry of Industry and Trade allocated to 36 gasoline and oil business traders reached 28,437,856 cubic meters or tons.

According to reports from the two refineries and the General Department of Vietnam Customs, the total gasoline and diesel sources from production and imports in the first six months of 2024 reached 12.41 million tons, equivalent to about 15.2 million cubic meters or tons. Of this total, imports accounted for 44.5%, and domestic production accounted for 55.5%.