The VN-Index just experienced a rather dull trading session in terms of both index performance and liquidity. The benchmark index struggled for most of the trading day before a slight recovery towards the end. At the close of the August 13 session, the VN-Index edged up 0.14 points to 1,230.42. Liquidity remained low, with the trading value on HoSE reaching only VND 13,081 billion.

In this context, foreign investors’ net buying was a positive factor, with a net purchase of nearly VND 320 billion in the overall market, marking the third consecutive net buying session.

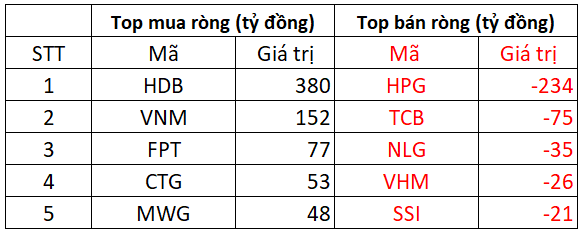

On the HoSE, foreign investors net bought VND 324 billion

In terms of net bought stocks, HDB continued to be the focus of foreign investors with a net buy value of VND 380 billion after net buying over VND 200 billion in the previous session. Following HDB, VNM was also strongly bought with VND 152 billion. FPT, CTG, and MWG were the next best-bought stocks, with net buys ranging from VND 48 to 77 billion.

On the other side, HPG faced the strongest selling pressure from foreign investors with nearly VND 234 billion. TCB and NLG were also net sold with VND 75 billion and VND 35 billion, respectively.

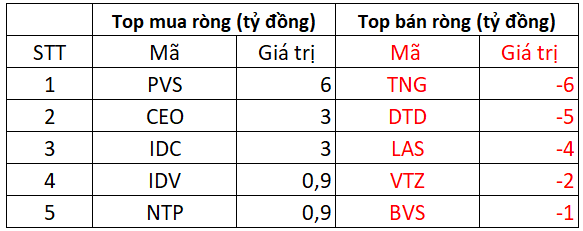

On the HNX, foreign investors net sold VND 6 billion

In terms of net sold stocks, TNG was net sold by foreign investors with nearly VND 6 billion. DTD and LAS were also net sold with VND 5 billion and VND 4 billion, respectively. Additionally, foreign investors net sold VTZ, BVS, and a few other stocks.

On the buying side, PVS was net bought with VND 6 billion. CEO and IDC were also net bought with VND 3 billion each.

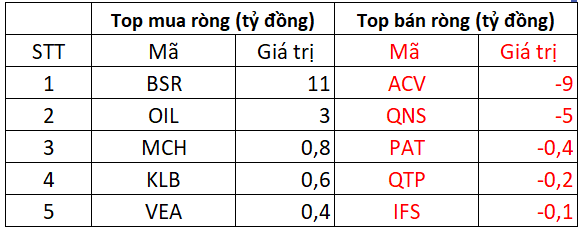

On the UPCoM, foreign investors net bought slightly with VND 2 billion

On the selling side, ACV faced the most significant net selling pressure from foreign investors with a value of nearly VND 9 billion. QNS, PAT, and QTP were also net sold, ranging from a few hundred million VND to a few billion VND.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”