In particular, KBC is offering 1,000 bonds with a par value of 1 trillion VND per bond, totaling a value of 1 quadrillion VND, with a 2-year term from the issuance date, and a fixed interest rate of 10.5%/year.

The bonds are non-convertible, do not include warrants, are asset-backed, and are not subordinate debt of the Issuing Organization.

The Northern industrial real estate giant, KBC, plans to use the proceeds from this bond issuance to restructure debts totaling over 1 quadrillion VND to two of its subsidiaries: Saigon – Bac Giang JSC (KBC owns 88.6%) and Hung Yen Investment and Development Group JSC (KBC owns 93.93%). The expected repayment period is in Q3-Q4/2024.

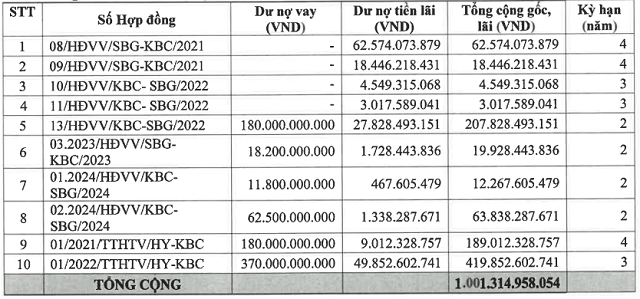

As of August 22, 2024, KBC owes both principal and interest to Saigon – Bac Giang, totaling over 392 trillion VND, and to Hung Yen Investment and Development Group, totaling nearly 609 trillion VND. These debts have been borrowed by KBC from its subsidiaries since 2021.

|

Information about KBC’s debts as of August 22, 2024

Source: KBC

|

The collateral for this bond issue is the pledge of shares of Saigon – Hai Phong Industrial Zone JSC, owned by KBC (89.26% ownership).

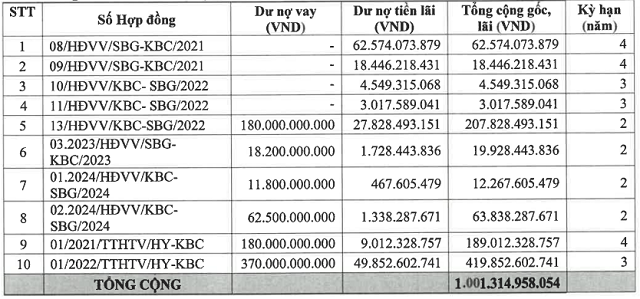

Notably, Kinh Bac Urban Development Corporation’s decision to issue bonds to repay debts comes at a time when the company’s bank deposits (as of June 30, 2024) have surged to over 6,900 trillion VND, an increase of 8.3 times compared to the beginning of the year.

Source: KBC

|

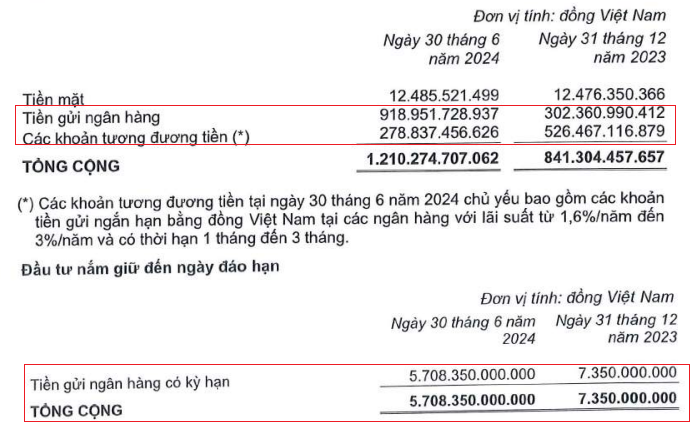

Additionally, KBC’s net profit has decreased by more than 90% in the first half of 2024. Specifically, the company’s revenue for this period was over 1,044 trillion VND, and net profit was just over 151 trillion VND, a decrease of 77% and 92%, respectively, compared to the first half of 2023. Revenue from land and infrastructure leasing was over 531 trillion VND, an 88% decrease.

| KBC’s Financial Results for the First Half of 2024 |

For the full year 2024, KBC has set a target of 9,000 trillion VND in consolidated revenue and 4,000 trillion VND in after-tax profit, an increase of 47% and 80%, respectively, compared to 2023. Given the results of the first half, the company has achieved only 14% of its revenue target and has a long way to go to reach its profit target.

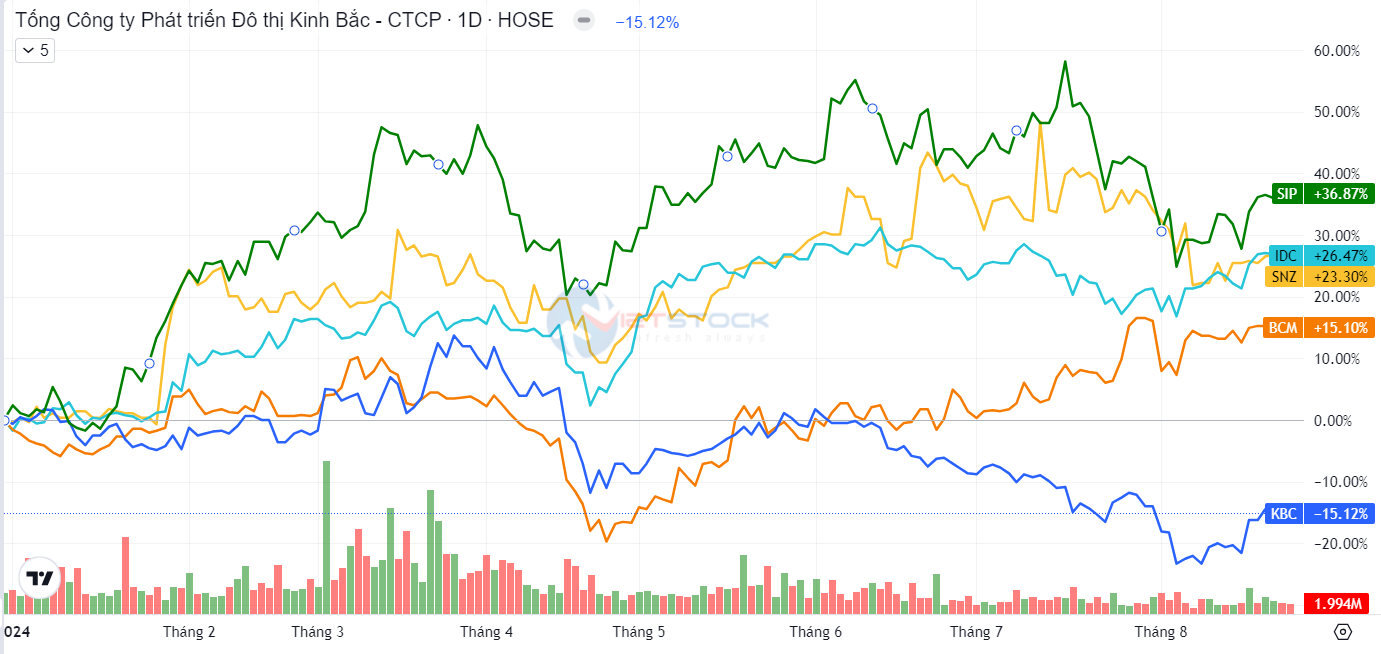

On August 23, KBC’s stock price closed at 26,950 VND per share, a 15% decrease compared to the beginning of the year. The average trading volume was nearly 6.6 million shares per day. KBC is one of the few industrial zone businesses whose stock price has declined while others in the industry have seen increases.

Regarding this issue, KBC’s Chairman, Mr. Dang Thanh Tam, shared that KBC’s stock price is quite unique, as the company’s performance is always excellent, receiving outstanding performance flags, but the stock price sometimes plummets due to various reasons. As a non-securities analyst, KBC tries to take advantage of the price drop to buy more shares.

“At the end of 2022, when the stock price dropped too low, the Board of Directors was ready to buy immediately. Then, at the beginning of 2023, KBC’s stock price recovered and showed a positive trend until now,” said Mr. Tam.

KBC operates based on the trust of its shareholders, and the stock market also thrives on trust. When trust is high, stock prices tend to rise in a stable and sustainable manner, which is what the company strives for, Mr. Tam added.

Source: VietstockFinance

|

Overcoming Challenges in Dealing with Bad Debts

In the newly passed Revised Securities Law, securities companies (SCs) no longer have the privilege to hold collateral. Therefore, SCs need to recognize that debt collection is their responsibility, and they should be extremely strict in assessing borrowers, ensuring compliance with principles, procedures, and conditions before granting loans.

Exposing the Tricks that Help Startup Founders Earn Big Before IPO

By employing this tactic, companies virtually guarantee that company executives will have a surprising profit on the first day of stock trading.