The image illustrates the issuance of bonds by Kinh Bac Urban Development Corporation to restructure its debt.

The Kinh Bac Urban Development and Investment Corporation (KBC) has recently announced its Board of Directors’ Resolution No. 2308.2/2024/KBC/NQ-HQT, approving the plan to issue bonds.

Specifically, the Board has agreed to issue non-convertible, non-warrant-attached, asset-backed bonds, with a total face value not exceeding VND 1,000 billion. These bonds, named KBCH2426001, will have a term of 2 years and a fixed interest rate of 10.5%/year.

The issuance is planned for the third quarter of 2024 and aims to restructure KBC’s main debts to Saigon – Bac Giang Industrial Park Joint Stock Company and Hung Yen Investment and Development Group Joint Stock Company.

The assets used as collateral include Kinh Bac’s shares in Saigon – Hai Phong Industrial Park Joint Stock Company (SHP) and the associated rights, benefits, and interests related to the pledged SHP shares.

As per the collateral ratio, it will be maintained at a minimum of 220% of the total par value of the outstanding and unpaid principal bonds.

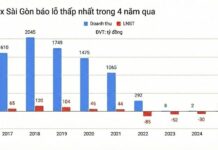

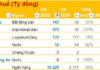

Regarding KBC’s business performance, the company’s consolidated financial statements for the second quarter of 2024 reported a decrease in revenue of 62% year-on-year, amounting to nearly VND 892 billion. Gross profit also witnessed a decline of 72%, reaching VND 464.6 billion.

There was a 20% reduction in financial activities, generating over VND 109.3 billion, while financial expenses decreased by 56% to nearly VND 55.4 billion. Selling expenses and management expenses were cut by 68% and 41%, respectively, amounting to VND 49 billion and VND 116.7 billion.

Notably, other income surged to nearly VND 34 billion, a significant increase compared to the same period last year, although it lacked detailed explanations.

Consequently, KBC posted a net profit of VND 268 billion in the second quarter of 2024, a 74% decrease from the previous year’s figure. The company attributed this decline primarily to reduced revenue recognition from its industrial park business compared to the previous year.

For the first six months of 2024, KBC’s revenue reached over VND 1,044 billion, with a net profit of just over VND 191.2 billion, representing a decrease of 77% and 91%, respectively, compared to the first half of 2023. Notably, revenue from land and infrastructure leasing decreased by 88%, amounting to over VND 531 billion.

Overcoming Challenges in Dealing with Bad Debts

In the newly passed Revised Securities Law, securities companies (SCs) no longer have the privilege to hold collateral. Therefore, SCs need to recognize that debt collection is their responsibility, and they should be extremely strict in assessing borrowers, ensuring compliance with principles, procedures, and conditions before granting loans.

Deputy Governor: Extension of Circular 02 Agreed, Potentially Extendable in Q1

In the face of challenging economic conditions, the weak market demand has affected customers’ ability to repay their debts, prompting banks to recommend extending Circular 02 for an additional period of 6 months to 1 year.