According to data from the Hanoi Stock Exchange (HNX), Nam Long Investment JSC (code: NLG, HoSE) has just announced the offering results of its private placement bonds with a total value of VND 950 billion.

Specifically, Nam Long issued bond batches NLGB2427002 and NLGB2427003, with 5,000 and 450 bonds, respectively, each with a par value of VND 100 million per bond.

Both bond batches were issued on August 22, with a term of 3 years. The total issuance value is VND 950 billion.

According to the resolution approving the bond issuance plan announced by Nam Long in late July, these are non-convertible bonds, without warrants, secured, and establishing the direct debt obligation of the issuing organization.

The bond interest rate will be a combination of fixed and floating rates. For the first four interest calculation periods, the fixed interest rate is 9.78% per annum; the remaining periods will have a floating rate equal to the sum of 4.73% and the reference interest rate of the related calculation period.

In terms of the bond issuance guarantee plan, the VND 500 billion bond batch is secured by nearly 34.5 million shares of Southgate JSC owned by Nam Long. The value of the collateral on the issuance date is VND 1,000 billion, equivalent to VND 29,000 per share.

The VND 450 billion bond batch is secured by 31.03 million shares of Southgate JSC owned by Nam Long. The value of the collateral is VND 900 billion, based on the Appraisal Certificate issued by iValue Co., Ltd. on March 25, 2024.

However, the bond collateral can be supplemented, reduced, or replaced during the circulation period with Nam Long VCD JSC shares owned by NLG; NLG’s capital contribution to Dong Nai Waterfront City Co., Ltd.; and other assets owned by Nam Long to secure its payment obligations related to the bonds. At the time of issuance, Southgate JSC shares owned by Nam Long are prioritized for use.

Source: NLG

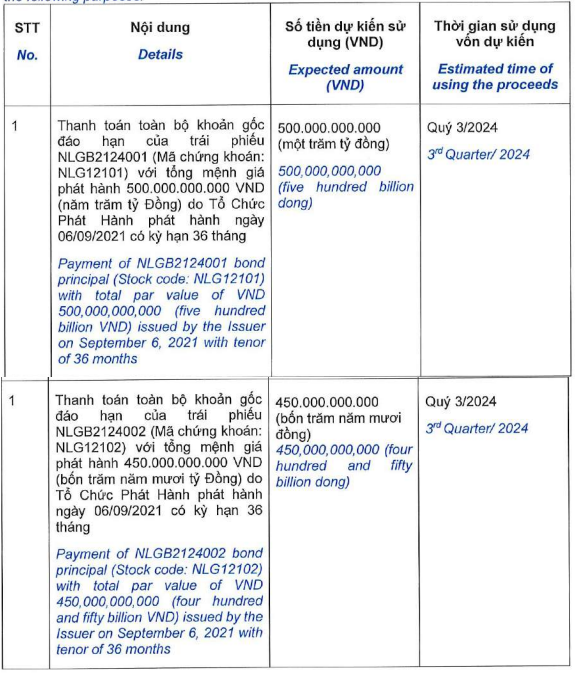

Regarding the plan for using the proceeds, Nam Long expects to use the entire VND 950 billion to repay the principal of matured bonds NLGB2124001 (issuance value of VND 500 billion) and NLGB2124001 (issuance value of VND 450 billion). Both bond batches were issued on September 06, 2021, with a term of 36 months.

So far this year, Nam Long has issued three bond batches with a total value of VND 1,500 billion.

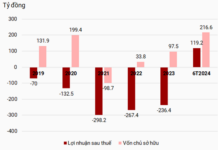

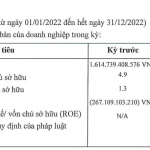

In terms of business performance, in the second quarter of 2024, Nam Long recorded a 74% decrease in revenue compared to the same period, reaching nearly VND 252.3 billion. Profit after tax was nearly VND 160 billion, down more than 30% compared to the same period, but significantly improved compared to the loss of VND 65 billion in the first quarter of 2024.

For the first six months of this year, NLG’s net revenue was nearly VND 457 billion, down 62% over the same period last year. Of this, revenue from real estate business and service provision reached nearly VND 372 billion (mainly from Southgate and Izumi projects) and VND 64 billion, respectively. NLG’s net profit decreased by 63% over the same period to nearly VND 131 billion.

As of the end of June 2024, Nam Long’s bond debt was approximately VND 3,600 billion.

Introducing a New Subsidiary of CII Issuing 550 Billion Dong Bonds

Following the success of BOT Binh Thuan, it is now the turn of the investor of the BOT project to expand Ha Noi Boulevard to issue a successful bond issue worth 550 billion VND. This is also a subsidiary of Ho Chi Minh City Infrastructure Investment JSC (CII).

Compassionate Food settles 70 billion VND bond ahead of schedule

On February 23, 2024, Huu Nghi Food successfully settled the bond batch HNFH2125002, which was issued on June 14, 2021, with a face value of 70 billion VND.