The market’s third session of tug-of-war within the peak range ended today, with selling pressure dominating and driving prices lower. There were more declining stocks, with clearer declines in margins, coupled with increased trading volume.

In the previous two sessions, trading volume was relatively low, price ranges were narrow, and there were even intraday recovery periods. Today’s intraday declines had superior trading volume and declined throughout the day. This indicates a controlled oscillation by the sellers.

Of course, there were still some strong stocks that went against the market trend. However, when this ratio is low and concentrated in a small group, the probability of investors benefiting is also low. The smaller this group is, the more it indicates that capital is not spreading as before, but rather being “pumped” into specific stocks. This is not a positive sign of differentiation.

In such a situation, it is advisable to condense the portfolio. Currently, the market has only been weak, with no specific signs of short-term risk, but it is clear that the strength is not what it used to be. Changes in price or charts always appear late. The earliest change is in the psychology of risk acceptance. The more risk-averse one becomes, the less one buys, the more selective one is about prices, and finally, the more one sells off existing stockholdings. Only when this psychological change persists over many sessions and spreads further will it gradually be reflected in fundamental data such as price fluctuations and trading volume, and eventually in technical indicators.

Today’s trading volume increased on both exchanges, reaching approximately 17.6 thousand billion, excluding matching transactions. This is only slightly higher than the last two sessions of the previous week (15.3 thousand billion/session). Compared to the accumulation volume during the upward trend last week, it is insignificant. Therefore, it is likely that this is only a portfolio restructuring or a reduction in proportions, not a “sell-off”. The scenario of a sideways market forming a base for further gains is still possible, as long as the range of fluctuations remains low and trading volume is maintained at a low level.

A worse scenario is that the market needs a clearer retreat to force out short-term stocks. Currently, there is no unfavorable information that can change the long-term trend, but supply and demand are factors that can completely control transactions in the short term of 1-2 weeks. The pillars, no matter how much they have increased in the last 3 weeks, are still just a simple recovery. There is no new story to stimulate further interest. Even if VNI surpasses 1300, very few stocks will reach new highs.

Currently, the profit margin for stocks in this upward trend has been quite good, so consider reducing the proportion. It may be balanced at 50/50. Margin should be released early. The positive scenario is that if the market continues to rise, the remaining stocks will reach higher resistance levels. In the negative scenario, having cash on hand will allow for the reconstruction of the old portfolio.

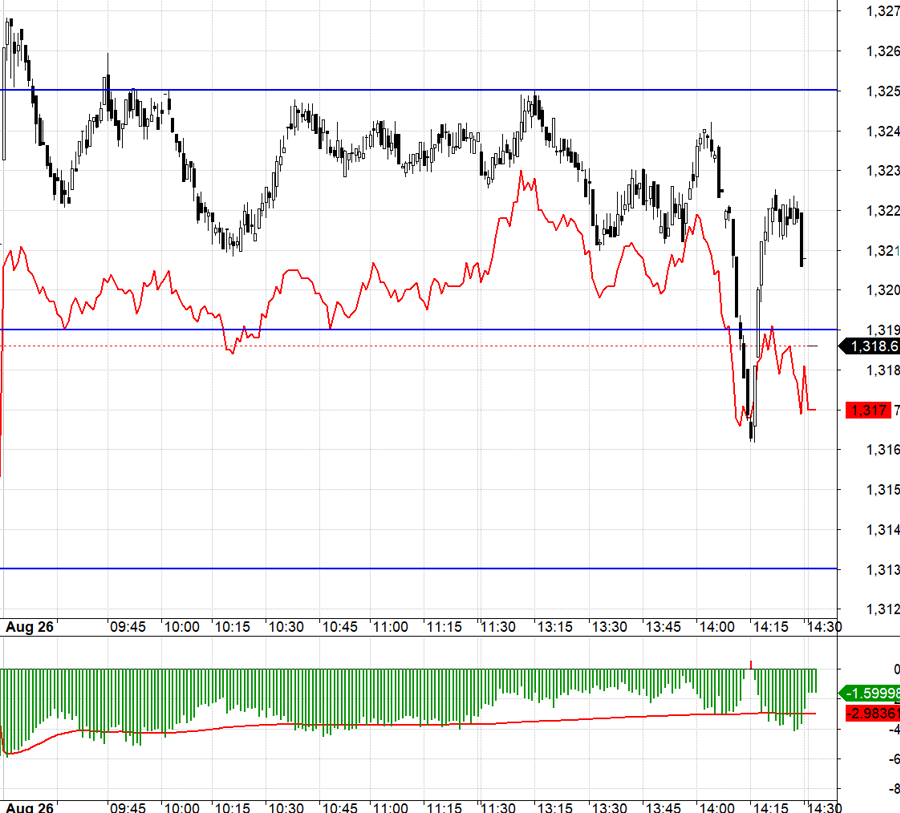

Today, the basis discount in the futures market was too wide to trade comfortably. VN30 had a resistance level of 1325.xx, and most of the time, the index touched this level, but F1 hardly rose. Above 1325.xx is an open range up to 1331.xx, and without a leading stock, it is very difficult to reach this level. This situation makes it difficult for both long and short positions. The only low-risk opportunity for shorting is at the beginning of the afternoon session when the basis narrows to below -2 points and VN30 “tests” 1325.xx unsuccessfully.

With the increase in selling pressure and the thinning of T+ profits today, it is likely that sellers will continue to offload in the coming days. If the range of fluctuations is narrow at the start, there will be periods of widening due to the impact of pillars. However, if there is a sharp decline, it is not advisable to short-sell. The strategy is to be flexible with long and short positions, prioritizing short-selling.

VN30 closed today at 1318.6. The nearest resistance levels for tomorrow are 1319, 1324, 1331, 1337, 1344, and 1350. The support levels are 1311, 1307, 1299, 1290, 1284, 1278, and 1270.

“Blog Chứng Khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The views and opinions expressed belong solely to the author, and VnEconomy respects the author’s style and perspective. VnEconomy and the author are not responsible for any issues arising from the opinions and views expressed in this blog.