Vietnam’s stock market closed a volatile session on Tuesday, with the VN-Index ending the day down 5.3 points at 1,280. Trading volume remained robust, with over VND 18,300 billion changing hands on the Ho Chi Minh Stock Exchange (HOSE). However, foreign investors turned net sellers, offloading nearly VND 419 billion worth of shares across all markets.

Foreign Investors Sell-off on HOSE

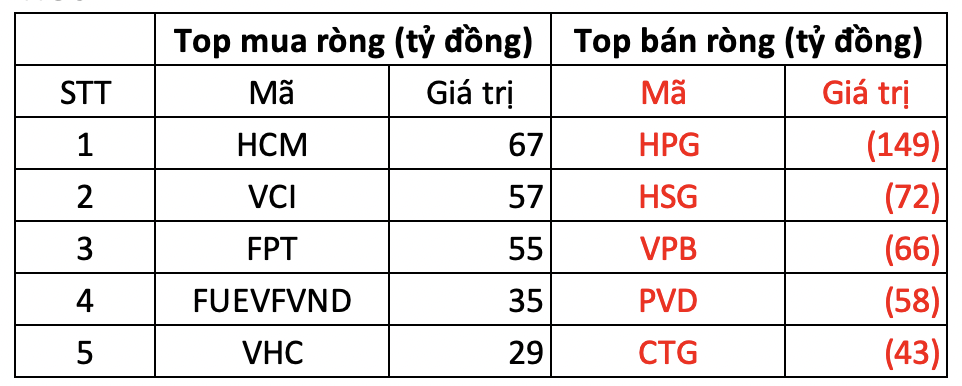

On the HOSE, foreign investors offloaded a net VND 390 billion worth of shares. HCM stock saw the largest net buy value, with foreigners purchasing over VND 67 billion worth of shares. VCI and FPT followed closely, with net buy values of VND 57 billion and VND 55 billion, respectively. FUEVFVND and VHC also witnessed net buying, with VND 35 billion and VND 29 billion, respectively.

In contrast, HPG faced the most significant net sell-off, with foreigners dumping nearly VND 149 billion worth of shares. HSG and VPB also experienced net selling pressure, with VND 72 billion and VND 66 billion, respectively.

Foreign Investors’ Activity on HNX and UPCOM

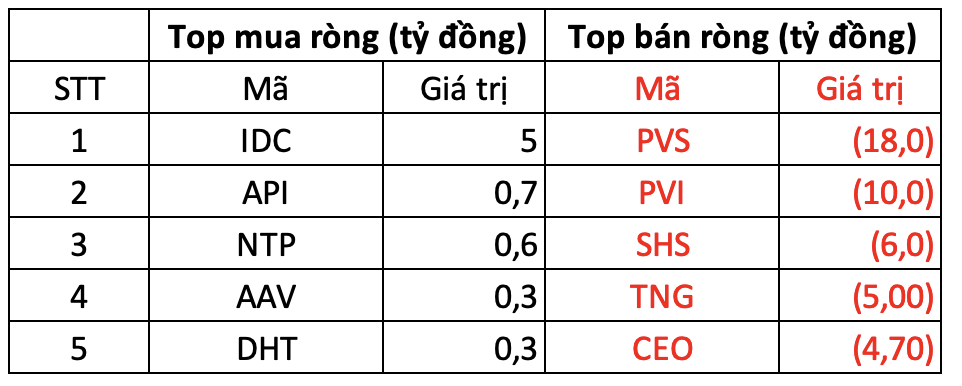

On the Hanoi Stock Exchange (HNX), foreign investors sold a net VND 46 billion worth of shares. IDC witnessed the highest net buy value, with VND 5 billion. API followed with a net buy value of VND 1 billion. Additionally, foreign investors also net bought small amounts of NTP, AAV, and DHT.

On the selling side, PVS faced the most significant net sell-off, with foreigners offloading nearly VND 18 billion worth of shares. PVI, SHS, and TNG also experienced net selling pressure, with a few billion Vietnamese dong worth of shares sold.

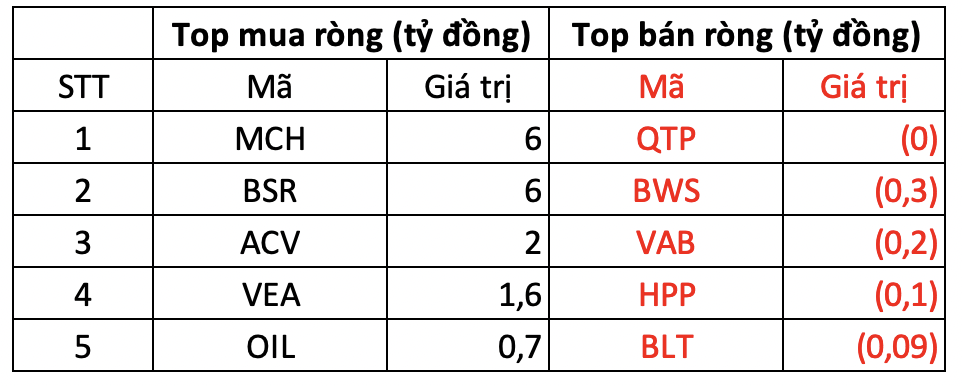

On the other hand, QTP faced a net sell-off of VND 0.3 billion by foreign investors. Additionally, they also net sold small amounts of BWS, VAB, and a few other stocks.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.