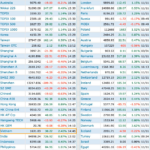

Data statistics from VietstockFinance show that 15 enterprises engaged in rubber exploitation, processing, and production (listed on HOSE, HNX, and UPCoM) have announced their business results for Q2/2024, with 10 units reporting increased profits, 4 reducing profits, and 1 continuing to make losses.

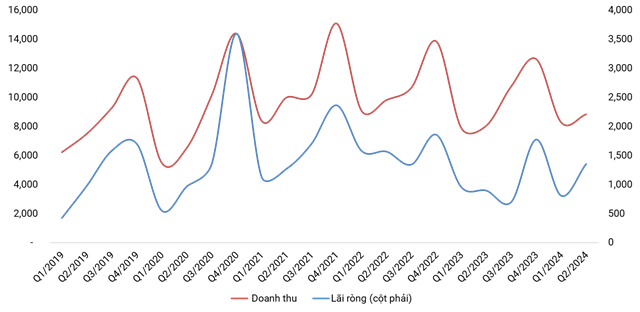

The total revenue of these companies reached VND 8.8 trillion, a slight increase of 9%, but their net profit doubled compared to the same period last year, recording VND 1.3 trillion.

In the group of finished rubber products, mainly used for tire manufacturing, four companies, including SRC, BRC, CSM, and DRC, reported revenue and profit growth ranging from 17% to 100% compared to Q2/2023. These enterprises generated VND 3 trillion in revenue during the period, a 6% improvement. Their net profit was VND 218 billion, a 201% increase, mainly due to SRC’s extraordinary profit.

Meanwhile, the segment of rubber exploitation and raw material processing (dominated by GVR and its subsidiaries) achieved a total revenue of VND 5.7 trillion, a 12% improvement, with a net profit of over VND 1.1 trillion, a 38% increase. A notable breakthrough was made by DPR, with a 60% surge in revenue and a 118% jump in profits.

|

Quarterly business results of rubber companies listed on the stock exchange from 2019 onwards (Unit: VND billion)

Source: Author’s compilation

|

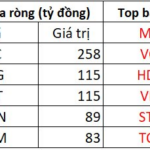

Benefiting from exchange rate differences

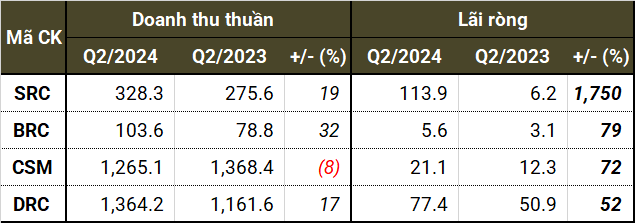

In the tire manufacturing group, Cao su Sao Vàng (HOSE: SRC) surprised with a record net profit of VND 114 billion, a staggering 1,750% increase compared to the same period. However, this surge resulted from other income sources, including the transfer of land lease rights with infrastructure and attached assets. SRC’s core business revenue increased by 19%, reaching VND 328 billion, and its business profit was nearly VND 16 billion, doubling that of Q2/2023.

Cao su Đà Nẵng (HOSE: DRC) surpassed CSM to become the top revenue earner in the tire group, with a 17% increase to over VND 1.3 trillion, the highest ever for the company. This achievement resulted from enhanced sales strategies, despite a 2.5-fold increase in selling expenses. DRC still managed a profit of over VND 77 billion, a 52% increase.

On the other hand, Công nghiệp Cao su Miền Nam (HOSE: CSM), the owner of the Casumina brand, reported an 8% decrease in revenue to VND 1.2 trillion but a 72% surge in net profit to VND 21 billion due to a significant reduction in cost prices. As a result, the gross profit margin for the quarter was the highest since 2020.

Cao su Bến Thành (HOSE: BRC), the only company not engaged in tire manufacturing, also had a successful quarter, achieving a record revenue of VND 104 billion, a 32% increase. Both conveyor belt and technical rubber sales increased significantly. Net profit reached VND 5.6 billion, a 79% increase.

In Q2, the profits of some exporting enterprises, such as DRC and CSM, benefited considerably from exchange rates. According to DRC, the rise in exchange rates since the beginning of the year was one of the factors that improved export performance. DRC realized a gain of VND 16 billion from exchange rate differences in Q2, double that of the same period last year. Similarly, CSM earned VND 27 billion from exchange rate differences, triple the previous amount.

|

Q2 business results of finished rubber product companies (Unit: VND billion)

Source: VietstockFinance

|

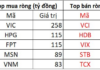

Profits rise due to high rubber prices

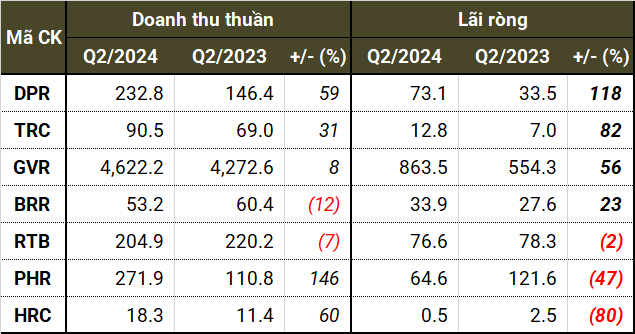

In the group of rubber exploitation and raw material processing, GVR and its subsidiaries mostly enjoyed a favorable quarter due to various factors, including high rubber prices, substantial income from other sources (rubber garden liquidation, compensation, etc.), and more.

The average selling price of rubber was higher than in the same period last year (a 21.7% increase in the first six months) despite a decrease in output, boosting Cao su Đồng Phú’s (HOSE: DPR) revenue by 59% to VND 233 billion. Net profit increased by 118% to VND 73 billion, supported by compensation and damages totaling VND 61 billion, 3.6 times higher than in Q2/2023.

Similarly, the increase in rubber prices pushed Cao su Tây Ninh’s (HOSE: TRC) revenue to over VND 90 billion, a 31% increase. Gross profit tripled from the previous year. Other income sources helped the company achieve a net profit of nearly VND 13 billion, an 82% increase.

Meanwhile, BRR and RTB were the only two companies with declining revenue. Cao su Bà Rịa (UPCoM: BRR) still made a substantial profit of VND 34 billion, a 23% increase, thanks to rubber garden liquidation. However, Cao su Tân Biên (UPCoM: RTB) experienced a decrease in both revenue and net profit, despite a 32% increase in income from the sale and liquidation of fixed assets.

Despite a remarkable 146% surge in revenue to VND 272 billion, Cao su Phước Hòa’s (HOSE: PHR) net profit was only half of the previous year’s, at nearly VND 65 billion, due to the absence of profits from rubber tree liquidation and financial losses.

These companies contributed to the overall performance of Tập đoàn Công nghiệp Cao su Việt Nam – CTCP (HOSE: GVR). Consequently, its revenue and net profit were VND 4.6 trillion and VND 864 billion, respectively, representing an 8% and 56% improvement. For this industry giant, the favorable factors compared to the same period last year also included improved performance in wood processing and profits from joint ventures and associates, coupled with significantly reduced loan interest.

|

Q2 business results of the GVR group and its subsidiaries (Unit: VND billion)

Source: VietstockFinance

|

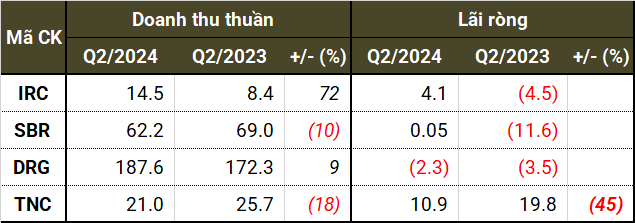

Most of the remaining rubber companies also delivered satisfactory results. Notably, Cao su Công nghiệp (UPCoM: IRC) achieved revenue of nearly VND 15 billion, a 72% increase, thanks to increased sales of RSS rubber products, resulting in a profit of VND 4.1 billion, a positive turnaround from a loss of VND 4.5 billion in the previous period.

Despite a decline in revenue and continued business below cost, Cao su Sông Bé (UPCoM: SBR) managed to break even with a net profit of over VND 50 million. This outcome resulted from the sale and liquidation of assets. Cao su Đắk Lắk (UPCoM: DRG) increased its revenue from rubber sales but remained unprofitable.

Cao su Thống Nhất (HOSE: TNC) experienced a decline in both revenue and profits. The decrease in rubber consumption and the absence of significant gains from rubber tree liquidation caused a 45% drop in net profit to just under VND 11 billion.

|

Q2 business results of the remaining companies (Unit: VND billion)

Source: VietstockFinance

|

Other income has been high for several quarters

In Q2/2024, many rubber companies recorded a significant increase in other income, which contributed considerably to their final profits. For instance, rubber garden liquidation doubled BRR’s other income to VND 23 billion, the highest since Q2/2022. Compensation and damages increased DPR’s other income fivefold to over VND 53 billion, the highest since Q4/2022. RTB earned VND 70 billion from the sale and liquidation of fixed assets, a 43% increase. CSM, TRC, and SBR also reported increases of several dozen percent. GVR’s other income rose by 19% to VND 417 billion.

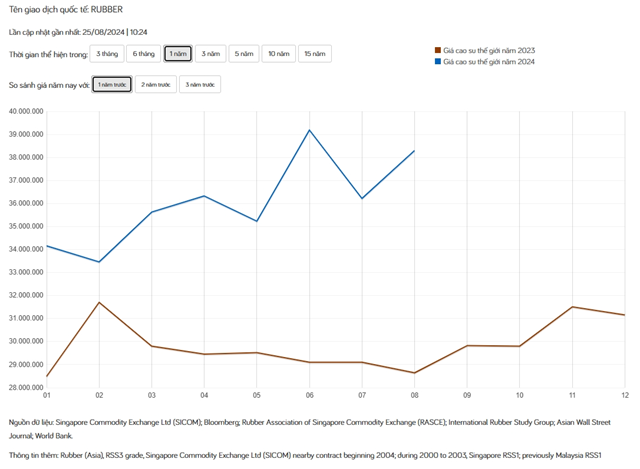

Regarding industry prospects, Phu Hung Securities (PHS) believes that the global natural rubber industry is entering a period of supply shortage. As a result, rubber prices are projected to remain high as the global market faces an annual deficit of 600-800,000 tons. Specifically, the price of TSR20 rubber is expected to reach 1.6-1.8 USD/kg (40-45 million VND/ton, exchange rate of 25,000 VND/USD) in 2024-2025.

Vietnam’s supply is expected to recover at a growth rate of 3-5%/year, with production reaching 1.36-1.4 million tons in 2024-2025. By 2030, the exploited area is estimated to decrease by 1-2% annually to about 800-850,000 hectares (compared to 930,000 hectares in 2023), and the annual output is projected to be 1.3-1.5 million tons.

According to PHS, rubber companies will continue to benefit from the upward price trend and the potential to increase market share as other markets face shortages. Global natural rubber consumption is expected to grow at an average rate of 4-6%/year in 2024-2025, driven by the automotive industry, especially in China.

At the 2024 Extraordinary General Meeting of Shareholders of GVR in March, GVR Deputy General Director, Mr. Trần Thanh Phụng, acknowledged that the average selling price of rubber was high but “abnormal” and “affected by two factors”: the low season and high oil prices. He predicted that the average price in 2024 would still be VND 2-3 million/ton higher than in 2023, equivalent to VND 34-35 million/ton.

Comparison of rubber price movements in 2023 and 2024. Source: Commodity Market

|

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.