The issuance ratio is 5%, equivalent to shareholders owning 100 shares receiving 5 new shares. With over 341 million shares currently in circulation, the Company is estimated to issue nearly 17.1 million new shares to complete the dividend payment to shareholders, thereby increasing its charter capital to nearly VND 3,600 billion (over 358.3 million shares).

This dividend rate was also approved at the 2024 Annual General Meeting of Shareholders on June 25. On August 16, the State Securities Commission issued a document approving GEG’s issuance plan.

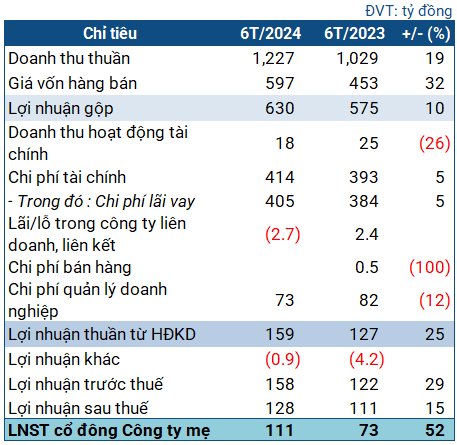

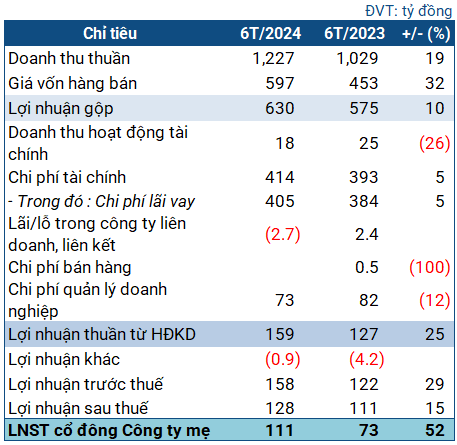

The entitlement to receive dividends can be considered good news for GEG shareholders, especially given the company’s strong business recovery. In the first half of 2024, with the operation of the Tan Phu Dong 1 wind power plant and lower borrowing rates compared to the same period last year, GEG achieved growth in both revenue and profit. Specifically, revenue in the first six months (according to the reviewed semi-annual financial statements for 2024) reached nearly VND 1,230 billion, up 19%; net profit exceeded VND 111 billion, up over 52%.

|

GEG’s business metrics according to the 2024 semi-annual financial statements

Source: VietstockFinance

|

With these results, GEG has achieved approximately 40% of its revenue target and about 47% of its profit plan in the first six months. The 2024 General Meeting of Shareholders approved the business plan with a revenue of over VND 3,100 billion, up 38% compared to the previous year; and a pre-tax profit of VND 335 billion, up 72%.

Of this, VND 364 billion is estimated revenue from hydropower, down 2% from the previous year. Revenue from solar power (farm and rooftop solar) is expected to reach VND 856 billion, up 6%. The most notable is the wind power segment, which is projected to generate over VND 1,400 billion (up 57%). However, this plan is based on the assumption that 2024 will fully recognize revenue from the Tan Phu Dong 1 Wind Power Project (TPD1, operational since Q3 2023) and expected to recognize retrospective revenue for 2023, as well as assuming the 2024 electricity price is calculated at the ceiling price of nearly VND 1,816/kWh.

However, as the negotiation of electricity prices depends on the direction and guidance of the Ministry of Industry and Trade and the implementation process of EVN, the timeframe for completion and recognition of specific revenues cannot be determined. The company stated that the retrospective amount is expected to be realized in 2024, and the progress of the electricity price negotiation will affect its 2024 business plan.

Chau An

Profit from Sugarcane, Durian, and Leafy Vegetables with the Lunar New Year approaching

Good news for farmers in the Mekong Delta provinces as the prices of sugarcane, durian, and vegetables… have skyrocketed during the days leading up to the Lunar New Year, providing them with attractive sources of income.