|

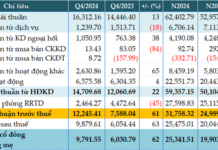

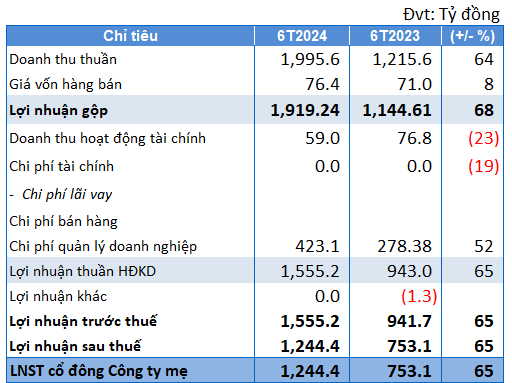

Financial Results for the First Half of VNX

Source: VNX

|

The Exchange’s total revenue from main operations reached VND 1,995 billion, up 64% over the same period. The Exchange’s revenue sources are mainly from securities trading services, reaching VND 1,870 billion in the first 6 months, up 70% over the previous year.

In addition, VNX also has revenue from financial activities, of which 95% is interest income (VND 56 billion).

The main expenses come from management fees, at VND 423 billion, up 52% over the same period. Of which, the largest part is the supervision fee paid to the State Securities Commission (VND 296 billion).

In addition, income payments to the management team also increased more than doubled over the same period, reaching over VND 2.8 billion in the first 6 months.

In the first half of this year, VNX reported a post-tax profit of over VND 1,240 billion, up more than 65% over the same period last year.

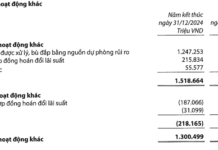

As of June 30, VNX had VND 2,068 billion in bank deposits with terms of 6-12 months. At the same time, the Exchange is holding VND 688 billion in cash, non-term deposits, and cash equivalents.

VNX’s total assets reached over VND 4,166 billion. In addition to deposits, the Exchange also has construction in progress worth more than VND 500 billion. This is the purchase of computer equipment for the construction project at HoSE.

This year, VNX sets a target of nearly VND 2,800 billion in total revenue and a post-tax profit of over VND 1,420 billion. After only 6 months, VNX has achieved 71% of its revenue target and 87% of its post-tax profit target.

Yến Chi

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.