Special consumption taxes on alcohol and beer are quite ancient taxes worldwide. A survey of the world situation shows that special consumption taxes increase the budget and contribute significantly to GDP growth and orient production, consumption, and protect the health of the people. The special consumption tax policy for alcoholic beverages also varies from country to country, depending on specific conditions and circumstances.

METHODS OF COLLECTING SPECIAL CONSUMPTION TAXES IN OTHER COUNTRIES

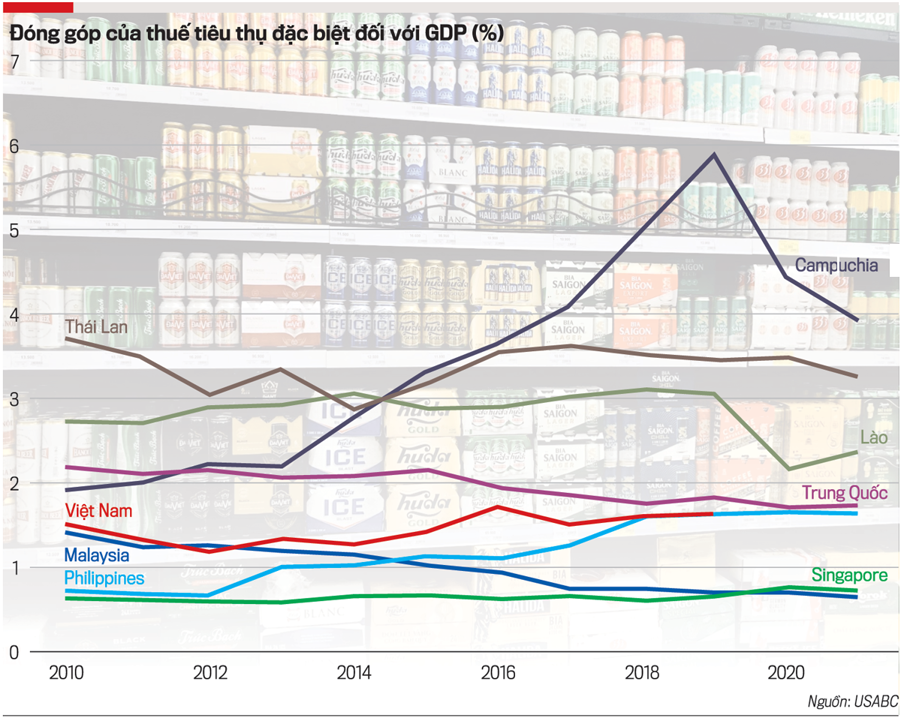

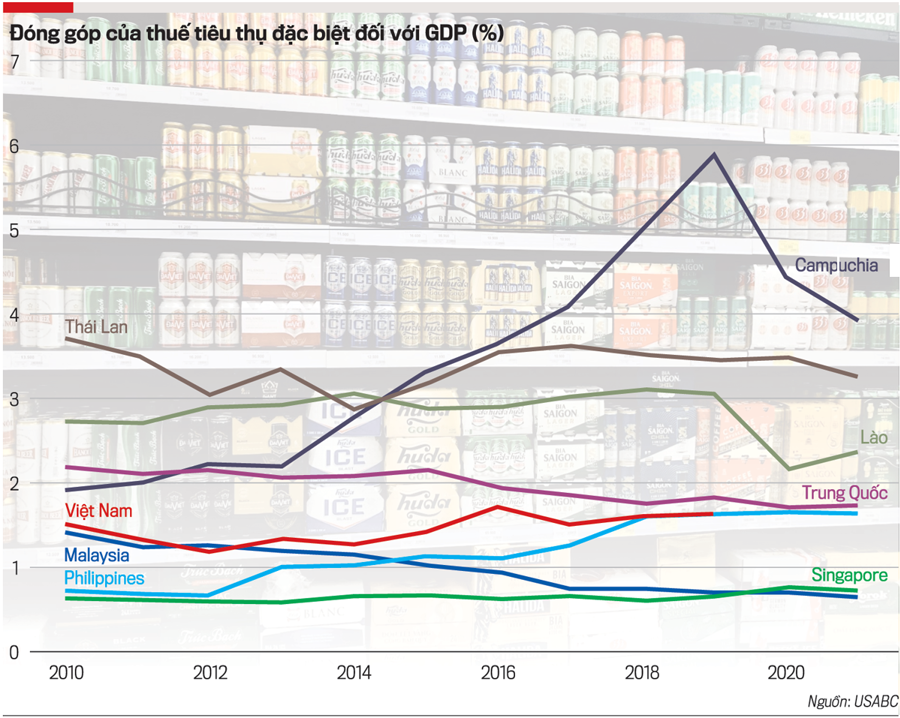

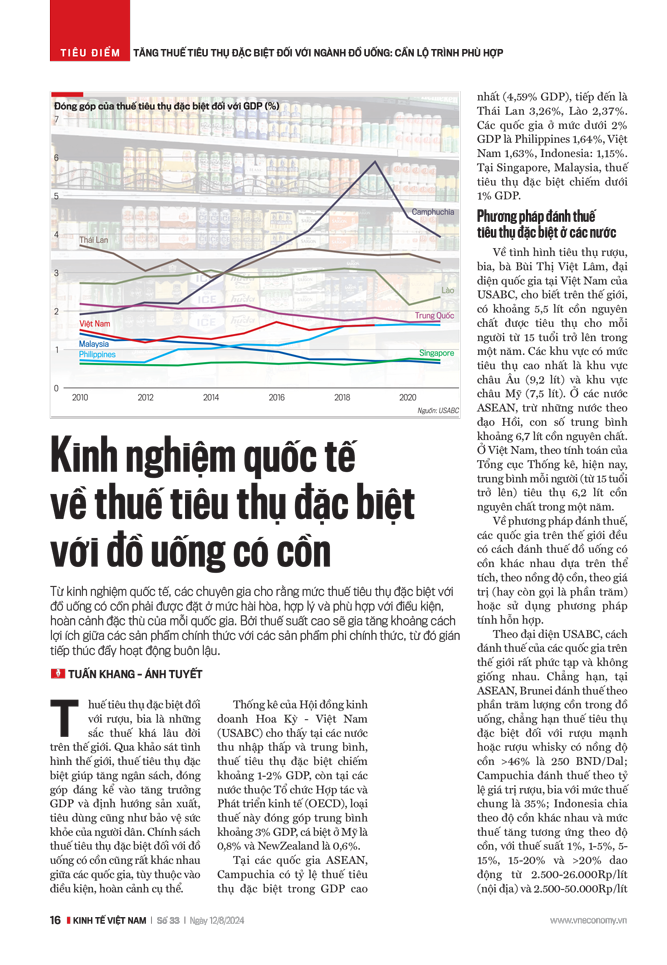

Statistics from the US-Vietnam Business Council (USABC) show that in low- and middle-income countries, special consumption taxes account for about 1-2% of GDP. In the countries of the Organization for Economic Cooperation and Development (OECD), this type of tax contributes on average about 3% of GDP, with the US at 0.8% and New Zealand at 0.6%.

In ASEAN countries, Cambodia has the highest ratio of special consumption taxes to GDP (4.59% of GDP), followed by Thailand at 3.26%, and Laos at 2.37%. The countries with less than 2% of GDP are the Philippines at 1.64%, Vietnam at 1.63%, and Indonesia at 1.15%. In Singapore and Malaysia, special consumption taxes account for less than 1% of GDP.

Regarding the consumption of alcohol and beer, Ms. Bui Thi Viet Lam, USABC’s country representative in Vietnam, said that worldwide, about 5.5 liters of pure alcohol are consumed per person aged 15 and older per year. The regions with the highest consumption are Europe (9.2 liters) and the Americas (7.5 liters).

In ASEAN countries, except for those in the Islamic faith, the average is about 6.7 liters of pure alcohol. In Vietnam, according to calculations by the General Statistics Office, the average person (aged 15 and older) consumes 6.2 liters of pure alcohol per year.

In terms of taxation methods, countries around the world have different ways of taxing alcoholic beverages based on volume, alcohol content, value (or percentage), or using a mixed calculation method.

According to the USABC representative, the way countries tax is very complex and not the same.

For example, in ASEAN, Brunei imposes taxes based on the percentage of alcohol in the beverage, such as the special consumption tax on spirits or whiskey with an alcohol content of >46% is 250 BND/Dal.

Cambodia imposes taxes based on the value ratio of alcohol with a general tax rate of 35%.

Indonesia is divided into different alcohol levels, and the tax rate increases correspondingly with the alcohol content, with tax rates of 1%, 1-5%, 5-15%, 15-20%, and >20% ranging from 2,500-26,000Rp/liter (domestic) and 2,500-50,000Rp/liter (imported).

Laos applies 50% to beer, 60% to wine, and 70% to spirits >15O.

A notable case is Thailand, which has the highest ratio of special consumption taxes to GDP in ASEAN, but applies a rather complex tax calculation method, based on both alcohol content and retail price of alcohol. However, from February 23, 2024, Thailand significantly reduced taxes on alcohol to stimulate tourism.

“Thus, through the survey, it can be seen that special consumption taxes on alcoholic beverages vary in different countries depending on economic, cultural, social, and income factors, as well as policies on the legal drinking age, import taxes on informal products, etc. Therefore, depending on the appropriate conditions and circumstances, countries will have choices in the level of special consumption taxes on alcoholic beverages and achieve their goals,” said Ms. Lam.

WIDENING THE PRICE GAP BETWEEN LEGAL AND ILLEGAL PRODUCTS

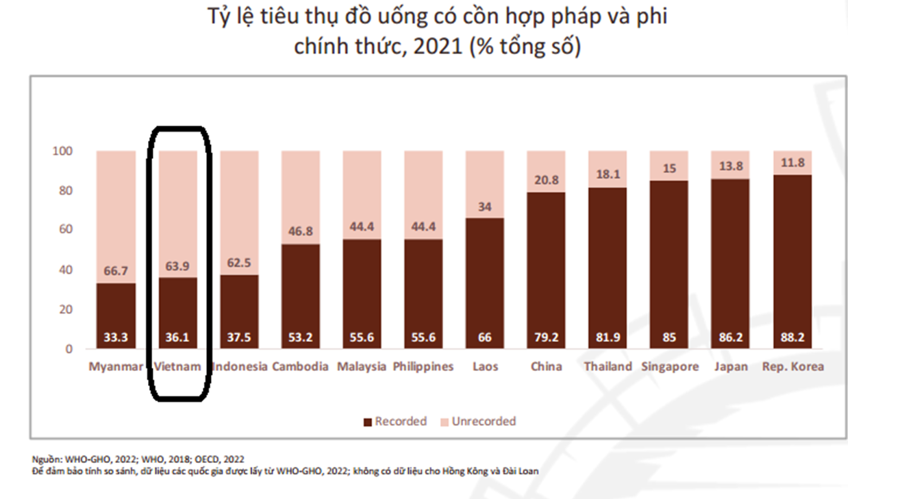

With the situation of informal alcohol and beer, many studies have shown that this is not only a problem in Vietnam but also a global problem. According to a global study on illegal alcohol by Euromonitor, one in four bottles of alcohol is illegal, accounting for 25% of total global consumption.

In addition to serious health risks for consumers, the illegal alcohol trade also causes significant losses in budget revenue. For the industry, the main impacts are related to market share loss, costs associated with intellectual property theft, reputation damage, and loss of consumer trust.

Analyzing the causes of the situation of informal alcohol and beer, Ms. Bui Thi Viet Lam said that part of it stems from people’s awareness.

However, a more important reason stems from the limitations and strict regulations on legal products, such as bans on advertising and marketing, bans or restrictions on sales hours and locations, production licenses, tax stamps, product labeling, compliance with quality standards, etc. The penalties for illegal alcohol and beer are not deterrent and disproportionate.

“The price gap between legal and illegal products is also too large, as legal products are taxed much higher than illegal products. If the special consumption tax is increased, it will promote the consumption of illegal alcohol and beer,” said Ms. Lam.

Citing the Laffer Curve principle, Ms. Olivia Widen, representative of the Asia-Pacific International Spirits & Wine Alliance (APISWA), said that there is a limit, and when taxes are too high, beyond a certain point, it will reduce the total budget of the government.

Because when applying a very high tax rate to prohibit consumption, it leads to many cases of switching to the use of less taxed alcoholic beverages, or increasing tax evasion through smuggling, counterfeiting, illegal production, and bookkeeping fraud. The trend towards the production and consumption of informally self-brewed alcohol and beverages, as well as cross-border shopping by buying alcoholic products abroad and paying taxes in those countries, is also stronger.

“Informal trade accounts for about 25% of global consumption. However, it is important to note that this figure is significantly higher for low-income countries, as the high rate of smuggling is closely correlated with affordability. We find that price and affordability are considered the main drivers of informal alcohol consumption in low-income countries. Higher tax rates on spirits are decisive for the increase in illegal trade, and higher selling prices to consumers increase the profit margin of counterfeit and smuggled alcohol,” said Ms. Olivia Widen.

Also, according to Ms. Bui Thi Viet Lam, when the UK government increased taxes by 10.1% in 2023, much lower than the proposed draft Law on Special Consumption Tax (amended) in Vietnam, the country experienced inflation and a 20% drop in spirits sales, resulting in a loss of up to £108 million in tax revenue from spirits sales in less than six months.

As a result, the UK government suspended the tax increase at the end of 2023 to deal with the reduction in tax revenue from alcoholic beverages as well as to reduce the pressure of rising living costs.

CONCERN ABOUT THE DOMINO EFFECT, MANY COUNTRIES HAVE INCREASED TAXES

Malaysia also experienced a tax shock in 2015 when it consecutively increased special consumption taxes. The tax increase did not support the government in achieving its goals but instead created a negative domino effect in the market, causing a loss of government revenue, leading to the closure of many factories and job losses…

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.

Vietnam Economy 2024: Reaching New Heights

Vietnam has set a target to achieve an economic growth rate of 6-6.5% in 2024 – the Year of the Dragon. Our goal is within reach when compared to the growth forecasts of reputable global economic organizations such as the International Monetary Fund (IMF), the World Bank (WB), and the Asian Development Bank (ADB). Just like a cable car system, Vietnam’s economy has only one direction – moving forward, aiming for even greater heights.