According to the Ministry of Construction, the real estate market in the first half of 2024 showed positive signals, such as increased customer and investor interest and information search for real estate; and an upward trend in transactions of apartments, detached houses, and land plots, with higher volumes in the subsequent quarters compared to the previous ones and the same period in 2023. After a long period of limited supply, the real estate market is showing positive signs of recovery, with many old projects being restarted and new projects being launched. Reduced bank interest rates, along with favorable policies offered by investors, have boosted customer confidence and market liquidity.

However, the Ministry also noted that while the real estate market has overcome its most challenging period, it still faces many difficulties due to the impact of numerous unfavorable factors, both domestically and internationally.

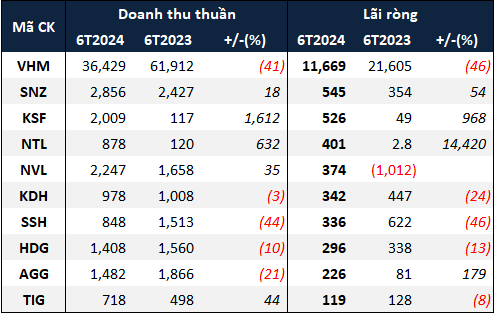

According to statistics from VietstockFinance, the revenue and net profit of 78 residential real estate businesses on the stock exchange in the first half of 2024 decreased by 27% and 36%, respectively, compared to the same period last year, reaching nearly VND 64.3 trillion and over VND 15.5 trillion. Among these, 57 businesses made a profit, while the rest incurred losses.

Less than half of the companies achieved profit growth.

Among the profitable companies, Vinhomes Joint Stock Company (HOSE: VHM) continued to top the list with a net profit of nearly VND 11.7 trillion, although this figure represents a 46% decrease compared to the first half of 2023. VHM’s profit during this period was mainly attributed to the recognition of a large-lot transaction at the Vinhomes Royal Island project and the ongoing handover of existing projects.

|

Top 10 residential real estate companies with the highest net profit in the first half of 2024 (in trillion VND)

Source: VietstockFinance

|

Ranking third in the industry, the net profit of Sunshine Group (HNX: KSF) in the first half of 2024 was nearly 11 times higher than the same period last year, reaching VND 526 billion. This growth was mainly driven by a 17-fold increase in revenue, which amounted to VND 2 trillion.

Novaland (HOSE: NVL) recorded a net profit of VND 374 billion in the first half, a modest improvement compared to a loss of over VND 1 trillion in the previous year. One of the most notable events for NVL recently was a loss of over VND 797 billion from the divestment of 99.98% of its capital in Huynh Gia Huy Company, the investor of the NovaHills Mui Ne project, at a transfer price of approximately VND 2 billion. Following this transaction, Mr. Le Dinh Tuan became the Chairman of the Board of Directors and legal representative of Huynh Gia Huy. Mr. Tuan is currently a member of the Board of Directors and Vice President of EverLand Corporation (HOSE: EVG).

Urban Development and Construction Joint Stock Company (HOSE: NTL) surprisingly achieved a net profit of VND 401 billion, an increase of over 145 times compared to the same period last year, thus entering the top 10 companies with the highest profit growth in the industry. This remarkable result was due to a sudden surge in both revenue and financial income after the company recognized revenue from the sale of products with full payment for the 23ha Bai Muoi project in Quang Ninh province. Revenue increased by 7.3 times to over VND 878 billion, while financial income increased by 456 times to nearly VND 12 billion.

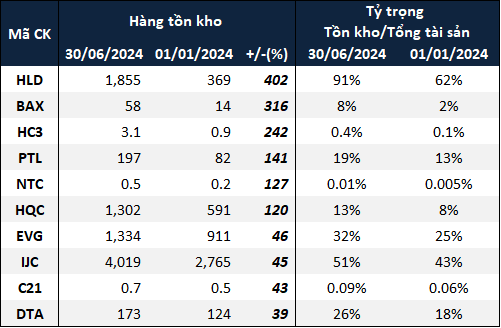

In the first half of the year, out of the 57 profitable companies, only 21 achieved growth in profit compared to the previous year.

Following NTL, the second-highest profit growth was achieved by the Southern Hanoi Urban Development and Investment Corporation (HOSE: NHA), with a net profit of VND 41 billion, nearly 51 times higher than the previous year. NHA attributed this growth to the significant contribution of real estate business to its revenue structure (over VND 79 billion, accounting for 83% of total revenue) during this period, compared to the previous period when revenue mainly came from construction and services. Additionally, the gross profit margin for real estate business was significantly higher than that of other business activities.

|

21 residential real estate companies with growing net profit in the first half of 2024 (in trillion VND)

Source: VietstockFinance

|

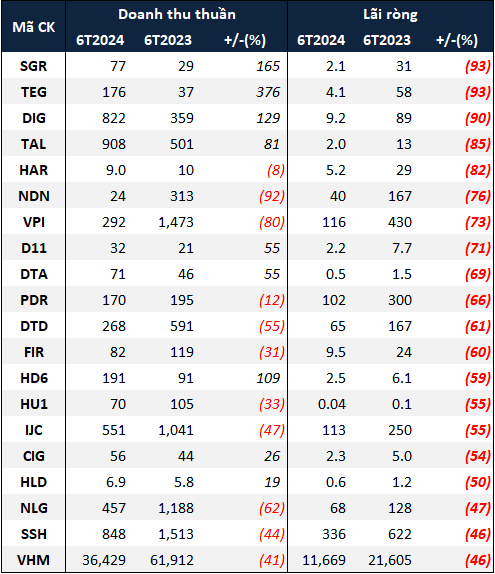

Many large companies experienced profit declines.

Several industry giants appeared on the list of 36 companies with reduced profits, including Saigon Real Estate Corporation (HOSE: SGR), Construction and Infrastructure Development Joint Stock Company (HOSE: DIG), Phat Dat Real Estate Development Joint Stock Company (HOSE: PDR), Nam Long Investment Corporation (HOSE: NLG), among others.

|

36 residential real estate companies with decreased net profit in the first half of 2024 (in trillion VND)

Source: VietstockFinance

|

The most significant decline was observed in SGR, with a 93% decrease, leaving its net profit at just over VND 2 billion. In the first quarter, SGR incurred a loss of nearly VND 14 billion, and in the second quarter, its profit decreased by 62%. Notably, SGR’s revenue increased by nearly 2.7 times compared to the same period last year, reaching nearly VND 78 billion. However, in the second quarter of the previous year, SGR recorded a profit from lending and late payment of over VND 38 billion, while this figure was less than VND 600 million in the same period this year. Consequently, the increase in revenue was insufficient to offset the decline in financial income.

A similar situation occurred with DIG, whose net profit in the first half of the year decreased by 90%, amounting to just over VND 9 billion. This was mainly due to a loss of VND 117 billion in the first quarter. In contrast, the second quarter witnessed a remarkable surge in profit thanks to the transfer of apartments in the Cap Saint Jacques (CSJ) project and the transfer of raw houses in the Dai Phuoc and Vi Thanh projects. As a result, the net profit in the second quarter was 12 times higher than the same period last year, exceeding VND 126 billion. Nonetheless, it was insufficient to achieve positive growth for the first half of the year.

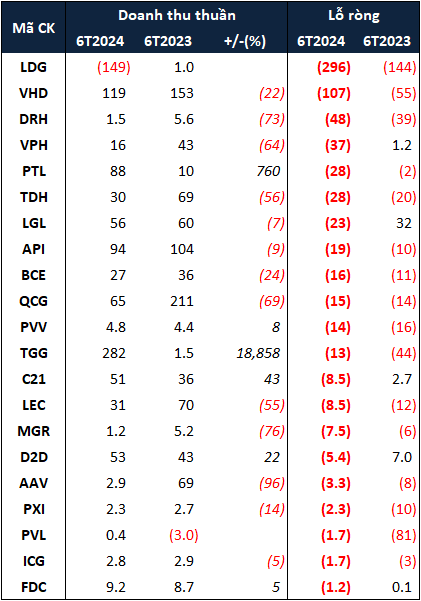

Finally, 21 companies incurred losses, with LDG Joint Stock Company (HOSE: LDG) recording the highest loss in the industry during this period and being the only company with negative revenue. This was attributed to a significant amount of returned real estate value, amounting to VND 316 billion, while sales revenue was only about VND 156 billion, resulting in a negative revenue of over VND 149 billion in the first half of the year. Combined with minimal changes in expenses, LDG suffered a net loss of over VND 296 billion. As of the end of June, the company’s accumulated loss exceeded VND 175 billion.

|

21 residential real estate companies with losses in the first half of 2024 (in trillion VND)

Source: VietstockFinance

|

Quoc Cuong Gia Lai Joint Stock Company (HOSE: QCG) has also attracted attention recently. In addition to the arrest of its General Director, Nguyen Thi Nhu Loan, in July, the company experienced its heaviest loss since 2012 in the second quarter of 2024.

QCG’s revenue in the second quarter decreased by 41%, reaching just over VND 26 billion, as the real estate market continued to face challenges. According to QCG, the second quarter of each year has not yet entered the rainy season, resulting in low electricity production. Additionally, rubber plantations were only put into operation at the end of May, leading to a decrease in revenue compared to the previous year. On the other hand, depreciation and interest expenses remained unchanged, resulting in higher production costs than revenue. Consequently, the company incurred a net loss of over VND 16 billion in the second quarter, bringing the six-month loss to over VND 15 billion.

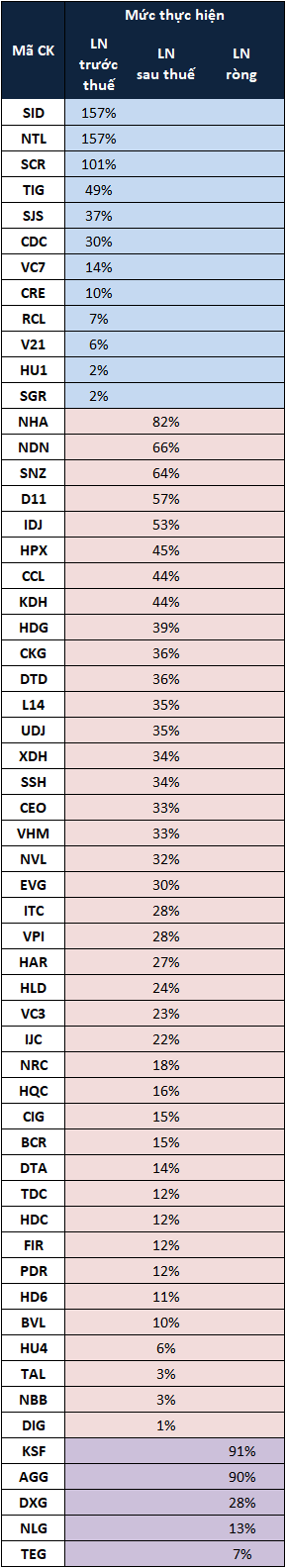

Only 10 companies achieved more than half of their annual plan in the first half.

With many losses and declining profits, most residential real estate businesses did not perform well in terms of their 2024 business plans in the first half of the year. Among the 57 profitable companies, only 10 achieved more than 50% of their annual targets during this period.

|

Performance of 2024 business plans by 57 profitable residential real estate companies in the first half of the year

Source: VietstockFinance

|

Three companies, including Saigon Co.op Investment Joint Stock Company (UPCoM: SID), NTL, and Saigon Thuong Tin Real Estate Joint Stock Company (HOSE: SCR), exceeded their annual profit plans. Notably, NTL surpassed its plan by 57% due to its exceptional profit growth. Meanwhile, SID and SCR set modest profit targets, lower than their achievements in 2023.

Regarding PDR, at the 2024 Annual General Meeting of Shareholders held in April, the management anticipated that the company would achieve only 12% of its annual profit plan in the first half. The Chairman of the Board of Directors, Nguyen Van Dat, explained that the company’s profit is mainly recognized in the second half of the year when its key project, Bac Ha Thanh, is expected to complete the payment for land use fees and meet the conditions for sales starting from the second quarter. According to the plan, the project will commence sales in the second quarter and recognize revenue and profit in the last two quarters of the year.

In 2023, GELEX earns nearly 1,400 billion VND

In the face of macroeconomic pressures over the past year, GELEX Corporation has implemented flexible strategies to maintain stability and strive for sustainable growth.