Investing in stocks with a strong fundamental base, stable earnings results, sustained growth, and a unique story is a top priority for many investors. Mirae Asset recently identified a range of stocks that meet these criteria.

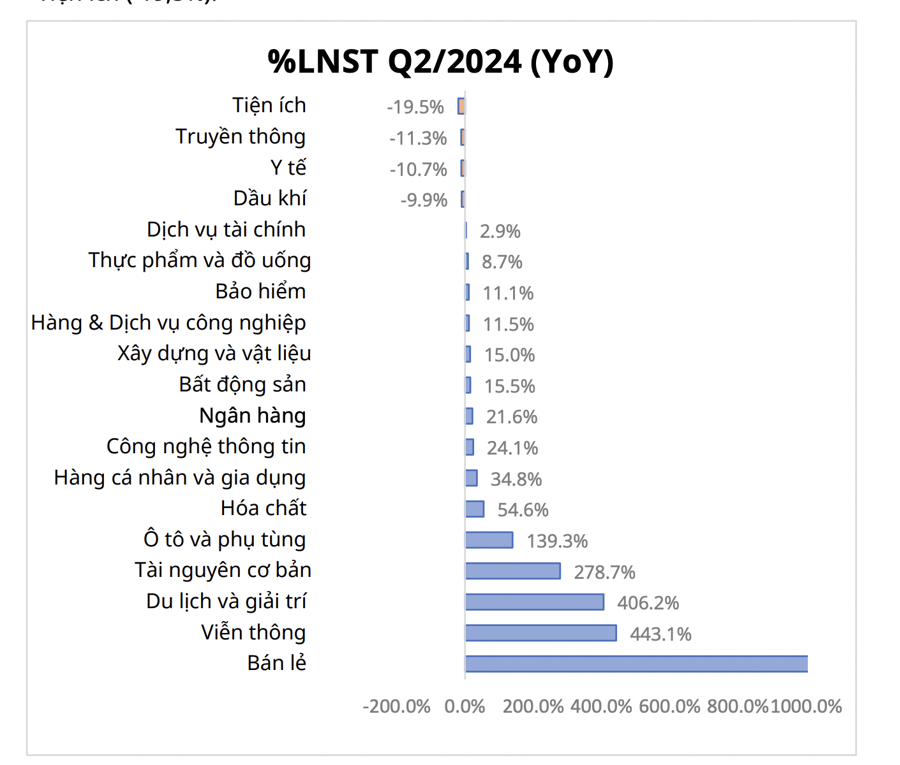

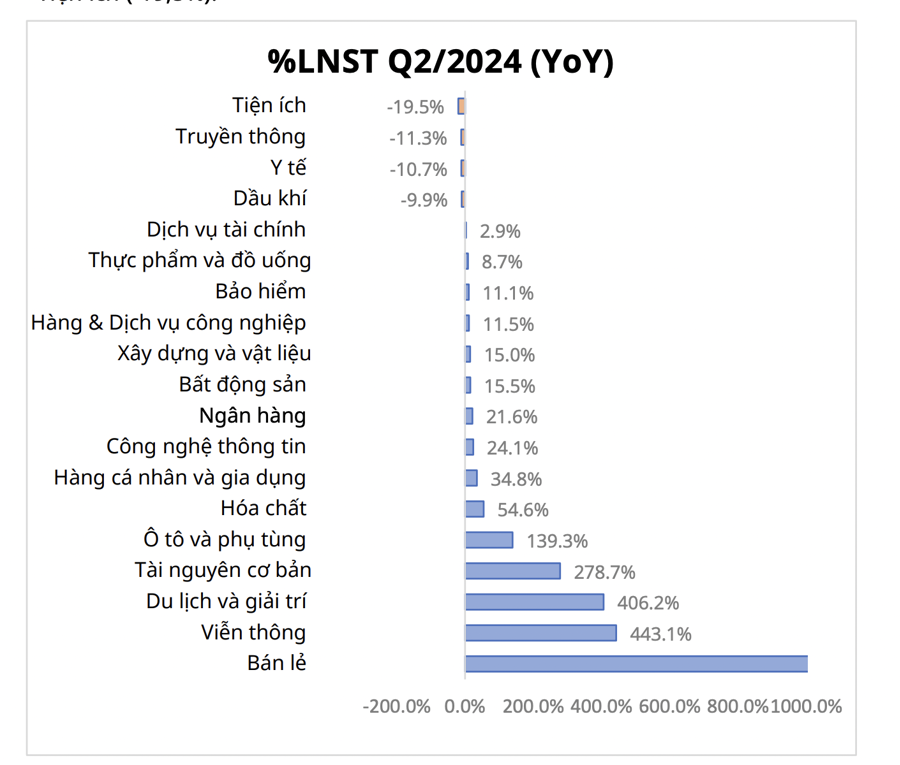

The Q2 2024 earnings picture showed improvement and differentiation across sectors. Although the number of sectors with positive after-tax profit growth was lower than in Q1 2024, the overall market’s after-tax profit growth rate was higher.

Specifically, according to FiinPro data, total after-tax profit for Q2 2024 grew 26% year-over-year, higher than the 21.5% increase in Q1 2024, but significantly lower than the 56.6% surge in Q4 2023.

The Non-Financial sector saw a stronger profit increase than the Financial sector in Q2 2024, rising 32.9% and 20.6% year-over-year, respectively. Notable performers included: Retail (+1403.3%), Telecommunications (+443.1%), Travel & Entertainment (+406.2%), Basic Resources (+278.7%), Automotive & Components (+139.3%), Chemicals (+54.6%), Personal & Household Goods (+34.8%), Information Technology (+24.1%), Banking (+21.6%), Real Estate (+15.5%), Construction & Materials (+15.0%), Industrial Goods & Services (+11.5%), Insurance (+11.1%), Food & Beverage (+8.7%), and Financial Services (+2.9%).

Sectors that experienced declines were: Oil & Gas (-9.9%), Healthcare (-10.7%), Media (-11.3%), and Utilities (-19.5%).

The Vietnamese stock market did not perform overly optimistically in Q2 2024, falling into a downward trend in April, recovering in May, and trading sideways in June. On the last trading session of June, the VN-Index closed at 1,245.32 points, a 1.3% decrease from May but still maintaining a 10.21% gain compared to the end of 2023.

The average trading volume in June 2024 exceeded 857 million shares per day, with an average trading value of over VND 22,914 billion per day, representing a 3.71% increase in volume and a 6.11% increase in value compared to May 2024.

As of June 30, 2024, the market capitalization of stocks on the HOSE reached over VND 5,080 trillion, equivalent to 50.26% of GDP in 2023 (at current prices), a 1.11% decrease from May 2024 but an over 11.58% increase from the end of 2023. This accounted for more than 93.46% of the total market capitalization of listed stocks in the market.

Based on Q2 2024 earnings results, Mirae Asset screened for stocks with stable earnings, sustained growth, and unique stories. The criteria were based on a combination of the SEPA stock-picking method by Mark Minervini and the Canslim investment approach by William O’Neil.

Stocks from stable sectors such as food and insurance were relatively safe choices. Additionally, prospective sectors with recovery stories, including apparel, retail, technology, and construction materials, were also suitable picks when they entered attractive price regions.

Mirae Asset selected and evaluated stocks by comparing gross profit margins between the last two quarters and the previous year to identify potential stocks with revenue and profit growth. The stocks also had to meet criteria for trading value, meaning they had to be liquid.

Super Fundamental Group: Stocks with a higher gross profit margin in Q2 2024 compared to both Q1 2024 and 2023. These included: CTD, HPG, HSG, HVN, NKG, MWG, VNM, ACV, PVB, PLX, MCH, and VGI…

Good Fundamental Group: Stocks with a higher gross profit margin in Q2 2024 compared to Q1 2024. These included: GAS, GVR, POW, and LAS…

Previously, Mirae Asset’s outlook for the stock market in August suggested that trading activity in the first few sessions of the month reflected investors’ risk aversion, particularly among domestic individual investors. However, the downside risks remained, as downward pressure on major global stock markets could negatively impact Vietnam’s market.

In the worst-case scenario, the market is expected to find supportive demand at attractive valuation regions for the VN-Index, such as -1 to -2 standard deviations from the 10-year average P/E, ranging from 1,050 points to 1,150 points. This support expectation is based on Vietnam’s improved macroeconomic performance in the first seven months and the trend of corporate profit recovery in the first half of the year.

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.