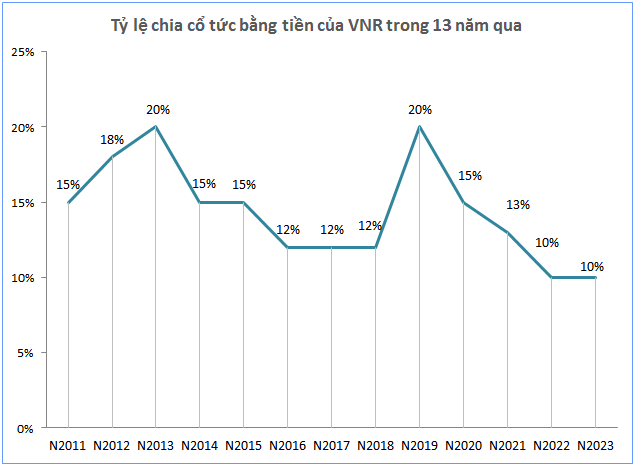

With a payout ratio of 10% (1 share receives VND 1,000) and nearly 166 million shares in circulation, VNR is estimated to distribute nearly VND 166 billion in dividends to shareholders. The expected payment date is September 27, 2024.

Source: VietstockFinance

|

Since 2011, VNR has consistently maintained a double-digit cash dividend ratio for its shareholders, with a minimum of 10%.

Source: VNR

|

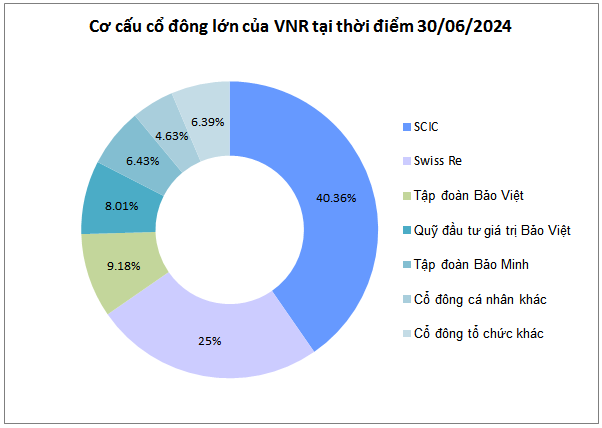

As of June 30, 2024, the State Capital Investment Corporation (SCIC) is VNR’s largest shareholder, with a 40.36% stake, and is expected to receive nearly VND 67 billion in dividends. The second largest shareholder is Swiss Reinsurance Group, holding 25% of the shares, potentially earning over VND 41 billion.

| VNR’s Insurance and Financial Profit in the First Half of 2024 |

For the first six months of 2024, VNR recorded a net profit of nearly VND 300 billion, a 6% decrease compared to the same period last year. Insurance business profits increased by 17% to nearly VND 196 billion, while financial business profits decreased by 15% to over VND 223 billion (mainly due to reduced interest income and dividends).

| VNR’s Net Profit in the First Half of 2024 |

In 2024, VNR targets a pre-tax profit of VND 505 billion, a 7% increase compared to 2023. The company has achieved 72% of its profit target for the year in the first six months.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.