The latest residential market data for July 2024 from DXS-FERI reveals three notable trends among home buyers.

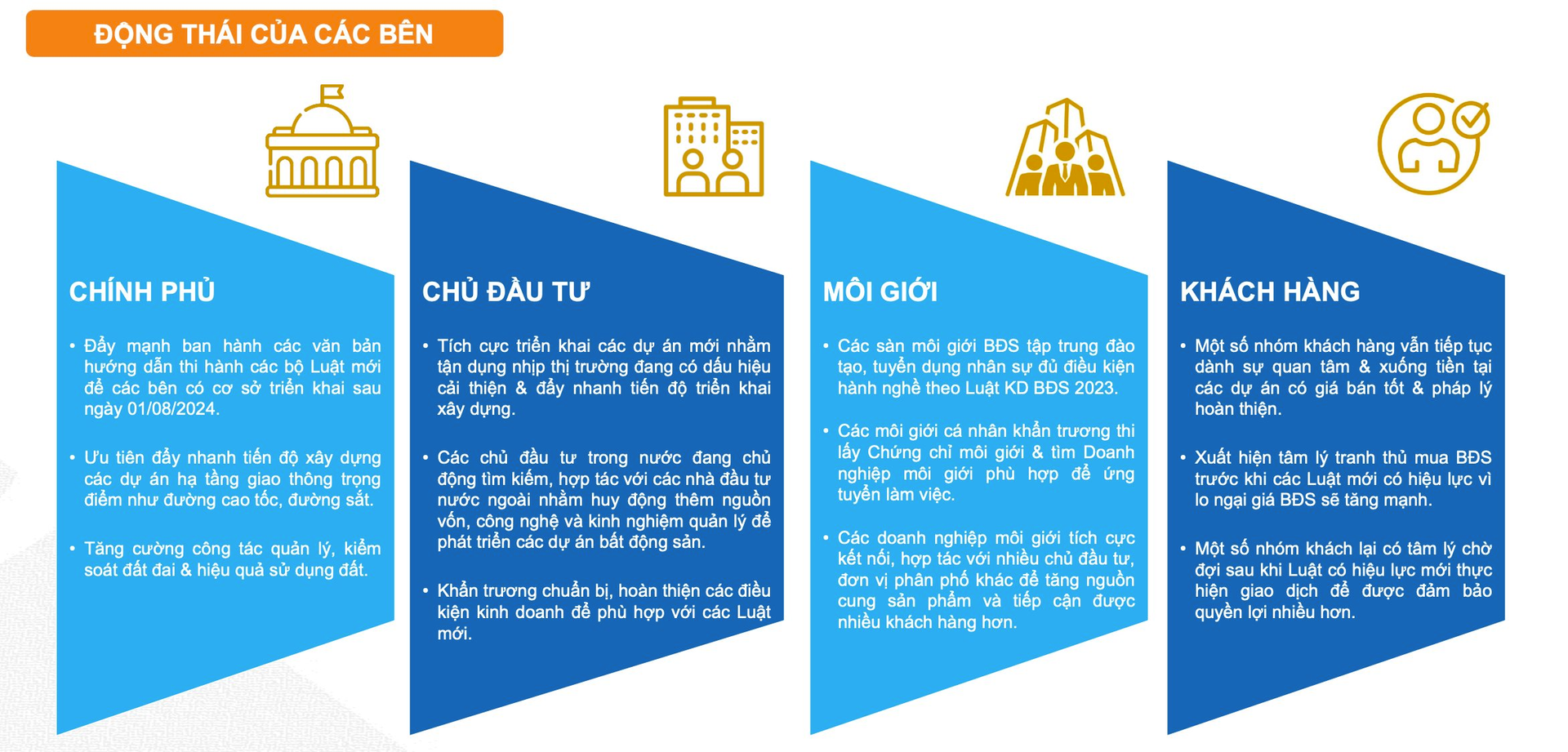

Firstly, some groups of customers continue to show interest and invest in projects with competitive prices and complete legal documentation. Secondly, there is a growing sense of urgency among buyers who want to purchase real estate before the new laws come into effect, fearing price increases. Thirdly, some buyers prefer to wait until the new laws are implemented to ensure better protection of their rights.

According to DXS-FERI, compared to June 2024, the absorption rate of new real estate supply in July 2024 experienced a slight dip of 5%, currently averaging 50-55%.

The real estate market is witnessing positive signals from all sides.

In tandem, developers and brokerage firms are actively finalizing their preparations and strengthening their internal capabilities to embrace the new era of the market as the new laws take effect from August 1, 2024. A cautious and observant approach will dominate the initial phase as the laws are not yet fully operational. Hence, transactions will primarily occur in projects offering reasonable prices, affordable options, solid legal frameworks, reputable developers, and guaranteed construction progress.

“Buyers’ confidence has markedly improved due to the resolute and positive actions taken by both the government and businesses to implement the new laws, prioritizing the protection of homebuyers’ rights,” emphasized DXS-FERI’s representative.

Recently, Nam Long’s completed Flora Panorama (located in Mizuki Park) and soon-to-be-completed Akari City (in West Ho Chi Minh City) have maintained a steady pace of interested customers and sales. Akari City, situated on Vo Van Kiet Avenue, boasts not only an attractive location and competitive prices but also stands out as a rare supply in Ho Chi Minh City during this period. Furthermore, the project benefits from the developer’s supportive payment policies. Specifically, buyers need only 30% of the apartment value as their own capital, with the remaining 70% financed by the bank, offering an interest-free period of 18 months and a 24-month grace period for principal repayment. Alternatively, customers who opt out of this policy will receive a direct discount of 10% on the selling price.

In the neighboring province of Binh Duong, the soon-to-be-handed-over Phu Dong Sky Garden apartment project has witnessed an increase in demand thanks to its reasonable prices, complete legal framework, and attractive sales policies offered by the developer, Phu Dong Group. They have recently introduced a rental guarantee policy, pledging to rent back the apartments for a total value of up to VND 432 million over three years, equivalent to VND 12 million per month. Customers need not furnish the apartments with anything other than the fittings provided by the developer. On top of that, buyers also receive a gift worth 5% of the apartment value as a token of appreciation from the developer.

The DXS-FERI survey also reveals a significant shift in buyer psychology. Specifically, 79% of customers prioritize buying for their own residence, while the remaining 21% buy for investment purposes, indicating a growing focus on the actual value of the product. Moreover, the developer’s reputation remains a crucial factor, with 75% of buyers prioritizing it, while only 25% are attracted by high discount policies.

Notably, project legalities are gaining prominence, accounting for 17% of the factors influencing real estate purchases, reflecting buyers’ concerns amidst market fluctuations.

According to Vo Huynh Tuan Kiet, Director of CBRE Vietnam, the new laws strengthen the protection of homebuyers and promote the participation of reputable and financially robust developers in the market. Consequently, there has been a “resolute” shift in buyer behavior.

Additionally, the new Land Law will replace the concept of a price framework with a land price list. This list will be updated annually based on market prices. Ho Chi Minh City’s new land price list, expected to increase by 5-51 times depending on the area, will be urgently applied to keep pace with the new laws taking effect from August 1.

As a result, according to Mr. Kiet, land use fees and other costs for real estate projects will rise. This development will also influence the behavior of homebuyers. Many understand that real estate prices cannot be reduced in the future, so they start hunting for properties while the new laws are in their initial phase, awaiting guiding circulars.

In the context of the real estate market’s incomplete recovery, scarce supply, and the ongoing pandemic, completed apartment projects in Ho Chi Minh City and neighboring provinces like Binh Duong and Dong Nai continue to attract end-users and long-term rental investors.

Notably, the fluctuations of the previous period have taught customers and investors to set stricter requirements when buying properties. Currently, buyers show a stronger preference for soon-to-be-handed-over apartments over those in the future. People have been making quicker decisions regarding projects that offer a combination of favorable factors, including price, location, and quality of handover…

Chinese citizens flock to buy 280 tons of gold, realizing real estate and stocks are no longer a good investment channel

Regardless of the global decline in demand for gold, the purchasing power of Chinese citizens has propelled the price of gold to surpass the $2,000 per ounce threshold in 2023.