In Q2 2023, the average piglet price in Vietnam surged to a yearly peak of VND 55,000/kg. However, prices subsequently plummeted, bottoming out around VND 45,000/kg before rebounding to approximately VND 49,000/kg in Q4 2023.

In 2024, the situation reversed. In Q1, piglet prices soared past VND 60,000/kg and remained elevated around VND 65,000/kg in Q2, an 18% year-on-year increase. This price hike brought much-needed relief to the pig farming industry, with several companies reporting improved financial performance in the first half of the year.

|

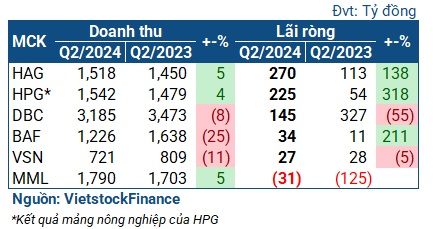

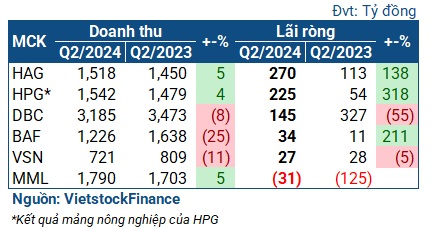

Financial performance of pig farming companies in Q2 2024

|

Leading the pack in terms of profitability was HAG, owned by “Bầu Đức,” with a net profit of VND 270 billion in Q2, nearly 2.4 times higher than the previous year. However, this increase was primarily driven by their fruit exports, particularly bananas, which generated over VND 1,100 billion in revenue, double the previous year’s figure.

HAG’s pig farming segment brought in VND 320 billion in revenue in Q2, a 28% decrease year-on-year. Nonetheless, their gross profit improved significantly by 68%, reaching VND 86 billion, as cost of goods sold decreased by 40%, likely due to lower feed costs.

| Financial performance of HAG |

Ranking second was the agricultural segment of HPG, which experienced growth in both revenue (VND 1,542 billion, up 4%) and profit (VND 225 billion, four times higher than the previous year) in Q2. This segment contributed the second-highest profit for HPG, four times higher than their real estate business and only surpassed by their core steel business.

BAF also stood out in Q2, despite a 25% decline in revenue. The company, known for its “vegetarian pigs,” recorded a net profit of VND 34 billion, three times higher than the previous year. Notably, the revenue decrease was due to BAF’s decision to scale back its agricultural produce sales, while their pig farming segment witnessed remarkable growth, with revenue increasing by 4.7 times year-on-year.

According to the company, their ability to produce their own feed from two vegetarian feed mills and the lower feed costs in the second half of 2023 contributed to a reduction in cost of goods sold. As a result, their gross profit margin improved from 5.8% to 14.2%.

| BAF’s improved profitability in Q2 2024 |

On the other hand, Dabaco (HOSE: DBC) experienced a setback, with profits plunging by 55% to VND 144 billion. This decline was largely due to a one-off real estate revenue of VND 754 billion in Q2 2023. Additionally, their pig farming business was impacted by fluctuations in feed prices and the complex situation of African Swine Fever (ASF).

| Financial performance of Dabaco |

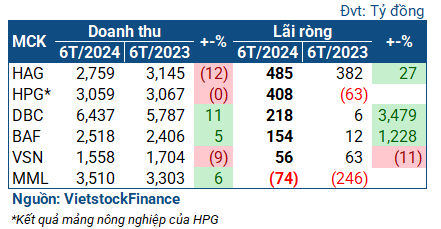

Despite the mixed performance in Q2, the pig farming industry, as a whole, fared well in the first half of 2024. HAG recorded a net profit of VND 485 billion, a 27% increase, while HPG’s agricultural segment turned a substantial profit of VND 408 billion, compared to a loss of VND 63 billion in the previous year. Dabaco’s profit reached VND 218 billion, a significant improvement from the VND 6 billion profit in the same period last year, and BAF’s profit soared to VND 154 billion, thirteen times higher than the previous year.

In contrast, VSN reported negative results in the first half, with a net profit of VND 56 billion, an 11% decrease. This was attributed to lower sales volume, and as a food processing company, VSN was adversely affected by the higher piglet prices compared to the previous year.

Masan Meatlife (UPCoM: MML) remained the only company to report a loss, with a net loss of VND 74 billion in the first half of the year. However, this represented a significant improvement from the previous year’s loss of over VND 246 billion, thanks to profit sharing from its subsidiaries, recorded as financial income.

|

Financial performance of pig farming companies in the first half of 2024

|

Questions about explosive growth potential

Since Q1 2024, with the upward trend in piglet prices, the pig farming industry has garnered high expectations. Several securities companies and businesses predicted that the average piglet price in Vietnam could reach VND 70,000/kg in Q2. For instance, MBS forecasted prices to reach VND 75,000/kg, citing it as a growth driver for pig farming companies due to a domestic supply shortage. Additionally, the feed segment was expected to remain stable, benefiting from low and stable raw material prices and an increase in herd replacement rates, resulting in a projected 5% growth in feed consumption compared to 2023.

Sharing a similar outlook, TPS anticipated rising piglet prices due to strong demand and insufficient supply as farmers were still in the process of herd replacement following the ASF outbreak. They expected prices to climb to VND 70,000/kg by the end of Q2 as farmers and smallholders needed time to rebuild their herds, with new supply expected to enter the market by the end of the year.

However, since Q2, piglet price movements have not met these optimistic expectations. The upward trend has shown signs of slowing down, and prices have even decreased slightly. As of August 12, the average piglet price in Vietnam stood at VND 63,400/kg. Consequently, the anticipated substantial growth for the pig farming industry, based on earlier price projections, now seems challenging to attain if the current price trend persists.

Nonetheless, the pig farming industry’s growth potential remains stable in the medium to long term. According to TPS, Vietnam is among the top pork-consuming countries in Asia. In 2023, pork consumption reached 27.7 kg/person/year, and the USDA forecasts Vietnam’s pork consumption to reach 3.8 million tons in 2024, a 3.9% increase from 2023. The USDA also predicts that Vietnam will be one of the fastest-growing markets for pork consumption in the 2023-2030 period, with an expected growth rate of 30%.

The feed market also presents a positive outlook. As Vietnam relies largely on imported raw materials for feed production, accounting for approximately 65% of the total domestic demand, stable raw material prices bode well for the industry. TPS believes that the prospects for domestic feed production are very promising. As consumers’ income rises, there will be a higher demand for animal protein, driving up feed consumption. Additionally, the shift towards farm-based livestock farming creates opportunities for the industrial feed production sector.

In the short to medium term, well-established farming companies with efficient disease control measures will benefit from having pigs ready for sale. Smallholder farmers, who currently dominate the market, are the most affected by the ASF outbreak.

“When pig prices are low, farmers may not have sufficient capital for herd replacement, especially if they suffered losses from the previous ASF outbreak. Moreover, adopting industrial farming practices requires significant investment (nearly VND 200 billion) in building biosecure farms. If not properly designed and implemented, the risk of disease outbreaks remains high, leading to potential losses and further hindering herd replacement efforts, thus creating a supply shortage. In this scenario, well-established farming companies with healthy herds will have a competitive advantage,” said Mr. Ngo Cao Cuong, CFO of BAF.

Châu An