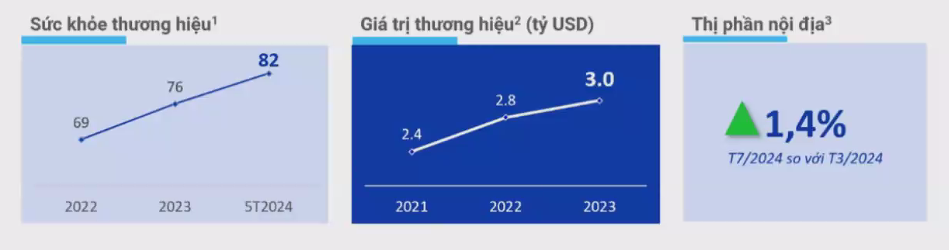

Vinamilk’s innovative marketing activities have significantly enhanced its innovation index, making the brand appear fresher in consumers’ minds and subsequently expanding its market share, according to the company’s Executive Marketing Director, Nguyen Quang Tri.

“In a large-scale dairy market, an additional 1.4% market share is very significant for us,” said Mr. Tri at a seminar on August 27.

|

Positive signals after Vinamilk’s repositioning of the dairy industry

Source: H1 – Measured based on the Always Innovating and Creative Index of Vinamilk’s fresh milk products 100%, according to Ipsos; H2 – According to Brand Finance; H3 – According to AC Nielsen

|

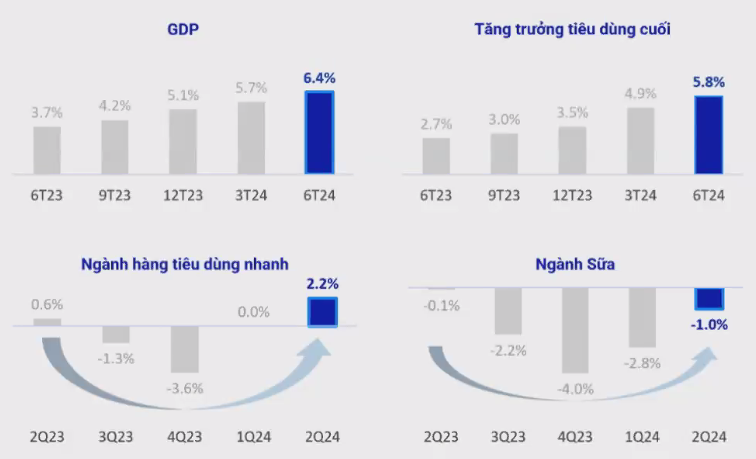

According to Vinamilk’s representative, the fast-moving consumer goods industry showed signs of recovery in the first half of 2024, after a period of decline. This recovery is also evident in the dairy industry, although it has not regained its expansionary momentum.

Amid a shrinking dairy industry, Vinamilk initiated a brand repositioning strategy in July 2023, and has now begun to reap positive results.

Vinamilk’s market share increased during the March-July 2024 period, mainly due to contributions from condensed milk, liquid milk, and drinking yogurt, especially live yogurt, which achieved growth of nearly 30% in the first seven months.

After achieving record revenue in the second quarter of 2024, Vinamilk plans to further boost sales and introduce new products in the second half to maintain the upward trajectory of its sales.

“Profit growth is also expected to remain in the double digits in the last two quarters of this year,” said Mr. Tri. Well-controlled operating costs and low raw material prices will be the drivers of profit growth. Some raw materials that had seen significant price increases during the COVID period have now stabilized. Additionally, Vinamilk has changed its purchasing policy to stockpile more raw materials at present to serve production and sales for the upcoming quarters.

New products are the foundation for growth

At the seminar, Vinamilk’s representative stated that they would continue to implement the brand repositioning strategy. “This is not just about advertising and packaging… but a comprehensive change in products, flavors, features, and the stories surrounding the products,” emphasized Mr. Tri.

|

Products that keep up with consumer trends

Source: Vinamilk

|

Vinamilk plans to focus on developing products that benefit consumers’ health and physique, such as the launch of drinking and eating yogurt that is good for the immune system and digestion. Additionally, low-sugar products or those that offer convenience to consumers (such as Ong Tho milk with a screw cap) are also being emphasized.

One trend that Vinamilk is paying attention to is plant-based products. In the past two years, the company has introduced milk made from 9 types of nuts. Mr. Tri revealed that the sales of this product line have grown well and now account for more than one-third of the plant-based milk market in Vietnam.

The new product lines will be launched alongside a different marketing approach compared to the past, according to Vinamilk’s representative. With an extensive product portfolio, “we will try to combine multiple brands, product lines, and marketing programs to leverage the power of the mother brand and optimize costs,” said Mr. Tri.

After achieving positive results with liquid milk, Vinamilk plans to focus on repositioning the infant formula category in the third and fourth quarters of this year. This area has not grown in the past due to the declining birth rate in Vietnam and parents’ increasing awareness of the benefits of breastfeeding.

Vinamilk’s representative stated that they still consider infant formula an important product category. “Every year, there are still 1.5 million children born… and once consumers use the product, they will be loyal to the brand for a long time,” they added.

Vinamilk has been preparing for the past two years to re-launch its infant formula products with new communication strategies and expects sales in this category to improve significantly in the future.

New products are crucial for Vinamilk’s development as they form the foundation for future growth, although their short-term contribution to sales “may not be significant.”

“We will continue to launch products that are good for health and physique and explore new consumer segments,” shared Mr. Tri.

Awaiting economic recovery

At the seminar on August 27, Vinamilk’s representative also shared the reasons for the stagnation of the dairy industry in recent years, citing three main factors: economic development falling short of expectations, a significant decline in the infant formula category, and the increasing availability of attractive alternative products.

“We are certain that when the economy recovers, milk consumption will increase,” asserted Mr. Tri.

|

Fast-moving consumer goods industry recovery follows the economy’s path

Source: General Statistics Office, AC Nielsen

|

According to Vinamilk’s representative, the average annual milk consumption in Vietnam is currently around 27 kg per person, with a significant gap between urban and rural areas. The low consumption in rural areas presents an opportunity for Vinamilk to get ahead of the curve. “We believe the market will grow again in the next 3-5 years,” predicted Mr. Tri.

E-commerce, despite not contributing a large proportion of total sales, is also a channel that Vinamilk is keen to promote. “The growth rate of the online channel is very good. It almost doubles every year,” shared the Marketing Director.

Vinamilk has actively participated in live streaming sales on social media platforms such as TikTok and plans to develop its own sales channel on mobile applications and corporate websites.

“We have a significant advantage over our competitors in the market due to our 700 delivery centers, which ensure the best supply to consumers,” said Mr. Tri.

Vinamilk: Impressive nearly 20% growth in Q4/2023 export revenue

Vinamilk has announced its financial report for Q4 2023, recording a consolidated total revenue and after-tax profit of VND 15,630 billion and VND 2,351 billion, respectively. This represents an increase of 3.6% and 25.8% compared to the same period last year. For the full year, the consolidated total revenue and after-tax profit reached VND 60,479 billion and VND 9,019 billion, completing 95% of the revenue target and 105% of the profit target.

Attracting talented individuals is challenging, but retaining them is even more difficult.

Not only is it about salary and benefits, but employees nowadays also have increasing desires for their working environment. Among them, what used to be considered as “additional perks” such as comprehensive healthcare programs, learning and development opportunities, and an environment to explore new things… are now being prioritized.