In relation to the proposal, “Policies to Attract and Promote Overseas Remittance Resources in Ho Chi Minh City for the period 2024 – 2030,” Dr. Bui Duy Tung from RMIT University Vietnam, shared that in countries such as India and Mexico, remittances have been successfully channeled into areas such as education, healthcare, and environmental conservation. This approach not only generates profits for investors but also uplifts local communities.

Investing in Infrastructure

Reporter: The proposal, “Policies to Attract and Promote Overseas Remittance Resources in Ho Chi Minh City for the period 2024 – 2030,” has been approved by the Standing Committee of the Ho Chi Minh City Party Committee, and units are completing the contents to soon submit to the People’s Committee of Ho Chi Minh City for issuance. In your opinion, what are the solutions to contribute to mobilizing this golden resource of remittances?

– Dr. BUI DUY TUNG: In countries like India and Mexico, remittances have been successfully directed towards sectors such as education, healthcare, and environmental conservation, yielding profits for investors and positively impacting local communities. For instance, investing in high-tech education centers or green energy projects can create a dual impact by boosting economic growth while addressing social challenges such as educational gaps and environmental degradation.

In Vietnam, especially in Ho Chi Minh City, utilizing remittances in similar ways can bring about significant benefits. For example, investing in healthcare infrastructure, particularly in underdeveloped areas, can improve community health outcomes while generating stable profits. As a result, these projects become attractive to overseas Vietnamese.

The success of remittance programs in the Philippines is closely linked to the strength of their diaspora network. Ho Chi Minh City and the whole country can also build and expand communication channels with overseas Vietnamese through embassies, consulates, and Vietnamese organizations abroad, not only for information provision but also for fostering a sense of participation and ownership within the diaspora community. These networks serve as crucial channels for not just money transfers but also for the transfer of skills, knowledge, and technology back to Vietnam.

By establishing a dialogue channel with regularly updated information for the Vietnamese diaspora, the city can better understand the interests and capabilities of these communities and subsequently adjust investment opportunities accordingly. For instance, Ho Chi Minh City could develop a remittance portal that continuously updates information on projects, policies, and investments, providing the diaspora with a transparent and accurate source of information.

Developing Financial Products

What role do financial solutions play in encouraging remittances to flow back to the city, sir?

– Providing flexible financial solutions is key to transforming remittances into effective investments. Countries like Kenya have achieved tremendous success with mobile money platforms that facilitate easy and secure financial transactions for their diaspora communities.

Ho Chi Minh City can develop similar financial products, such as diaspora bonds that have been successfully utilized in countries like Israel and India as a means for the diaspora to express their patriotism and raise significant capital for national development projects.

Essentially, these bonds are debts issued by the government or businesses to citizens living abroad. The funds raised through these bonds are typically used for large-scale infrastructure projects or to support economic stability.

In addition to diaspora bonds, other innovative financial products can be structured to attract remittances into efficient channels: real estate investment funds for foreigners, impact development bonds, and community fundraising platforms.

Developing financial products is considered one of the solutions to help Ho Chi Minh City attract remittances for socio-economic development. Photo: LAM GIANG

Investing in Housing

With the new laws related to real estate taking effect, including the provision that overseas Vietnamese are also allowed to own houses in Vietnam, will this contribute to boosting remittance flows into this market?

– Allowing overseas Vietnamese to own houses in Vietnam opens up a new, safe, and attractive investment channel for the diaspora. Real estate is a valuable asset with long-term value and is often seen as a safe haven for capital. With this new regulation, many overseas Vietnamese may view this as an opportunity to invest in their homeland, driven by both profit motives and emotional connections to the country. In other countries like the Philippines and Mexico, similar policies have helped boost remittance flows into the real estate market, positively contributing to the industry’s growth.

Permitting home ownership will give overseas Vietnamese greater peace of mind when sending money back home to invest in real estate, reducing legal risks and other barriers. This also implies enhancing stability and transparency in the real estate market, as transactions will be conducted through official channels, complying with legal regulations.

Beyond the economic aspect, homeownership holds significant meaning in strengthening the bond between the diaspora and their homeland. This not only encourages remittance flows but also stimulates the diaspora’s involvement in social, charitable, and community development activities.

What is a remittance investment fund?

A remittance investment fund is a financial product where members of the diaspora can contribute capital to a collective fund that invests in development projects in Ho Chi Minh City. These funds can be managed by reputable financial institutions, ensuring transparency and efficiency in capital utilization.

Remittance investment funds can be designed to invest in various sectors, ranging from real estate and infrastructure to high technology and renewable energy, thus reducing investment risks while ensuring that priority areas in Ho Chi Minh City receive the necessary investment.

With investment funds, diaspora members can contribute a small amount of money and still participate in large-scale projects. This broadens investment opportunities for more individuals instead of only catering to those with substantial capital.

Redirecting Remittances: The Ho Chi Minh City Plan

Remittances are a golden resource that significantly contributes to the economic growth of Ho Chi Minh City and Vietnam as a whole.

Choosing the Right VND Bank Partner: A Shift for FDIs

The influx of FDI into Vietnam presents a significant opportunity for the economy as a whole and, more specifically, for the banking sector. With their deep understanding of the local market, culture, and people, domestic banks are ideally positioned to support and facilitate the expansion and growth of FDI enterprises in the region. This unique advantage enables them to foster the development of the local economy and strengthen their own position in the process.

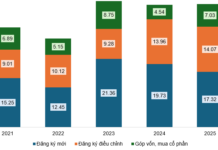

Remittances to Ho Chi Minh City Reach Nearly $5.2 Billion in First Half of 2024

Remittances to Ho Chi Minh City reached an impressive figure of 5.178 billion USD in the first six months of 2024, surpassing the total for the whole of 2023 by 54.7% and marking a significant 19.5% increase compared to the same period last year.