Petrochemical and Fertilizer Corporation (Phu My Fertilizer Joint Stock Company, code: DPM) has just announced that August 22, 2024, will be the record date for the 2023 cash dividend payment, with a ratio of 20% (1 share will receive VND 2,000). The payment date is expected to be September 24, 2024.

With more than 391 million shares outstanding, this fertilizer company will have to spend approximately VND 783 billion on dividend payments.

Thus, Phu My Fertilizer has completed its 2023 dividend plan approved by shareholders at the Annual General Meeting. The dividend rate for 2024, as agreed upon at the meeting, is 15%.

According to the Q2/2024 financial report, Phu My Fertilizer recorded a slight increase of 6% in net revenue compared to the same period last year, reaching VND 3,948 billion. After deducting the cost of goods sold, the company reported a gross profit of VND 545 billion, a significant increase of 40% compared to Q2/2023.

Net income after tax was nearly VND 236 billion, an increase of 124% over the same period last year. Net income after tax attributable to the company’s shareholders was approximately VND 231 billion, up nearly 129% over the same period in 2023.

In the first half of 2024, DPM recorded net revenue of VND 7,255 billion and net income after tax of VND 503 billion, up 4% and 37%, respectively, compared to the same period last year.

For the full year 2024, Phu My Fertilizer set a target of VND 12,755 billion in revenue and VND 542 billion in net income. After the first half, the company has achieved 57% of its revenue target and 93% of its net income target.

As of June 30, 2024, Phu My Fertilizer’s total assets were VND 15,740 billion, an increase of 18% from the beginning of the year (equivalent to an increase of VND 2,431 billion). This mainly comprised short-term assets valued at VND 12,250 billion. Cash, cash equivalents, and deposits exceeded VND 9,700 billion, accounting for 62% of total assets. This figure is nearly VND 3,100 billion higher than at the beginning of the year.

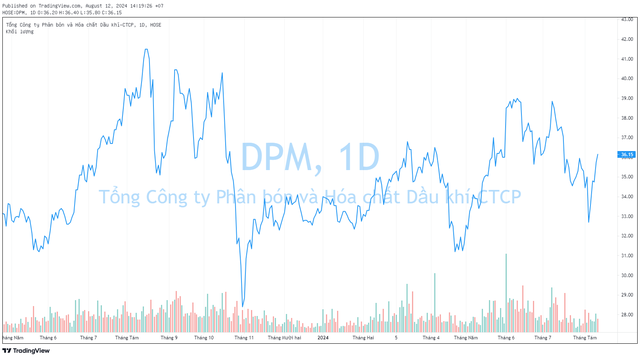

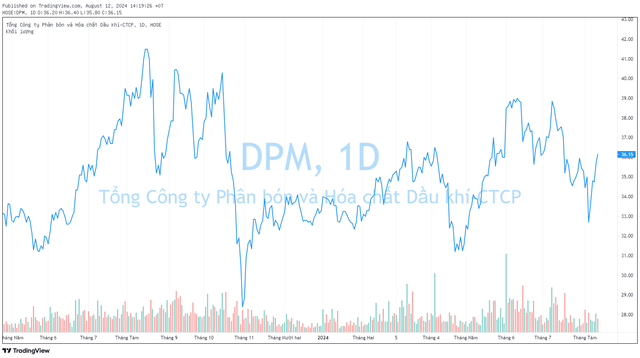

In the market, DPM shares are currently trading at VND 36,150 per share, 6% higher than the price range at the beginning of the year.

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.