The sudden explosive growth over the weekend came right after three hesitant sessions of the market hovering around the technical resistance threshold. This development has put investors who had prematurely closed their positions and those who had not bought yet at a sudden disadvantage…

The experts interviewed by VnEconomy shared the consensus that the unexpected sharp increase in the last session was a session that met the criteria of a momentum burst. This implies a high probability of the market continuing its upward trajectory. The rapid and robust growth is also considered an action to shake off short-term speculators, especially when the data showed that before Friday’s session, individual investors were net sellers on a fairly large scale.

What is needed now is action. Experts advise that investors can still buy at chasing prices, but stock selection is essential. Speculative stocks that have risen quickly are likely to be a trap for chasing prices. It is safer to choose stocks that have not increased much and are still in the base-building process, although they may be slower in pace.

In line with the assessments of the market, most experts have also significantly increased their stock proportions, and some have even used margin for short-term purposes. However, most still evaluate that after the explosive growth session last week, the market will not be able to continue to increase at a large intensity and may even stagnate to form a base. Therefore, maintaining a certain cash proportion will create opportunities to buy stocks that have price retracements.

Nguyen Hoang – VnEconomy

The unexpected breakout session at the end of the week went along with very high liquidity compared to the recent average. It seems that investors were waiting for a “test” dip to buy but could not restrain their impatience? Were you surprised by this explosive development when the VN-Index had its most substantial increase in the last four months?

The trading session at the end of the week met the conditions to establish a momentum burst with a sudden surge in liquidity, an increase of more than 2%, and strong money flow diffusion. Technically, this will be a significant boost for the VN-Index’s recovery momentum.

Mr. Nghiem Sy Tien

Mr. Nghiem Sy Tien – Investment Strategy Analyst, KBSV Securities

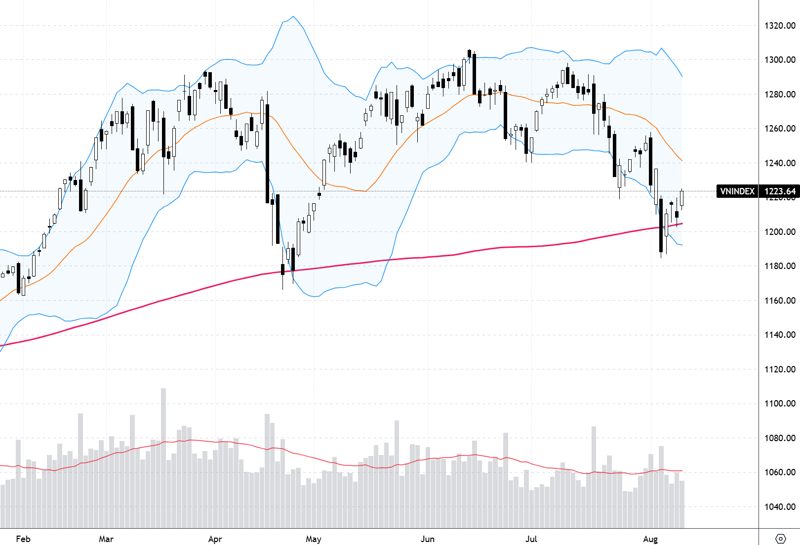

The fact that the market is in a short-term downward trend, along with dwindling trading liquidity, indicates that investors are becoming more cautious about opening new positions. Therefore, money flow tends to wait for participation when the index falls to deep support levels on a long-term framework or needs a confirming factor such as breaking through resistance with a sudden surge in liquidity.

However, it can be seen that the market is less concerned about the information dominating the downward trend in the previous period, such as exchange rate pressure, geo-political conflicts, concerns about a recession in the US, Japanese Yen carry-trade, etc., after specific impact assessments on the Vietnamese stock market. Meanwhile, the adjustment phases have brought the market’s P/E ratio to a relatively cheap level, around 14 (according to Bloomberg’s calculation method), close to the -1std region. At the same time, the profits of all listed companies continue to show good growth in the second quarter. With the medium-term uptrend still being maintained, combined with the cooling signals from short-term risks and the market’s reasonable valuation, a burst rebound session when bottom-fishing money flow enters is entirely reasonable.

Mr. Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

In my opinion, it is understandable that investors are still holding “full money” without restraining their impatience as the market has rebounded from the bottom, bringing many stocks profits of 10-15% and some even close to 30%. The market’s momentum burst session on Friday did not surprise me because, in the previous weeks, I predicted that the market would form a bottom around the 1191 mark (the market has rebounded from this region) and that the market is very likely to form a V-bottom up to now. The momentum burst session on Friday makes the V-bottom prediction increasingly realistic.

Ms. Nguyen Thi My Lien – Head of Analysis Department, Phu Hung Securities Company

Indeed, the session at the end of the week was somewhat surprising after what the market had shown before. Previously, the recovery momentum had occurred with weak buying power as the market continuously increased with small candles and decreasing volume. Meanwhile, it also ignored the opportunity to rise in sync with the global market in the burst session on August 13 in the US market and then adjusted again. However, in those two declining sessions, the selling pressure was not strong, and this time, the buyers took advantage of the opportunity to push the price up when the US market continued to have another burst session.

Mr. Nguyen Huy Phuong – Senior Head of Analysis Center, Rong Viet Securities

The sharp increase at the end of the week, the strongest in the last four months, has surprised many investors, especially after the stagnant and cautious state of the money flow recently. Waiting for a “test” dip to buy stocks at discounted prices did not happen, and this is causing impatience for some investors.

I was also quite surprised by this trading session. Although I predicted the possibility of an increase in the last session following the positive momentum of the global stock market before the news that the Fed would likely cut interest rates from September, I did not expect the possibility of a strong diffusion of green on a large scale, including stocks that have underperformed in the past time.

Mr. Le Duc Khanh – Analysis Director, VPS Securities

The burst session finally happened in the most attractive way. We discussed the trading trend of the week, which was to create a bottom of 1200 – 1220 points and then head towards the 1250 – 1260-point threshold. The upward trend is now more clearly confirmed, especially with the burst session with a sharp increase in volume, along with the price increase of many stocks.

Nguyen Hoang – VnEconomy

When the market falls, there seems to be bad news everywhere, and money flow leaves… But just one strong session has completely changed that, with all kinds of good news appearing. According to statistics, individual investors net sold more than VND 2,100 billion in the five consecutive sessions before the end of last week, focusing mainly on the three small fluctuating sessions when the VN-Index approached the MA20 level. It seems that the market has had an increase that shook off short-term speculators?

The strong increase at the end of the week signaled a standard momentum burst session (FTD) with a strong diffusion of money flow. However, investors should note that the FTD session is not a “holy grail,” meaning that it will always lead to a significant bottom; instead, it still has a 1/3 chance of failure and becoming a bull-trap.

Ms. Nguyen Thi My Lien

Ms. Nguyen Thi My Lien – Head of Analysis Department, Phu Hung Securities Company

In my opinion, there is a high possibility that this is the case. With the market’s previous sharp decline, the recovery momentum went along with small increasing candles and decreasing volume, approaching the MA20 resistance. Most investors would perceive this as merely a technical rebound and worry about a decline when touching the resistance, so the selling action at this point is understandable. In fact, the market had two adjusting sessions at the resistance, but because the selling pressure in those sessions was not strong, the index did not fall much, and the buying power emerged, taking advantage of the opportunity to push the price up.

Mr. Nguyen Huy Phuong – Senior Head of Analysis Center, Rong Viet Securities

I think that individual investors’ net selling action when the VN-Index approached the MA20 level is also understandable. The “sharp” fluctuations in the previous period had put some investors in a passive state, and when the market rebounded, they took the opportunity to restructure their portfolios to reduce risks, especially in the context of money flow instability and caution. In addition, the net selling action could be a short-term profit-taking action by some investors who quickly bought stocks at good prices when the market plummeted.

Mr. Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

In the three small fluctuating sessions, the VN-Index rebounded to near the MA20 level. It is understandable that individual investors net sold to secure their accounts, reminiscent of the rebound momentum at the end of July, also with low liquidity and a rebound to near MA20 (I analyzed the differences between the two rebound moments in the weekly review). In addition, many market experts predicted that the VN-Index would “test” the 1170 region to create a double bottom, so individual investors net sold to secure their accounts.

The strong increase at the end of the week surprised many investors, so it is challenging to avoid missing the timing.

Mr. Nguyen Huy Phuong

Mr. Le Duc Khanh – Analysis Director, VPS Securities

It is simple. When the “stagnant” development ended and the bottom-fishing money flow participated in buying again in unison – What has to come will come after the sessions with dwindling liquidity and the momentum burst session.

Mr. Nghiem Sy Tien – Investment Strategy Analyst, KBSV Securities

The continuous release of news during the sharp decline/strong increase of the market is probably just a way to rationalize the index’s movement. The most objective reflection is still the supply and demand status and trading liquidity of stocks in particular and the whole market in general. I agree with the view that the previous downward trend may have “shaken off” most short-term speculators using high leverage. In the context of negative news flooding information channels and sharp declines always accompanied by sudden liquidity, investors will worry about the situation of margin calls happening in series, leading to taking advantage of the technical rebound momentum to sell and reduce portfolio risks. This psychological trend is almost the opposite of long-term investors or those holding mainly cash in the downward trend. In that case, the plunging sessions will be a good opportunity for the above group to buy at good prices instead of panic selling due to concerns about margin calls like short-term speculators.

Nguyen Hoang – VnEconomy

Many investors believe that Friday’s increase was a momentum burst session, which means that the upward trend will continue. What do you think are the chances of the market returning to the 1300-point peak in August? Can the VN-Index reach a new high?

Mr. Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

Friday’s session met both price and liquidity criteria of a momentum burst session. In my opinion, it is highly likely that the VN-Index will not be able to reconquer the 1300-point threshold in August and may have to wait until September. Before returning to the 1300-point region and “breaking,” the VN-Index needs time to “sideway” and absorb the supply in that region. I assess that the index can reach a new peak in the last months of the year.

Mr. Nghiem Sy Tien – Investment Strategy Analyst, KBSV Securities

The trading session at the end of the week met the conditions to establish a momentum burst session with a sudden surge in liquidity, an increase of more than 2%, and strong money flow diffusion. Technically, this will be a significant boost for the VN-Index’s recovery momentum. In addition, short-term risk factors have somewhat cooled down, and the index has returned to a reasonable valuation level. Therefore, the opportunity to increase again to the 1300-point threshold is entirely possible. However, to break through the 1300-point threshold, a resistance level that the market has failed to conquer many times before, stronger supporting factors are needed. So I still think we need to be cautious and closely observe the money flow reaction when approaching the 1300-point threshold again.

In my opinion, the stock proportion in this phase can be large, and we can even buy more, including chasing prices, because the chance of the market breaking through again is more likely to happen.

Mr. Le Duc Khanh

Mr. Le Duc Khanh – Analysis Director, VPS Securities

I assess that this scenario is also likely to happen because the distance between the 1250 and 1300-point thresholds is not much. It is entirely possible for the VN-Index to return to the old peak region of 1290 – 1300 points right in August.

Ms. Nguyen Thi My Lien – Head of Analysis Department, Phu Hung Securities Company

Although many conditions show that Friday’s session was a standard momentum burst session, and the market sentiment has become more positive, with the volume of closing short positions also increasing strongly in the latest session, I think the chance of the market returning to the 1300-point threshold is still quite slim in August.

After many declining sessions with low liquidity and many stocks hitting multi-year lows, the market started to recover, taking advantage of the global market’s increasing momentum. However, I think the supply pressure from above is still quite large. Geo-political risks are still there and changing rapidly, along with the obvious weakening of the global economy. This year, I still think that the VN-Index can reach new peaks, likely in the fourth quarter, when positive news from both domestic and foreign contexts gradually emerges, and the economy and market improve.

Mr. Nguyen Huy Phuong – Senior Head of Analysis Center, Rong Viet Securities

The strong increase at the end of the week is considered a momentum burst session, but it is still too early to determine whether the market will continue to increase

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.