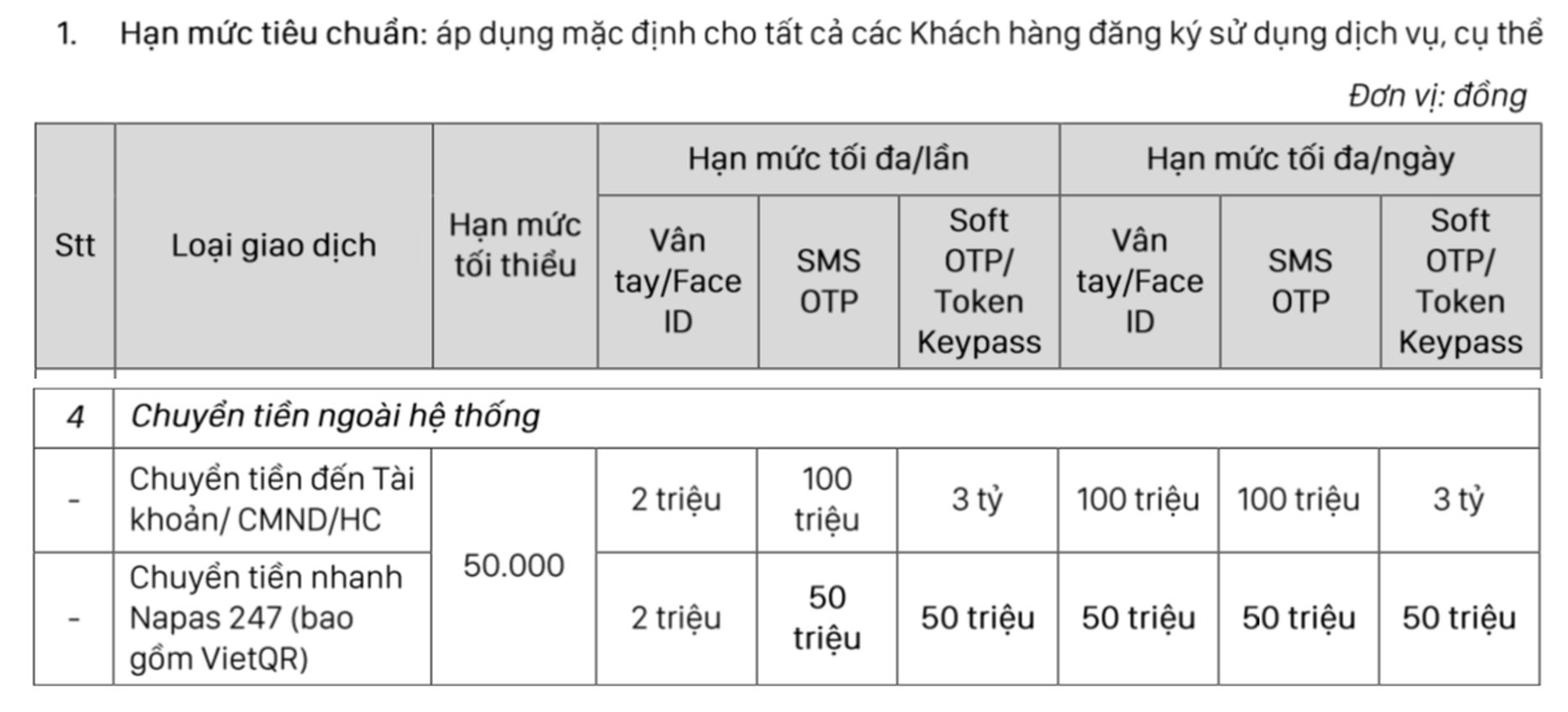

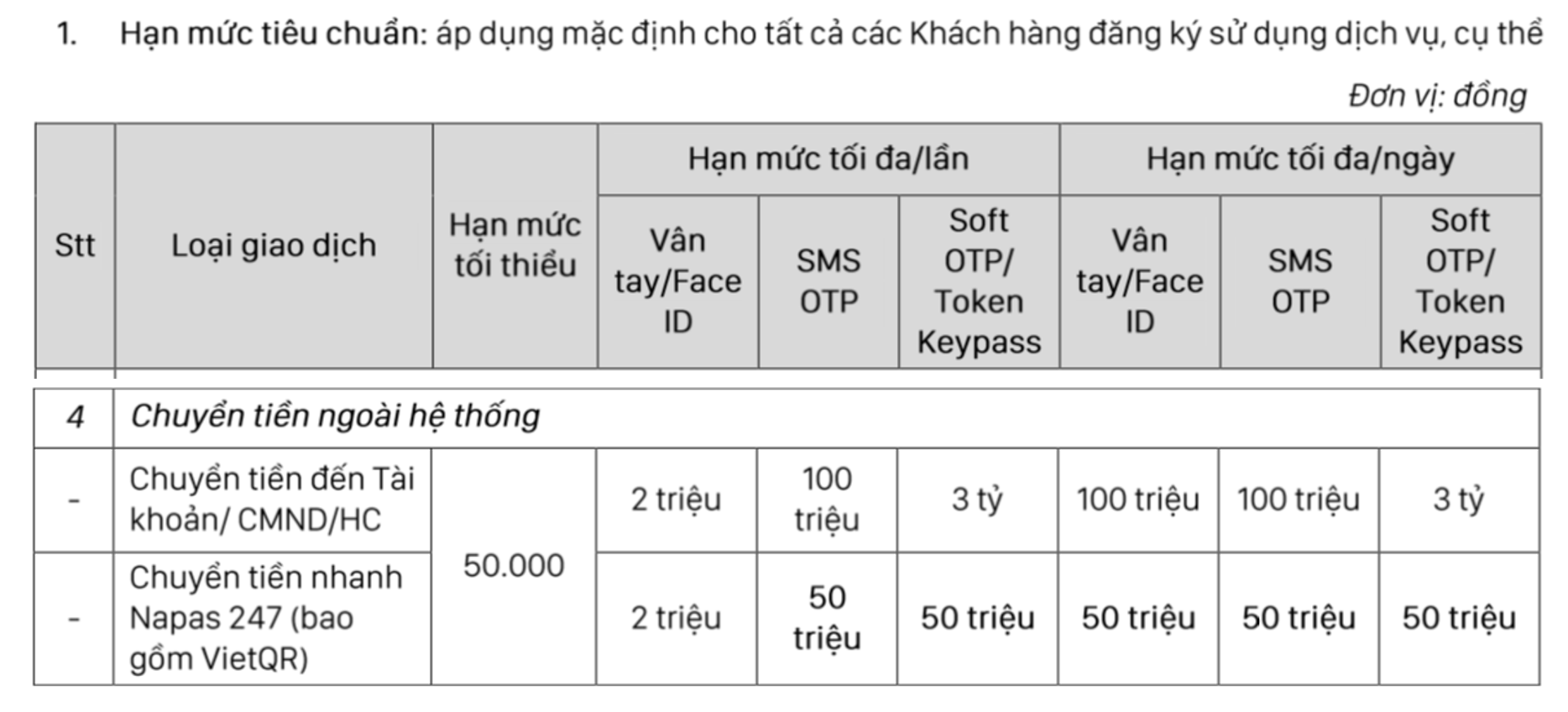

Saigon Commercial Joint Stock Bank (SCB) has announced an adjustment to the transaction limit for its Napas 247 Instant Money Transfer service for individual customers, effective August 23, 2024.

Customers can now transfer a maximum of VND 50 million per transaction per day via the counter service or SCB eBanking.

The new limits for instant transfers authenticated by fingerprint/Face ID are VND 2 million per transaction and VND 50 million per day. For SMS OTP authentication, the limits are VND 50 million per transaction and VND 50 million per day.

Customers using Soft OTP/Token Keypass authentication can transfer up to VND 50 million per transaction and a daily limit of VND 50 million.

Previously, on August 15, SCB had reduced the transaction limit for Napas 247 Instant Money Transfer from VND 200 million to VND 100 million per transaction per day.

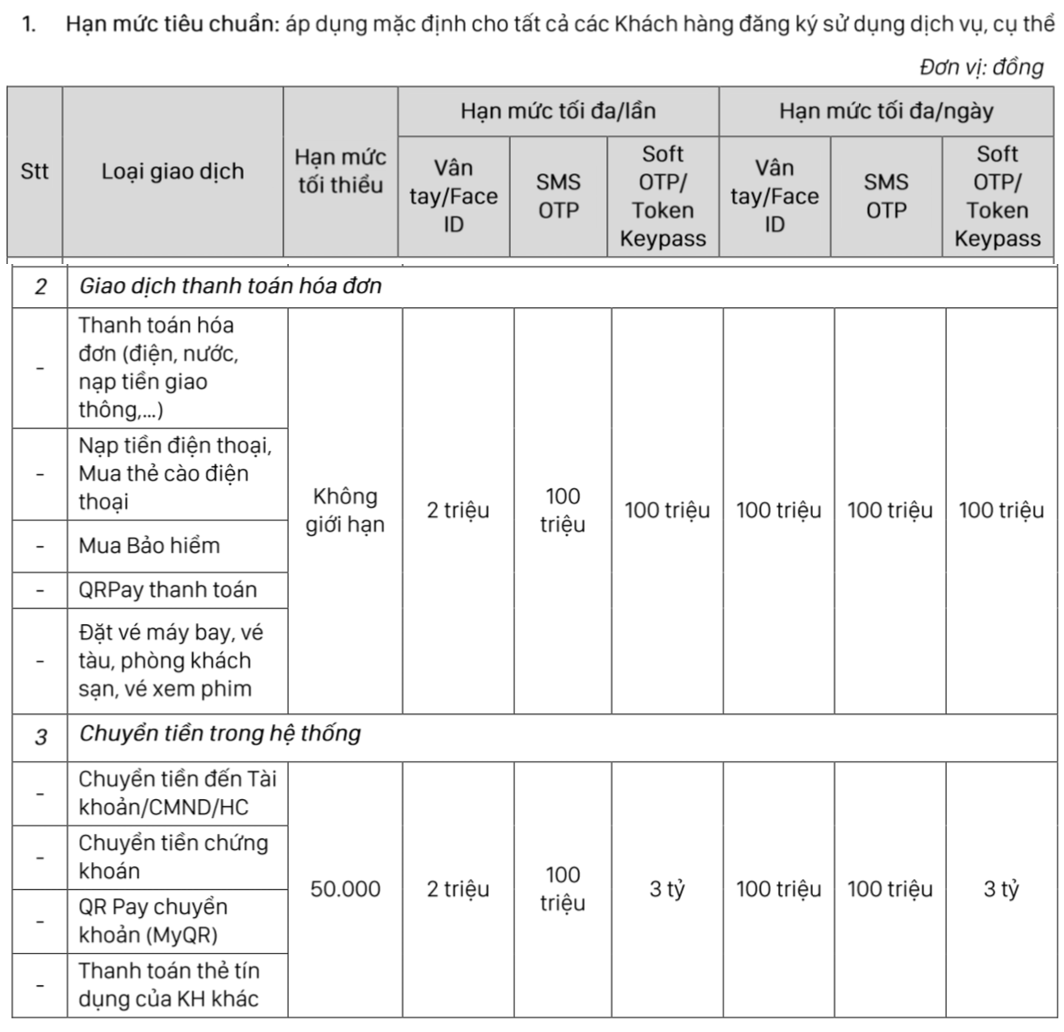

Other transaction limits remain unchanged. For intra-system transfers, the limits are VND 2 million per transaction and VND 100 million per day for fingerprint/Face ID authentication, VND 100 million per transaction per day for SMS OTP, and VND 3 billion per transaction per day for Soft OTP/Token Keypass.

The payment limit for individual customer bill payments is VND 100 million per day. These payments include utility bills, mobile phone top-ups, insurance purchases, QR code payments, and flight bookings, among others.

Latest SCB Bank Interest Rates for February 2024: Highest Rate at 4.75% per annum

The highest deposit interest rate at SCB Bank in February 2024 is 4.75% per annum, applied to online deposits with terms of 12 months or more and interest payment at the end of the term.