The market was abuzz this afternoon with news of the impending removal of the 100% pre-trade margin requirement for foreign institutional investors. This breathed new life into the securities stocks, with SSI and HMC attracting strong buying interest. While these stocks aren’t considered index leaders, their performance today was noteworthy.

The impact of securities stocks is often psychological, as their performance tends to be synchronized—they either rise or fall together. Today’s rally in these stocks is being interpreted as a positive reaction to the news of the prefunding requirement removal, which is the most recent and sole factor influencing the trading and prospects of major securities firms at this point.

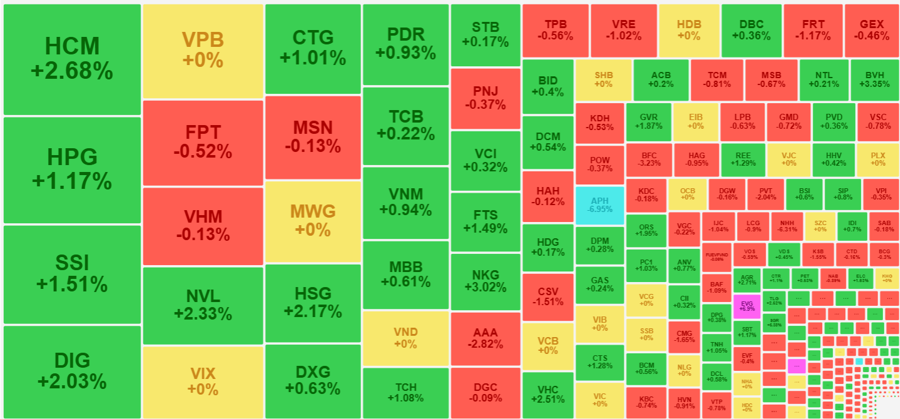

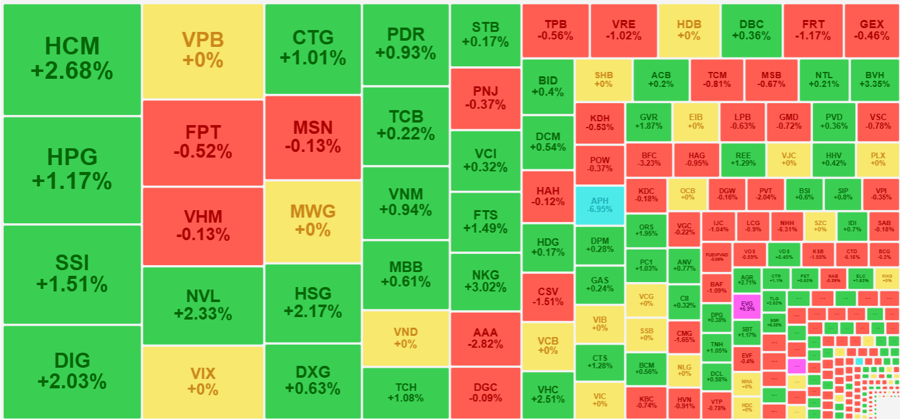

Most securities stocks ended the day in positive territory, although there was significant differentiation in their performance. TCI, DSE, IVS, APS, and VIG were the only stocks in the red, but their impact was negligible. Fourteen other stocks in the same sector rose over 1% from their reference prices at the close, indicating a generally positive performance for the group. HCM and SSI stood out with gains of 2.68% and 1.51%, respectively, and impressive buying volumes. HCM unexpectedly led the market with 21.1 million matched units, equivalent to VND 599.6 billion. SSI followed with VND 532.9 billion.

The session’s dynamic and upward trend for securities stocks began in the afternoon, despite rumors circulating since last night about the “imminent signing” and “submission” of the new draft regulations. HCM and SSI are naturally considered the biggest beneficiaries of this news. HCM, which was down 0.71% in the morning, surged nearly 4% in the first 35 minutes of afternoon trading. SSI, which had been down 0.6% earlier, rose 2.74% at the start of the afternoon session. Other stocks in the same sector changed more slowly but generally followed an upward trajectory. However, not all stocks maintained their momentum, with VND and VIX quickly falling behind, and VCI, SHS, BSI, MBS, and BVS ultimately posting only modest gains.

The most significant outcome of this development was the stimulation it provided to the market, with many stocks recovering as a result. Of the VN30 basket, 24 stocks closed higher than their morning session prices, with only three declining. Even weak pillars like VHM, FPT, and MSN edged higher. These blue-chip stocks were the driving force behind the successful recovery of the VN-Index and VN30-Index above the reference level. The VN-Index closed slightly higher, up 2.54 points (+0.2%), while the VN30-Index gained 2.58 points (+0.2%). Additionally, the overall market breadth improved: the HoSE had only 94 gainers and 295 losers at the end of the morning session, but 40 minutes into the afternoon session—when securities stocks were at their strongest—there were 126 gainers and 263 losers, and by the end of the day, this had improved to 172 gainers and 212 losers.

The stimulus-driven rally didn’t result in significant gains, as most stocks struggled to climb out of the red. Only 64 stocks on the HoSE rose more than 1%, and 93% of the liquidity was concentrated in the top 15 stocks. Besides the securities sector, HPG, DIG, NVL, HSG, TCH, NKG, and VHC also contributed to the high turnover.

The HoSE’s afternoon trading volume increased by 64% compared to the morning session, reaching VND 8,848 billion. HCM, SSI, and other securities stocks naturally contributed significantly to this increase, but there was also a rise in trading in other stocks. For instance, the VN30 basket’s afternoon trading volume was 50% higher than in the morning, and SSI accounted for only about 12.7%. HPG, CTG, MBB, FPT, MSN, MWG, STB, TCB, VHM, and VPB also witnessed substantial trading increases.

The positive performance of securities stocks indicates that the market is hungry for fresh news. Today’s improvement in market breadth also suggests the presence of bottom-fishing funds in stocks undergoing short-term corrections.

Real Estate Stocks Making Surprising Waves

The market faced correction pressure when it opened for trading on March 4th, with a relatively volatile performance. Surprisingly, the real estate sector surged, attracting a strong influx of capital and leading the market in terms of liquidity.