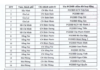

Specifically, at SJC Company, gold ring prices are listed at 76.8-78.3 million VND per tael, a decrease of 100 thousand VND. Bao Tin Minh Chau applies a rate of 76.93-78.23 million VND per tael. DOJI Group and PNJ listed prices at 76.85-78.2 million VND per tael and 76.85-78.2 million VND per tael, respectively.

SJC gold price remains unchanged, continuing to trade at 78.0 million VND per tael for buyers and 80.0 million VND per tael for sellers.

In the international market, spot gold prices reversed course, falling about $10 per ounce and slipping below the $2,500 mark. As of 9:00 am, spot gold was trading at $2,497 per ounce, equivalent to about 77 million VND per tael when converted at the current VND/USD exchange rate, excluding taxes and fees.

According to several experts, gold prices could remain above $2,500 per ounce this week as the market anticipates a rate cut by the US Federal Reserve (Fed).

Additionally, escalating geopolitical tensions in the Middle East and Ukraine are further driving the demand for gold as a safe-haven asset.

This week, nine analysts participated in Kitco News’ gold survey, with a majority expecting prices to climb higher after reaching record highs last week. Five experts, or 56%, predict a rise in gold prices, while three experts, or 33%, foresee a consolidation at current levels. Only one person, accounting for 11%, anticipates a decline in gold prices.

Meanwhile, 219 votes were cast in the Kitco online survey. The results show that 130 retail investors, or 59%, expect gold prices to rise, and 44 others, or 20%, predict lower trades. The remaining 45 people, or 21%, believe prices will move sideways this week.

Deadline for Reporting Gold Market Management and Operations Results to SBV Today, January 31

As per the directive of Prime Minister Pham Minh Chinh, today (January 31, 2024) is the deadline for the State Bank of Vietnam (SBV) to submit a report on the summary of Decree 24, which includes proposals for amending and supplementing certain regulations for managing the gold market.

Market Update on February 2nd: Oil, Copper, Iron & Steel, Rubber, and Sugar Prices Decline, Gold Surges to Almost 1-Month High.

At the end of the trading session on February 1st, the prices of oil, copper, iron and steel, rubber, and sugar all dropped, while natural gas hit a nine-month low and gold reached its highest point in nearly a month.