The lethargic pre-holiday mood was evident despite positive news such as the exchange rate breaching the 25,000 VND/USD threshold. Hesitant capital inflows resulted in a volatile session, with the index ultimately inching up by a negligible 0.88 points to 1,281.

Breadth remained unfavorable, with 225 decliners overwhelming 168 advancers. The real estate sector witnessed a notable correction of 0.89%, dragged down by heavyweights like VIC (-1.55%), VHM (-1.21%), and VRE (-2.74%). DIG also suffered a sharp decline of 3.99%, alongside DXG and KDG. The real estate giants alone wiped out 1.4 points from the market. Conversely, VCB lent support by contributing 0.54 points.

On the upside, banks climbed 0.14%, materials rose 0.7%, securities expanded by 0.17%, telecom services jumped 1.45%, and food & beverages inched up 0.54%. GVR, TCB, and MBB were among the top performers, lifting the market by 0.68, 0.60, and 0.32 points, respectively.

With only two trading days left before a four-day holiday weekend, liquidity remained subdued, with total matched orders barely reaching VND18 trillion. Foreign investors offloaded VND125.8 billion net, and their net selling value in matched orders stood at VND89.8 billion.

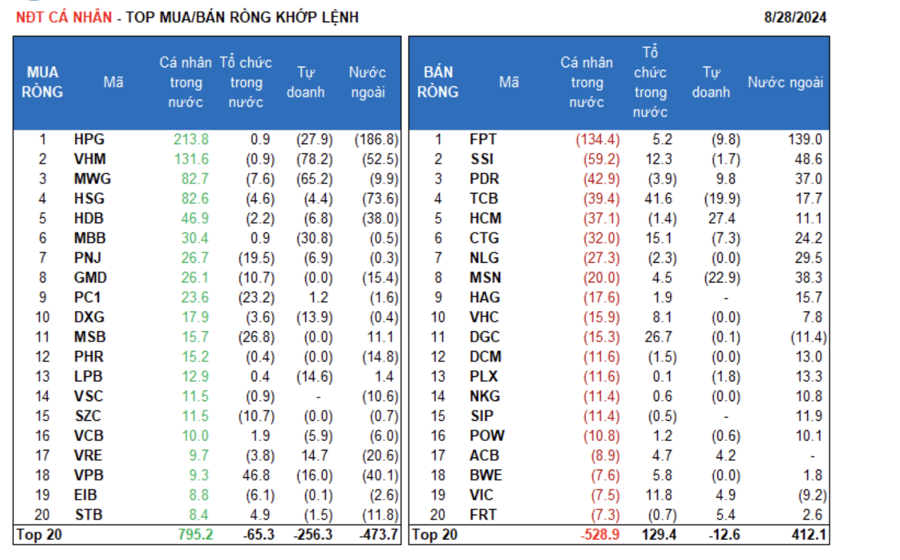

IT, food & beverages, and securities were the main sectors attracting net foreign buying in matched orders, with FPT, VNM, SSI, MSN, PDR, NLG, CTG, TCB, HAG, and PLX being the most sought-after tickers.

On the flip side, foreign investors dumped basic materials stocks, especially HPG, HSG, VHM, VPB, HDB, VRE, GMD, PHR, and STB.

Retail investors net bought VND373.6 billion worth of shares, with their net purchasing value in matched orders reaching VND350.2 billion.

In terms of matched orders, they net bought 10 out of 18 sectors, primarily basic materials. The most favored tickers among retail investors included HPG, VHM, MWG, HSG, HDB, MBB, PNJ, GMD, PC1, and DXG.

Meanwhile, they net sold securities, financial services, IT, and a few other sectors. FPT, SSI, PDR, TCB, HCM, CTG, MSN, HAG, and VHC witnessed the most significant net selling pressure from retail investors.

Proprietary traders net sold VND272.4 billion worth of shares, and their net selling value in matched orders stood at VND322.6 billion.

In terms of matched orders, proprietary traders net bought 4 out of 18 sectors, with financial services and insurance witnessing the most notable net buying pressure. HCM, FUESSVFL, VRE, PDR, BCM, DGW, FRT, VIC, ACB, and FUEVN100 were among the top tickers purchased.

On the selling front, banks and a few other sectors faced net selling pressure. VHM, VNM, MWG, MBB, HPG, MSN, TCB, VPB, LPB, and DXG were among the most prominent tickers offloaded by proprietary traders.

Local institutions net bought a marginal VND11.7 billion worth of shares, and their net purchasing value in matched orders reached VND62.2 billion. In terms of matched orders, they were net sellers in 9 out of 18 sectors, primarily real estate. MSB, PC1, PNJ, BCM, GMD, SZC, MWG, PVD, REE, and EIB were among the top tickers offloaded.

On the buying front, banks and a few other sectors attracted net buying interest. VPB, TCB, DGC, CTG, SSI, VIC, FUESSV30, FUESSVFL, VHC, and BID were among the most sought-after tickers.

Block deals today amounted to VND1,686 billion, down 14.1% from the previous session and contributing 9.3% to the total trading value.

Notable block deals occurred between domestic individuals in tickers like MSN, VHM, and TCB. Additionally, there were block transactions between foreign investors in bank tickers MBB and ACB.

In terms of capital allocation, there was an increase in the proportion of money flowing into securities, steel, agricultural & seafood, and IT. Conversely, sectors like real estate, banks, food & beverages, retail, construction, chemicals, oil & gas, and electricity witnessed a decrease in capital allocation.

Specifically, in terms of matched orders, the mid-cap VNMID group attracted a higher proportion of capital, while the large-cap VN30 and small-cap VNSML groups saw a decrease in capital allocation.