An investigation has revealed that, in addition to the public accounting system for tax purposes, the three companies mentioned also maintained an internal system to track actual revenue and expenses. They engaged in buying and selling invoices, which led to a reduction in payable taxes and a loss of over 743 billion VND for the state budget.

In this case, six of the accused have been identified for committing the offense of “Violation of accounting regulations with serious consequences.” These include: Nguyen Thi Hoa, the supervising accountant of the three companies (currently a fugitive); Nguyen Dang Thuyet (CEO of Thanh An Hanoi JSC), Bui Thi Mai Huong (Chief Accountant of Medical Equipment Company Danh)…

32 other accused individuals are proposed to be prosecuted for the offense of “Illegal printing, issuance, and trading of invoices and receipts for budget revenue payment.”

According to the investigation’s conclusions, between 2017 and 2022, at Thanh An Hanoi JSC, Medical Equipment Company Danh, and Medical Equipment Company Trang Thi, the accused individuals maintained two sets of accounting books using the FAST software. The first set of books was an internal financial accounting system that recorded all actual revenue and expense data. The second set of books was for tax purposes, with manipulated data used to create financial and tax reports for state management agencies. This manipulation involved inflating input costs and cost of goods sold, leading to reduced profits and taxable income.

Accused individual Nguyen Dang Thuyet.

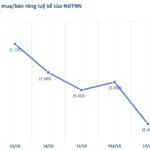

|

Nguyen Dang Thuyet directed the accountants of the Thanh An Hanoi group of companies to manage these two accounting systems. Specifically, Do Thi Hoa (Chief Accountant of Thanh An Hanoi JSC) was responsible for controlling the entire actual revenue and expense activities, which were recorded in the internal accounting software, and the tax declaration data (incorrect data) of the three companies.

Nguyen Thi Hoa’s task was to create a plan to estimate the amount of tax payable for the year, which was not based on actual data. This involved inflating input costs by purchasing fake invoices to reduce taxable income.

Bui Thi Mai Huong and Nguyen Thi Hoa were given the responsibility of managing digital signatures (TOKENs) by Nguyen Dang Thuyet to file tax reports and issue electronic invoices. After preparing the tax and financial reports, the group’s leaders would approve them, and the subordinates would use the digital signatures to submit them to the tax authorities.

Other accused individuals in the case.

|

To legitimize their criminal activities, the accused individuals purchased fake invoices from 32 different companies and individual business households. From 2017 to 2022, this network purchased 19,167 fake invoices (for medical supplies) from 110 companies and business households, with a total pre-tax value of 3,689 billion VND and VAT of over 75 billion VND. The cost of purchasing these invoices amounted to 257 billion VND.

The 19,167 fake invoices (without actual goods) purchased from 110 companies and business households were recorded in the tax accounting software (tax accounting system) to inflate expenses and reduce payable taxes. Meanwhile, the cost of purchasing these fake invoices and other actual revenue and expenses were tracked by Do Thi Hoa using the internal accounting software.

The financial performance of the three companies during the 2017-2022 period showed total assets and capital sources of over 8,542 billion VND, total pre-tax profits of 562 billion VND, post-tax profits of 448 billion VND, and a total corporate income tax payment of over 114 billion VND.

However, data extracted from the internal FAST software of the three companies revealed discrepancies. Specifically, Thanh An Hanoi JSC, Medical Equipment Company Danh, and Medical Equipment Company Trang Thi had total assets and capital sources of over 12,828 billion VND, total pre-tax profits of 2,655 billion VND, and total post-tax profits of 2,563 billion VND.

This indicates that there was a significant difference between the publicly disclosed books and the internal books, with a total increase in assets and capital sources of 4,286 billion VND and an increase in pre-tax profits of 2,092 billion VND.

During the investigation, a tax expert from the Hanoi Tax Department issued a conclusion regarding Value-Added Tax (VAT). The three companies used 19,167 fake invoices to claim VAT deductions for goods and services purchased, leading to a reduction in payable taxes and causing a loss of over 62 billion VND to the state budget.

Regarding Corporate Income Tax, the use of fake invoices purchased from companies and business households to manipulate accounting data when preparing financial reports and determining taxable income resulted in a reduction of over 680 billion VND in taxable income. Therefore, the actions of the accused individuals caused a total loss of more than 743 billion VND.

During the investigation, the accused individuals paid over 93 billion VND to rectify the consequences of the case. The Ministry of Public Security’s Investigation Police Department has seized 18 real estate properties belonging to the accused individuals and frozen several bank accounts with a total balance of over 2.3 billion VND.