In an interview, Mr. Nguyen Ngoc Chuc, CEO of StockTraders – with over 17 years of experience in the securities industry, shared his insights on the benefits of using a stock analysis app. He believes that such tools can help investors overcome the limitations of traditional analysis: “Manual analysis can be time-consuming and tedious, making it challenging to analyze multiple stocks and stay on top of the market. It also relies heavily on one’s experience and emotions, which can lead to subjective and impulsive decisions.” Mr. Chuc added, “In contrast, analysis apps, powered by technology and algorithms, are not constrained by human emotions or limitations in productivity and time.”

How can investors choose an effective stock analysis app?

With a plethora of new stock analysis apps flooding the market, investors may find it challenging to select the right one. Drawing from his extensive experience, Mr. Chuc outlined three critical levels to assess the effectiveness of such applications:

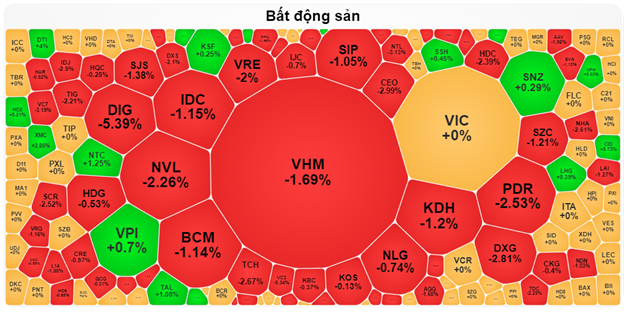

Level 1 – Description: The app should be able to describe and provide statistics on market movements and fluctuations.

Level 2 – Analysis: Based on the described statistics, the software should be capable of analyzing and interpreting the reasons behind those market movements.

Level 3 – Prediction: Utilizing the analysis results, the app should forecast market trends and provide effective investment recommendations.

However, to fully understand the signals and recommendations provided by the app, investors need to have a solid foundation of knowledge and grasp the investment principles employed by the application. Mr. Chuc pointed out that while many stock analysis apps offer a multitude of signals, they often lack specific principles, which can overwhelm investors with too much information, making it challenging to discern truly valuable insights.

AI Integration – StockTraders Empowers Investors with Sharp Investment Philosophy

AI StockTraders, with over 11 years of presence in Vietnam, has become an indispensable tool for numerous investors, boasting a remarkable 70% customer retention rate.

What sets AI StockTraders apart is its three distinct and clear investment philosophies: Trading at the Wave’s Foot, Following Leading Industry Waves, and Adhering to Capital Allocation Strategies.

Mr. Nguyen Ngoc Chuc, CEO of AI StockTraders, elaborated on one of these philosophies: “When the market forms a bottom and starts to rise, 80-90% of stocks tend to follow the overall upward trend. Therefore, if investors can buy at the right time, their chances of picking winning stocks increase significantly. This is why AI StockTraders introduced the principle of ‘Trading at the Wave’s Foot,’ sending signals to predict market bottoms and providing investment recommendations accordingly. Additionally, the app includes historical data charts to help users understand this investment philosophy.”

The features of AI StockTraders are built upon these three core principles, allowing users to customize their experience according to their preferred investment approach. Users won’t be overwhelmed by information overload as all signals received are highly relevant to their investment decisions.

Ms. Tran Trang, a securities broker from Ho Chi Minh City, shared her experience with using AI StockTraders. She used to spend a considerable amount of time and effort on fundamental and technical analysis. However, after discovering AI StockTraders, she found a more efficient approach: “Instead of relying solely on visual analysis, StockTraders helps me predict the market more accurately and logically. Combining the app with my knowledge, my predictions are rarely wrong. I feel much more confident when advising my clients, sometimes even wanting to keep the app to myself! *laughs*.” Ms. Trang revealed, “For instance, during the market bottom of 1,020 points on November 1, 2023, I was able to timely advise my clients thanks to the alert signal from StockTraders. As a result, within just one month, my clients’ accounts saw impressive profit increases ranging from 30-50%.”

After using AI StockTraders for over three years, Ms. Trang expressed her satisfaction with the app’s real-time alert and market wave-catching features, which allowed her to stay on top of market movements 24/7 without constant monitoring. Additionally, she found the app’s industry wave prediction and intelligent capital allocation strategies extremely useful in minimizing losses and optimizing profits.

With a customer-centric approach, StockTraders has introduced a free email service, providing investors with the latest market knowledge and information.

Subscribe to their email newsletter here: Link