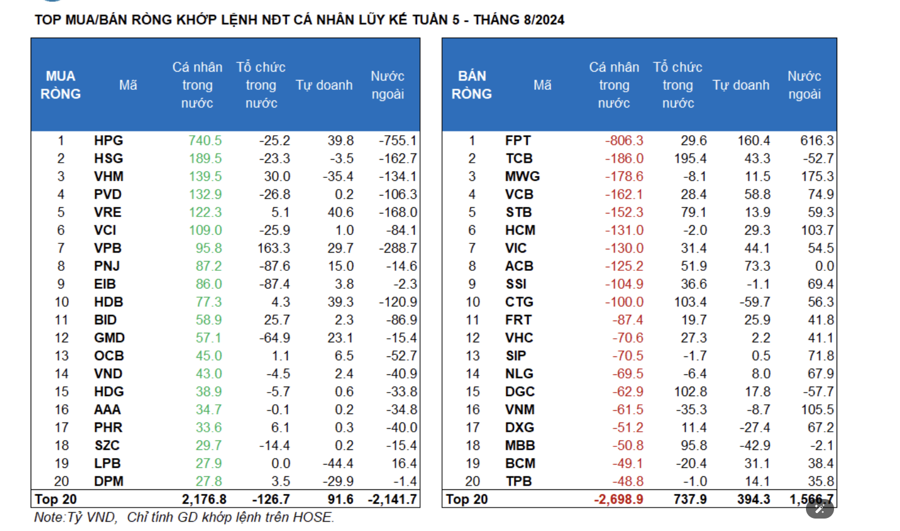

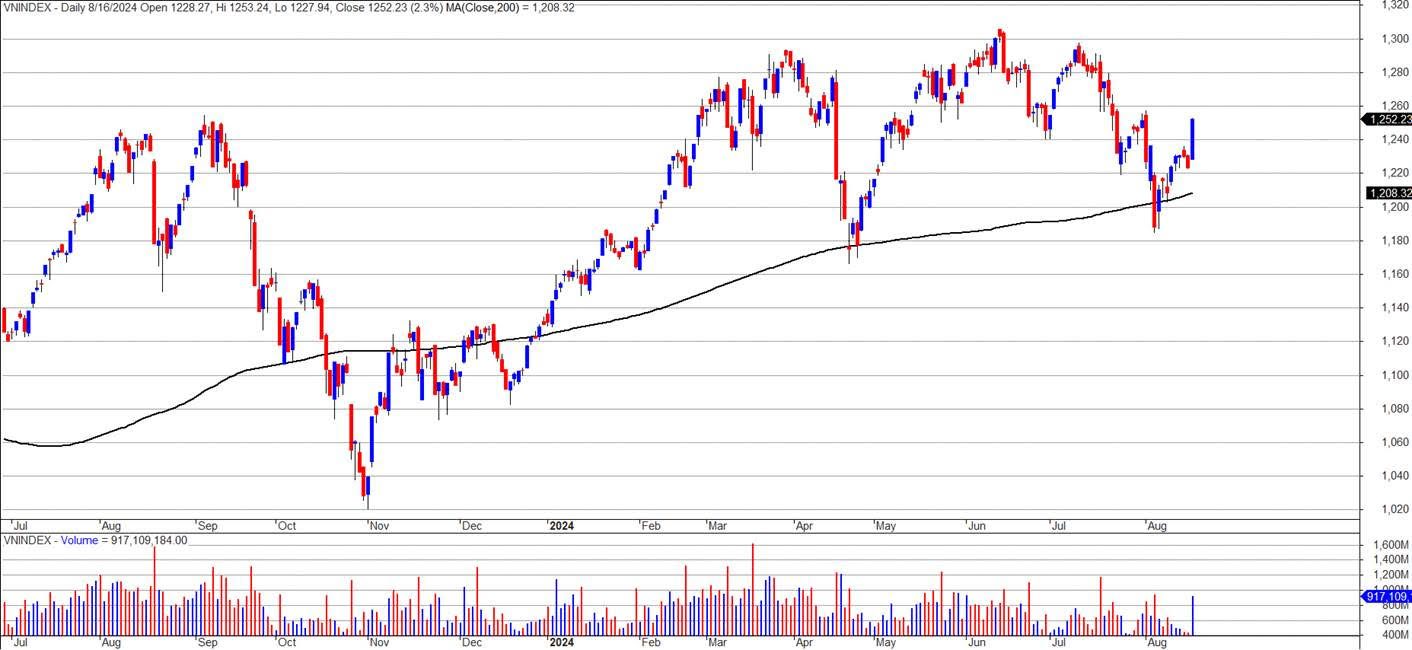

Vietnamese stocks surged last week, with the VN-Index climbing +28.59 points (+2.34%) to 1,252.23. This upward momentum was bolstered by positive investor sentiment and active buying from foreign investors, resulting in a net purchase of 1,088 billion VND for the week.

Analysts remain optimistic about the market’s prospects, anticipating continued growth. They suggest that investors consider timing their purchases to take advantage of opportunities in companies with compelling narratives and strong earnings expectations.

VN-Index has bottomed out, presenting opportunities for investors with cash reserves

Mr. Bui Van Huy, Director of Ho Chi Minh City Branch, DSC Securities Company, shared his perspective on the market’s performance. He attributed the recovery to stabilizing global markets and a return to pre-fall levels. Mr. Huy cautioned against hasty decisions driven by external factors, as they have minimal impact on Vietnam’s domestic market.

Regarding the domestic context, Mr. Huy believes that the worst of the negative news is likely over. He highlighted the economy’s ongoing recovery, the cooling of exchange rate concerns ahead of the FED’s expected rate cut, and positive developments in the market upgrade story. In summary, the domestic landscape remains positive and supportive.

Mr. Huy asserted that the market has established a short-term bottom, demonstrating resilience around the MA200 level of 1,200 points. He anticipates a more distinct market divergence in the coming week, with the VN-Index facing resistance around 1,260 points. While some volatility may occur, the market is in a “playable” state as investor confidence has improved.

“Next week will be a time to assess strong and weak stocks and determine entry points for certain stock categories for investors with cash reserves who have missed the boat. The market will continue to rise. Even if there is a downward correction, the VN-Index is likely to form a higher low,” Mr. Huy stated.

The market has once again found support around the MA200 level

Commenting on the FED’s actions, Mr. Huy predicted a likely rate cut in September, with the key question being the magnitude of the reduction. A 0.25% cut is the most probable scenario. This anticipated rate cut could narrow the interest rate differential between Vietnam and other countries by the end of the year, alleviating pressure on the exchange rate.

On the topic of foreign capital, Mr. Huy observed that foreign investors have been net buyers during the VN-Index’s bottoming process. While it’s challenging to predict a sustained return of foreign capital, he asserted that the outflow phase has likely passed.

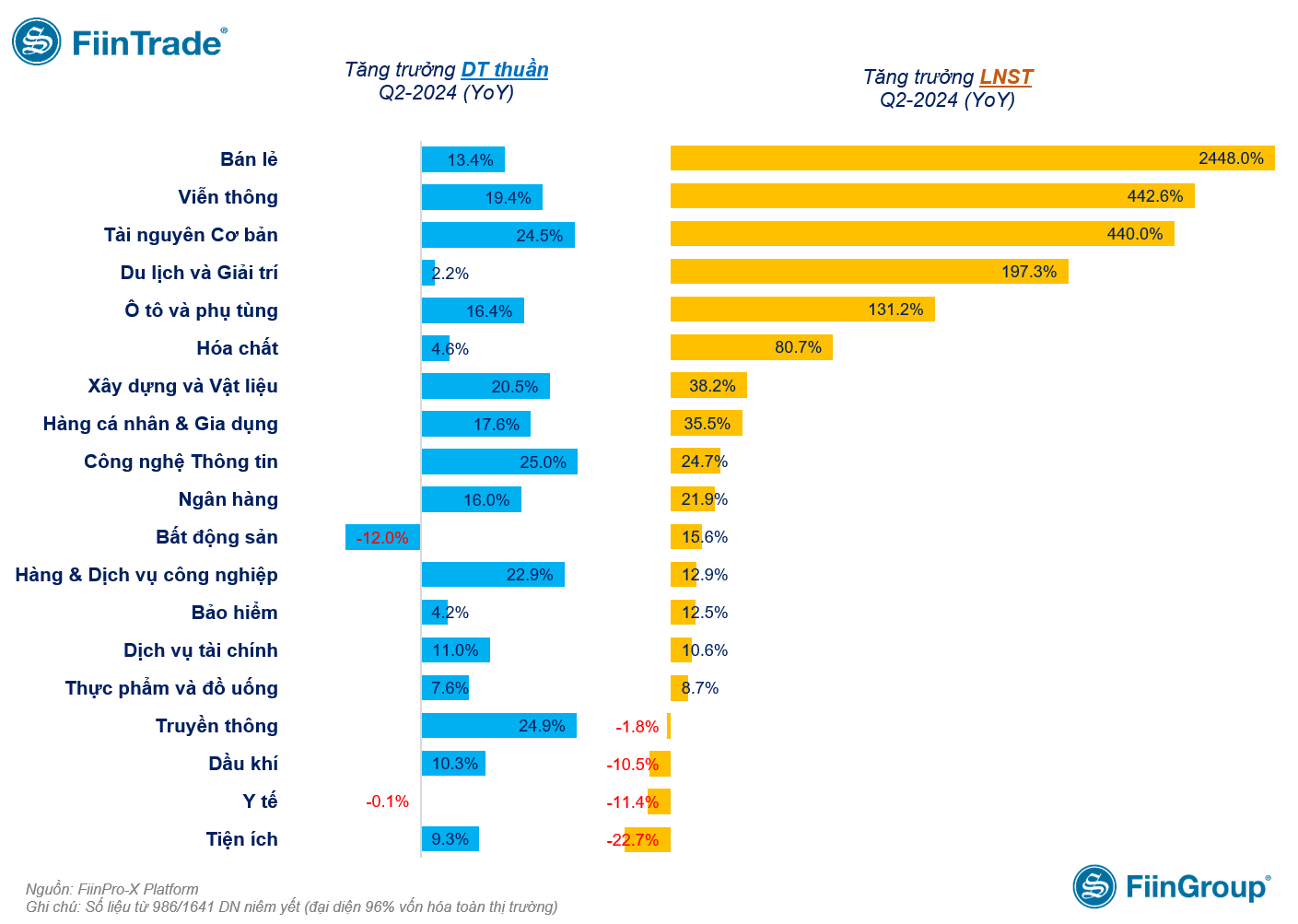

Looking beyond the recently concluded Q2 earnings season, Mr. Huy noted that it provided insights into the recovery and growth of various sectors. Currently, the market is in an information vacuum, and the global macroeconomic landscape doesn’t present any significant concerns. Vietnam’s economy, on the other hand, is on a growth trajectory after a strong recovery in the first half of 2024. This sets the stage for potential opportunities in the stock market towards the end of 2024 and the beginning of 2025.

“The market is always on the lookout for unique stories, and with signs of a short-term bottom, the upgrade story is heating up again. Many stocks with their own narratives, belonging to sectors experiencing strong recovery, have seen minimal declines or are poised to break through their peaks,” he added.

Mr. Huy advised investors against FOMO (fear of missing out) and chasing stocks too quickly. Instead, he suggested leveraging upcoming corrections to purchase shares of companies expected to report strong earnings in Q3 and Q4 of 2024, as well as Q1 of 2025.

Valuations become more reasonable, and three stock groups are expected to attract investment

Mr. Nguyen Dinh Thuan, Senior Investment Strategy Analyst at KBSV, offered his insights on the market’s performance. He noted that the VN-Index concluded the week with a strong gain, accompanied by high volume and broad participation across sectors. This, he believes, is a positive signal indicating a revival of market liquidity. Considering the recent positive news from the US market and stable macroeconomic conditions, Mr. Thuan is optimistic that the VN-Index has established a short-term bottom and will continue its upward trajectory next week.

Mr. Thuan elaborated on three ways in which the FED’s rate cut could positively impact the Vietnamese stock market. Firstly, a weaker USD is anticipated, and the narrowing interest rate differential between Vietnam and the US should ease pressure on the exchange rate. This, in turn, reduces the likelihood of tight monetary policies by the State Bank of Vietnam to maintain stability.

Secondly, during periods of declining interest rates in major central banks, global capital tends to flow towards emerging stock markets to take advantage of higher relative interest rates and robust economic growth. Consequently, foreign capital flows into the Vietnamese stock market may improve after a period of strong net selling.

Lastly, as the US is a key export market for Vietnam, the FED’s rate cut is expected to stimulate consumer demand over the long term, benefiting Vietnam’s export sector and positively impacting economic growth.

The market has experienced an over 8% decline since July due to a series of negative news. Many stocks have seen their valuations become more reasonable after corrections of 10-20% from their recent peaks. Following the Q2 earnings season, investors can now form new expectations for various stocks. Given the stable macroeconomic environment and the dissipation of recent concerns, Mr. Thuan suggested that investors consider initiating new long positions in stocks with compelling growth stories and reasonable valuations. However, depending on their risk appetite, investors should maintain a balanced portfolio.

Mr. Thuan identified three stock groups that are likely to attract investment in the coming period. Firstly, the Retail and Consumer Goods sectors are expected to remain in focus due to the recovery in domestic demand and improving earnings growth. Secondly, the Securities sector may rebound after a period of stagnation, driven by improved market liquidity and positive developments regarding the market upgrade story.