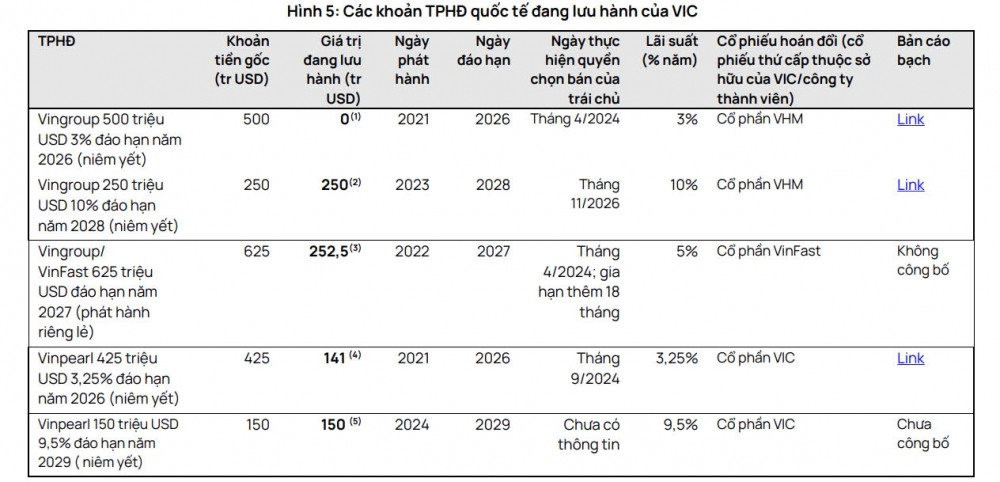

According to Vietcap Securities, in the first eight months of 2024, Vingroup has repaid multiple convertible bonds in VIC, VinFast (Nasdaq: VFS), and Vinhomes (HoSE: VHM), totaling $906.5 million.

Specifically, in late April, Vingroup used cash to repurchase 50% of the $500 million principal amount of the 3% fixed-rate convertible bond, which can be converted into VHM shares. Subsequently, Vingroup used the proceeds from the issuance of a $250 million bond with a 10% interest rate to repay the remaining 50%.

Regarding the $625 million convertible bond that can be converted into VinFast shares, Vingroup repurchased $312.5 million in April and $60 million in July. The corporation reached an agreement with bondholders to settle the remaining $252.5 million in 2027.

In August 2024, Vinpearl repurchased $284 million of the $425 million principal amount due in 2026, with a 3.25% interest rate and convertible into VIC shares. Recently, Vinpearl successfully issued $150 million in convertible bonds, due in 2029. Vietcap expects the remaining circulation value (equivalent to $141 million) of Vinpearl’s $425 million convertible bond due in 2026 to be bought back in September 2024.

Also, according to Vietcap Securities, apart from VinFast, most of Vingroup’s subsidiaries are self-sustaining in fulfilling their debt obligations and operating their businesses.

As of the end of Q2 2024, Vinhomes had unrecorded sales of VND 118,700 billion. The company owns a residential land fund of 185.4 million square meters, with expected sales from new projects in the 2024-2026 period reaching VND 89-96 trillion per year.

The financial performance of Vinpearl, Vinmec, and Vinschool is expected to gradually improve, supported by long-term drivers such as the growth of the middle class and profit margins. Vinpearl, in particular, is in the process of preparing for an IPO within the next 12-18 months, according to its management.

VinFast, on the other hand, is backed by billionaire Pham Nhat Vuong. As of the end of Q2 2024, Mr. Vuong had completed a $1 billion disbursement to VinFast, including a VND 3,300 billion contribution in Q2 2024 and VND 20,600 billion in 2023.

Vietcap believes that Mr. Vuong will continue to provide new funding in the 2025-2026 period, as stated at the 2024 Annual General Meeting, where he declared that he would finance at least $1 billion for VinFast from his personal assets.

Largest taxi company in Nghệ An cancels car purchase contract with Toyota to switch to VinFast

Mr. Ho Chuong, CEO of Son Nam International Transport Co., has recently disclosed that he had previously signed contracts to purchase gasoline-powered vehicles from a Japanese car manufacturer. However, he has since diversified his investment portfolio by also venturing into VinFast electric vehicles, in order to embrace long-term and sustainable development.

VinFast’s Success Leads the Way for Vietnamese Businesses to Conquer the Global Market

VinFast’s listing on the US stock exchange not only provides an opportunity for the company, but also inspires a strong sense of empowerment among young Vietnamese entrepreneurs. It affirms that dreams and ambitious visions are not bound by geographical limitations.