Technical Signals for VN-Index

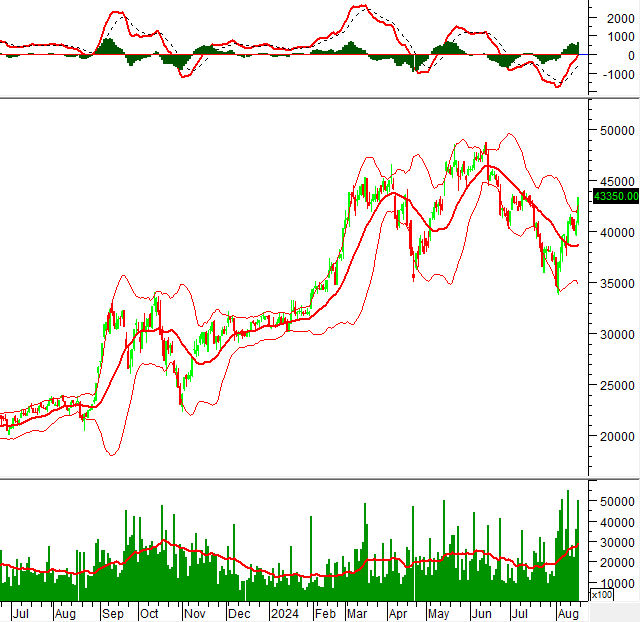

In the morning trading session of August 16, 2024, the VN-Index witnessed a strong upward surge and formed a White Marubozu candlestick pattern. This was accompanied by a significant volume breakout in the morning session, indicating a resurgence in investor activity. The index is expected to close above its 20-day average volume, signaling heightened market enthusiasm.

Currently, the VN-Index has climbed above the Middle Bollinger Band, while the Stochastic Oscillator continues its upward trajectory after generating a buy signal. This combination suggests a prevailing bullish outlook for the market.

Technical Signals for HNX-Index

On August 16, 2024, the HNX-Index witnessed a substantial increase and formed a Bullish Engulfing candlestick pattern, indicating a potential shift in market sentiment. The volume for this session is expected to surpass the 20-day average volume by the end of the day, reflecting the growing optimism among investors.

Additionally, the Stochastic Oscillator maintains its upward trajectory after providing a buy signal, and the index is retesting the Fibonacci Retracement level of 38.2% (corresponding to the 228-235 point region). Should the HNX-Index successfully breach this level, it would establish a strong support zone for future sessions.

During the morning session of August 16, 2024, FTS exhibited notable strength and formed a candlestick pattern resembling a White Marubozu. This formation occurred alongside a substantial increase in trading volume, which settled above the 20-day average volume. This combination underscores the prevailing optimism among investors.

Furthermore, the MACD indicator is trending upward and has crossed above the zero line, generating a buy signal. This development reinforces the prospects of a sustained recovery for FTS in the upcoming sessions.

MWG – Mobile World Investment Corporation

On the morning of August 16, 2024, MWG witnessed a price increase and established a new 52-week high. The volume for this session is anticipated to surpass the 20-day average volume, reflecting the optimism among investors. This development suggests that the stock is being actively traded and that investors are confident in its prospects.

Additionally, the MACD indicator continues its upward trajectory and remains above the zero line, providing a buy signal. The price action has also formed a series of higher highs and higher lows, reinforcing the likelihood of the medium-term uptrend persisting in the foreseeable future.

Technical Analysis Team, Vietstock Consulting