Just a few days ago, many individual investors were feeling glum as domestic stock trading remained lackluster, with liquidity hitting record lows and stock prices continuously falling. However, after last week’s explosive session, investors’ emotions erupted with hope that the downward trend had ended and that the market would return to an upward trajectory alongside the economy’s recovery.

Unlocking Individual Investor Capital

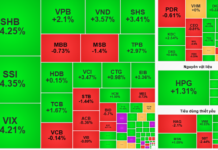

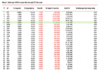

The highlight of the stock market last week was the final session, which halted the five-week losing streak of the VN-Index. The matched order liquidity on the HSX exceeded 917 million units, more than doubling the previous session and surpassing the 20-day average by over 50%.

Numerous investors expressed renewed optimism about the stock market. A “boom-along” session—where the market rises in both points and liquidity, spreading across sectors and leading stocks attracting capital—has boosted their expectations of the VN-Index breaking its losing streak and moving upward.

Mr. Nguyen The Minh, Director of Analysis at Yuanta Vietnam Securities Company, assessed that after the unexpected crash in early August, most major stock markets worldwide have recovered and quickly regained their previous peaks. Meanwhile, Vietnamese investors remain cautious. In the final session of last week, substantial capital from institutional investors officially entered the market, focusing on securities and real estate stocks, helping the VN-Index break its five-week downward trend.

“The essence of the recent multi-week correction was due to investors being caught up in the negative psychology of the sell-off in the international market. The crucial factor is that the domestic macro economy remains robust. After the explosive session last week, the market is unlikely to surge immediately but will consolidate around the current level before confirming an upward trend as more capital flows in,” Mr. Minh remarked.

Mr. Truong Hien Phuong, Senior Director of KIS Vietnam Securities Company, opined that the substantial capital in the final session indicated the return of institutional and foreign investors. With liquidity exceeding 1 billion shares and a transaction value of over VND 25,000 billion, it couldn’t be individual investors’ capital.

“The market experienced a five-week decline, and many stocks’ prices have reached reasonable valuations, attracting large investors to buy, helping to unlock capital and dispel the hesitation of individual investors, who dominate the market. Abroad, the latest signals also suggest that the Federal Reserve (Fed) may cut interest rates in September 2024 by 0.5 percentage points, much higher than expected. If so, global investment capital will reverse course and no longer withdraw from frontier and emerging markets. Vietnam will also be one of the benefiting markets,” Mr. Phuong predicted.

The stock market has just regained its green hue after weeks of lackluster trading. Photo: Hoang Trieu

Foreigners Stop Selling

One of the bright spots in the stock market last week was foreign investors’ net buying of over VND 1,000 billion on the HoSE. This is a positive signal, indicating the renewed interest of foreign investors in Vietnam’s stock market after a continuous net selling streak since the beginning of the year.

According to Mr. Nguyen The Minh, with the USD/VND exchange rate declining sharply and expected to cool further following the news of a possible Fed rate cut in September, foreign investors are net buying again. Last week, capital was withdrawn from technology stocks in some Asian markets and shifted to other markets with more attractive prices, including Vietnam.

Therefore, Mr. Minh believes that foreign capital from now until the end of the year will support the market. The second quarter of 2024 is typically when large investors price and select stocks to buy and hold for the year-end.

A very positive factor for the stock market is that the regulator is urgently seeking contributions to the draft circular related to removing the pre-funding requirement for foreign investors’ orders—the most significant bottleneck in the process of upgrading Vietnam’s stock market. A few days ago, the State Securities Commission met with custodian banks, securities companies, and foreign financial institutions regarding this matter.

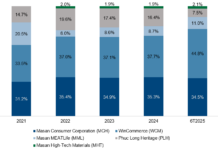

Mr. Dinh Minh Tri, Head of Analysis at Mirae Asset Securities Company, assessed that the circular related to removing the pre-funding bottleneck for foreign investors is likely to be issued in September, coinciding with FTSE’s evaluation period for considering an upgrade for Vietnam’s stock market. There is a high chance that Vietnam’s stock market will be considered for an upgrade in 2025.

Mr. Dinh Minh Tri analyzed: “A survey we recently conducted on five markets that FTSE has upgraded from frontier to emerging status showed that these markets experienced an upward wave before the official upgrade. The magnitude of the wave depends on the market’s responsiveness, but it will trigger speculative capital participation. Securities companies are rushing to raise capital to meet the new standards before the official upgrade of Vietnam’s stock market.”

No Need to Rush Buying

After the “boom-along” stock market session last week, experts predict that the market will struggle to surge immediately and may consolidate or fluctuate around the 1,250-point level.

Mr. Dinh Quang Hinh, Head of Macro and Market Strategy at VNDIRECT Securities Company, forecasted that the market would soon face “shaking” as the VN-Index approaches the strong resistance level of 1,260 points. Therefore, investors who “missed the wave” should refrain from rushing to buy and instead patiently wait for alternating upward and downward movements to purchase stocks at better prices.

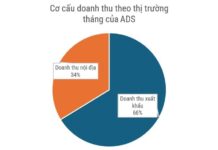

Regarding specific investment opportunities, investors can consider banking stocks as credit growth resumed in the second half of July, and the sector’s valuation remains relatively cheap after the recent decline. The textile, seafood, and wood industries also hold promise due to the strong improvement in exports.