The REE Board of Directors has approved a proposal from shareholder Platium Victory to conduct a public offering for 4 million REE shares, aiming to increase their ownership to 35.7% of the capital. The offering price is VND 80,000/share, slightly higher than the historical peak of VND 74,000 that REE reached in mid-July. The current market price is hovering around VND 70,000.

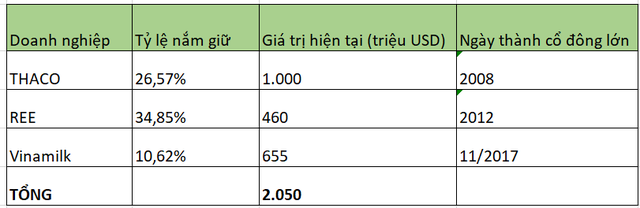

Platinum Victory has been investing in REE since 2012, starting with the purchase of convertible bonds worth VND 557 billion. These bonds were later converted into more than 18% of REE’s shares, and Platinum Victory continued to buy more to gradually increase its ownership to nearly 35% as of today. Based on market value, these shares are worth VND 11,600 billion, or approximately USD 460 million.

JARDINE MATHESON – A FAMILIAR NAME IN VIETNAM’S STOCK MARKET & COMMERCIAL FIELD

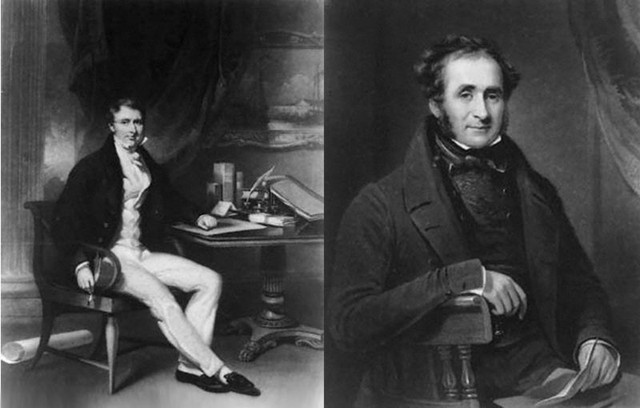

Platinum Victory is an investment unit of Jardine Cycle & Carriage (JC&C), a Singaporean subsidiary of the Hongkong-based conglomerate Jardine Matheson.

The company was established in 1832 by two Scotsmen, William Jardine and James Matheson. When Hongkong was ceded to the British in 1842, the company moved its headquarters there, where it remains to this day.

William Jardine and James Matheson.

After weathering the ups and downs of the 19th and 20th centuries, Jardine Matheson has emerged as a colossal conglomerate operating primarily in Asia. Through its numerous subsidiaries, the group’s business interests span a wide range of sectors, including financial services, construction and real estate, automotive, food, retail, and transportation.

The two pillars of the conglomerate are Jardine Matheson Holdings Ltd and Jardine Strategic Holdings Ltd. Interestingly, these two companies cross-hold 82% and 55% of each other’s shares, so either can be considered the parent company of the other. Each company holds a number of key investments.

Jardine Matheson is now a major player in Vietnam’s stock market. One of the group’s notable transactions in the country was the purchase of Vinamilk shares.

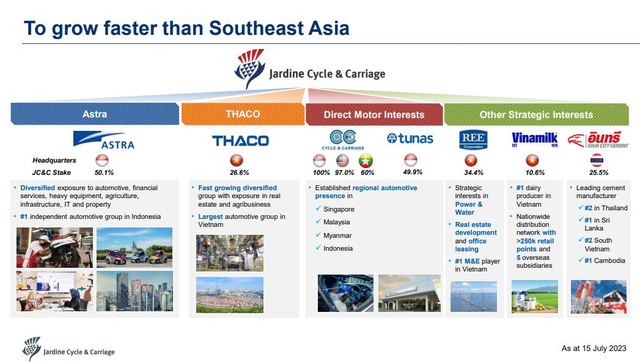

Specifically, in November 2017, Jardine Matheson, through Platinum Victory, spent USD 616 million to acquire all the shares of the Vietnam Dairy Products Joint Stock Company (VNM) divested by SCIC. Subsequently, Jardine Matheson continued to buy large quantities of VNM shares to increase its ownership to 10% as of today.

Thus, the Vinamilk shares held by the company are worth more than VND 16,600 billion (approximately USD 655 million). While VNM’s share price is currently lower than when the company first bought in, Jardine Matheson still receives hundreds of billions of VND in dividends from Vinamilk each year, totaling approximately VND 6,700 billion over the past 7 years.

Earlier, in 2008, Jardine Matheson, through its subsidiary Jardine Cycle & Carriage, acquired 20% of the shares of Truong Hai Auto Corporation (THACO). By February 2019, Jardine Matheson had increased its ownership to 26.6%, valuing the enterprise of billionaire Tran Ba Duong at USD 9.4 billion.

In the most recent transaction conducted by VietinbankSC in March 2023, the securities company valued THACO at nearly USD 4 billion. Therefore, the value of Jardine Matheson’s stake in THACO is no less than USD 1 billion.

In November 2023, Platinum Victory participated in the issuance of convertible bonds worth VND 8,680 billion – equivalent to USD 350 million. This means that Jardine Matheson could further increase its ownership in THACO in the future.

Thus, the estimated value of Jardine Matheson’s holdings in THACO, REE, and Vinamilk exceeds USD 2 billion.

Going further back, in the early 2000s, Jardine Matheson, through Jardine Cycle & Carriage, acquired 7.3% of the shares of Asia Commercial Bank (ACB). However, JC&C later divested almost all of these shares and withdrew VND 2,350 billion in 2017.

BUSINESSES RANGING FROM OFFICE BUILDINGS TO CEMENT AND ESCALATORS

Jardine Matheson’s investments in Vietnam are not limited to listed companies but also span other sectors.

In Hanoi, two of the most expensive office buildings for rent are 63 Ly Thai To, located opposite the Opera House, and Central Building, situated at the intersection of Hai Ba Trung and Ba Trieu streets. Both properties are owned by Hongkong Land, a real estate subsidiary of Jardine Matheson.

After a period of inactivity, in 2015, Hong Kong Land returned to Vietnam by partnering with Son Kim Land to develop the high-end project The Nassim in District 2, Ho Chi Minh City. Hong Kong Land is also CII’s partner in the development of the Thu Thiem New Urban Area.

The two office buildings with the highest rental rates in Hanoi are owned by Hong Kong Land.

When it comes to infrastructure and real estate, it is worth mentioning the construction materials and utilities segments. Siam City Cement, a company in which Jardine Matheson owns more than 25%, spent USD 580 million to acquire Holcim Vietnam (now known as Siam City Cement Vietnam with the Insee brand).

Jardine Schindler Group, a joint venture between Jardine Matheson and Schindler, is also present in Vietnam as one of the largest providers of elevators and escalators. The company has been a partner in several prestigious real estate projects, such as the VietinBank building, Thang Long Number One apartment building, Lotte Center Liễu Giai, and Vinhomes Central Park.

THE TYCOON OF THE FB INDUSTRY

However, Jardine Matheson’s interests are not limited to manufacturing; they also extend to the realms of fast food, beverages, and retail.

Through a joint venture with Bầu Kiên (represented by CTCP Phát triển sản xuất và XNK Thiên Nam), Jardine Restaurant Group (JRG – the branch of Jardine Pacific that specializes in restaurants) currently owns 25% of KFC Vietnam, one of the most popular fast-food chains in Vietnam. The Pizza Hut chain in Vietnam is also operated by JRG under a franchise agreement.

Jardine Matheson, through its “grandchild” company Maxim’s Caterers (a subsidiary of Dairy Farm in which Jardine Matheson owns 50%), is the franchise partner for the Starbucks coffee chain in Vietnam. Established in 2000 in Hong Kong, Maxim’s Caterers is also Starbucks’ partner in four other markets: Cambodia, Hong Kong, Macau, and Singapore.

In the retail sector, Jardine Matheson’s subsidiary Dairy Farm invests in two systems: the Guardian chain of health and beauty product stores and the Giant supermarket chain. Guardian now operates over 500 brands in the health and beauty space across 99 stores in major cities such as Ho Chi Minh City, Hanoi, Bien Hoa, Vung Tau, and Danang, as well as online channels like Shopee, Grabmart, and Eshop for nationwide delivery.

A Guardian store in Vietnam.

According to our observations, in the first half of August 2024, many Guardian stores were covered with tarpaulins, concealing their signage. Employees at these stores explained that this was due to ongoing renovations and upgrades.

The timing of these renovations coincided with a change in capital by the parent company. Specifically, at the beginning of August, Công ty TNHH MTV Thương mại và Đầu tư Liên Á Châu – the parent company of Guardian and a member of the Jardine Matheson group – increased its chartered capital from VND 260.7 billion to VND 275.7 billion.

Vinamilk: Impressive nearly 20% growth in Q4/2023 export revenue

Vinamilk has announced its financial report for Q4 2023, recording a consolidated total revenue and after-tax profit of VND 15,630 billion and VND 2,351 billion, respectively. This represents an increase of 3.6% and 25.8% compared to the same period last year. For the full year, the consolidated total revenue and after-tax profit reached VND 60,479 billion and VND 9,019 billion, completing 95% of the revenue target and 105% of the profit target.