|

Mr. Le Quang Chung, Deputy General Director of SmartInvest Securities JSC (UPCoM: AAS), registered to sell 575,000 shares, equivalent to 0.25% of AAS‘s capital, with the purpose of reducing ownership, expected to be implemented during the period from September 1 to September 30, 2024.

Mr. Chung was appointed as Deputy General Director of AAS on February 22, 2022. He is introduced by AAS as having 15 years of experience in the Vietnamese financial market. Prior to joining AAS, he had worked at various financial institutions, notably including VNDIRECT Securities…

The leader bought 500,000 AAS shares on September 8, 2023, when AAS closed at VND 12,800/share. In November 2023, Mr. Chung received a dividend of 75,000 AAS shares (ratio 100:15) from AAS, thereby increasing his ownership to 575,000 AAS shares as at present.

Based on AAS‘s closing price on August 27, the latest session, at VND 7,400/share, it is estimated that the Deputy General Director of AAS could collect approximately VND 4.3 billion through the sale of shares. However, compared to the market price at the time of purchase, Mr. Chung is likely to incur a loss on this investment.

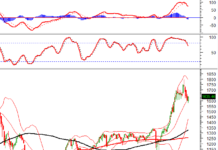

In fact, AAS‘s share price has not performed well in recent years. The share price once peaked at VND 20,000/share in April 2022 but then continuously dropped to bottom out at VND 4,000/share in November 2022. Although there have been recovery efforts, the share price has resumed its downward trend since September 2023.

| AAS stock has gone through many fluctuations |

In terms of business results, in the first 6 months of 2024, AAS recorded a net profit of nearly VND 56.6 billion, down nearly 6% over the same period in 2023. During this period, AAS recognized many items with large fluctuations.

In terms of revenue, profit from the sale of financial assets at FVTPL reached nearly VND 161 billion, up 64%; revenue from dividends and interest income from financial assets at FVTPL was over VND 69 billion, down 76%; revenue from securities brokerage business was over VND 4 billion, down 15%.

In terms of expenses, loss from the sale of financial assets at FVTPL was over VND 95 billion, down 67%; brokerage expenses were nearly VND 4.4 billion, up 50%; other service expenses were over VND 4.5 billion.