Prime Minister Pham Minh Chinh has just signed Official Dispatch No. 85/CD-TTg dated September 2, 2024, on the direction of the state budget estimate, sending it to the Ministers, heads of ministerial-level agencies, Government agencies; Chairmen of the People’s Committees of provinces and centrally-run cities.

The Official Dispatch clearly states that: In the first eight months of 2024, under the leadership of the Party, the supervision of the National Assembly, the synchronous participation of the entire political system, the resolute, close and timely direction of the Government, the Prime Minister, the efforts, determination, close coordination, proactive and flexible direction of the Ministries, sectors and localities, the socio-economic situation continues to be stable and shows a positive recovery, the major balances of the economy are guaranteed, inflation is under control, economic growth is promoted, national defense and security are maintained, social order and safety are ensured, and social security and people’s lives.

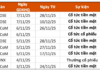

State budget revenue in the first eight months is estimated at 78.5% of the estimate, while many policies on tax, fee, charge and land rent exemption, reduction and extension have been implemented; state budget expenditure is tightly managed and saved.

The state budget balance is guaranteed, the state budget overspending, public debt, government debt and the country’s foreign debt are within the limit allowed by the National Assembly.

However, the production and business situation of a part of enterprises is still difficult, inflationary pressure is still large, and natural disasters and storms are complex. State budget revenue in general reached a fairly good progress and grew compared to the same period last year, but there are still some collections with low collection progress, especially land use levy.

The progress of disbursement of investment capital in the first eight months reached 40.49% of the plan assigned by the Prime Minister, lower than the same period last year; there are still 19 ministries, central agencies and 31 localities that have not allocated details of the capital plan assigned in 2024.

In addition, through the supervision results of the National Assembly, the conclusions of the Inspectorate and the State Audit Office, and the annual state budget settlement show that the observance of financial and budgetary discipline in some places is still not strict, there are still violations of the law, fraud, tax evasion, and management and use of budget and public property that are not in accordance with the regime regulations, waste and waste in some ministries, sectors, localities, agencies and units.

Enhancing regular expenditure savings, focusing resources on increasing investment expenditure for infrastructure development, and preventing and overcoming natural disasters

In the coming months, the world situation is forecast to continue to develop complicatedly and unpredictably, affecting our country’s economy. Domestically, the economy is facing many difficulties and challenges.

However, with the determination to strive to complete at the highest level the targets and tasks of the state budget estimate for 2024 according to the Conclusion of the Central Committee and the Resolutions of the National Assembly and the Government, in order to ensure the maintenance of the state budget balance at all levels in all situations, enhance savings in regular state budget expenditure, focus resources on increasing investment expenditure for infrastructure development, prevention and overcoming of natural disasters and storms, and response to climate change; tighten financial and budgetary discipline and state, the Prime Minister requested the Ministers, heads of ministerial-level agencies, Government agencies; Chairmen of the People’s Committees of provinces and centrally-run cities to focus on directing, guiding, inspecting and urging agencies and units and subordinates to continue their efforts and resolutely implement solutions and tasks for socio-economic development and state budget that have been set out, striving for revenue increase, enhancing savings in expenditure, proactively balancing the state budget in the remaining months of 2024; in which, focusing on implementing the following key tasks and solutions:

First, the ministries, agencies and localities: Continue to effectively implement key solutions and tasks to promote administrative procedure reform, improve the investment and business environment, enhance national competitiveness, remove difficulties for production and business, and promote socio-economic development according to the Government’s Resolutions No. 01/NQ-CP, No. 02/NQ-CP dated January 5, 2024, Resolution No. 93/NQ-CP dated June 18, 2024 and the Resolutions of the Government’s regular meetings; Directive No. 12/CT-TTg dated April 21, 2024, Directive No. 14/CT-TTg dated May 2, 2024, and Official Dispatch No. 71/CD-TTg dated July 21, 2024 of the Prime Minister.

Focus on implementing financial and monetary policies and other macro policies that have been issued to remove difficulties for businesses and people, control inflation, maintain macro-economic stability, maintain growth momentum and ensure the major balances of the economy; strive for a GDP growth rate of about 7% for the whole year of 2024, exceeding the set target, creating a premise and momentum for 2025 and the period of 2026-2030.

Continue to study and perfect regulations on house and land taxes; increase spending to create a source of salary reform

The Prime Minister directed a strong implementation of state budget revenue collection, striving to complete the assigned revenue estimate at the highest level.

Continue to perfect the institutions and laws on state budget revenue collection, synchronously implement solutions and measures to manage revenue collection, prevent revenue loss, and ensure collection of the right, sufficient and timely collection of newly arising revenues according to regulations.

Continue to study and perfect tax regulations for houses and land; expand and prevent tax base erosion, exploit remaining sources of revenue, and expand new revenue sources.

Promote and improve the effectiveness of digital transformation and application of information technology, improve the effectiveness and efficiency in revenue management, especially the collection of taxes on e-commerce transactions and foreign suppliers, deploy data portals on e-commerce floors and expand the application of e-invoices created from cash registers for businesses and business households that operate, provide goods and services directly to consumers, especially catering services…

On that basis, strive to achieve state budget revenue in 2024 exceeding 10% of the estimate assigned by the National Assembly, state budget revenue in 2025 higher than about 5% compared to the estimate in 2024 to ensure resources to meet the tasks of expenditure according to the estimate, increase spending to create a source of salary reform and handle sudden tasks arising.

Strengthen the prevention of commercial fraud, transfer pricing, import price fraud and smuggling across borders, especially digital platform-based business activities and real estate transfers.

Strengthen inspection and supervision of the implementation of regulations on price management, tax and fee, stabilize prices of raw materials and essential commodities for production and people’s lives.

Focusing resources on reforming salary policies

Organizing the direction of state budget expenditure in an active, economical manner, tightening financial and budgetary discipline, and improving the efficiency of state budget use;

Thoroughly save regular expenditures, proactively review and arrange tasks of expenditure; cut and save 5% of the regular expenditure estimate assigned according to Directive No. 01/CT-TTg dated January 4, 2024 of the Prime Minister and Resolution No. 119/NQ-CP dated August 7, 2024 of the Government.

For the year 2025, in addition to saving 10% of regular expenditures to create a source of salary reform according to regulations, in the process of implementation, the Ministries, agencies and localities shall synchronously implement solutions to review, arrange and arrange expenditure tasks, striving to save an additional 10% of regular expenditures increased in the 2025 estimate compared to the 2024 estimate (after excluding similar amounts in 2024 as prescribed in Resolution No. 119/NQ-CP dated August 7, 2024 of the Government) to reduce state budget overspending or for urgent tasks, arising, performing social security tasks of each Ministry, agency and locality or supplementing investment and development expenditure.

Implement the state budget expenditure in accordance with the prescribed regime, within the assigned estimate, ensuring strictness, economy and efficiency; focus resources on implementing the policy of salary reform, social security policies and regimes, and poverty reduction.

Cut the regular expenditure estimate that has been assigned to the ministries, central agencies but by June 30, 2024, has not been allocated to budget users (except with the permission of the Prime Minister) according to Resolution No. 82/NQ-CP dated June 5, 2024 of the Government.

Focus on implementing key tasks and solutions according to Directive No. 26/CT-TTg dated August 8, 2024 of the Prime Minister, speeding up the progress of implementation and disbursement of public investment capital, especially key national projects and programs, national target programs.

Timely transfer capital from tasks and projects that are not eligible for disbursement or slow disbursement to supplement tasks and projects that are capable of fast disbursement and in need of capital addition as prescribed.

Strive to disburse over 95% of the 2024 capital plan, thereby contributing to promoting economic growth.

Invest in the construction and purchase of public assets in accordance with the regime, standards and norms, ensuring thrift.

Organize the review and rearrangement of public assets, handle assets that are no longer in use in accordance with regulations; resolutely recover assets that are used for the wrong objects, wrong purposes, exceeding norms and standards; do not let public assets be wasted and lost.

Urgently reviewing and submitting a decision to amend and abolish financial mechanisms and special income

Urgently implement the provisions of Resolution No. 104/2023/QH15, Resolution No. 142/2024/QH15 of the National Assembly, review the entire legal framework to submit to the competent authority for consideration and decision on the amendment or abolition of the financial mechanism and special income of the agencies and units that are being implemented before December 31, 2024.

In the process of implementing the amendment and abolition of the financial mechanism and special income, the Ministries and central agencies shall have the responsibility to ensure the maintenance of the operation of the agency and unit according to the common regime prescribed by the State.

Localities implement the state budget expenditure according to the assigned estimate and revenue capacity according to the level of decentralization; proactively use reserves, reserves and local budget balances to handle tasks of expenditure for natural disaster and epidemic prevention and control and other urgent and sudden tasks arising in accordance with regulations.

Review, arrange and adjust the expenditure estimate in accordance with regulations; proactively cut unnecessary expenditures; save regular expenditures, especially expenditures for conferences, seminars, receptions, domestic business trips, and foreign research and survey.

In case the local budget revenue is expected to fall short of the estimate, the People’s Committees of the provinces shall build a plan and report to the People’s Councils on solutions to ensure the local budget balance as follows: (i) proactively retain 50% of the local budget reserve; (ii) balance the local resources to proactively make up for the reduction in local budget revenue (financial reserve fund, budget balance,…).

After using local resources but still unable to make up for the reduction in revenue, it is necessary to review, cut and stretch the tasks of expenditure, in which it is necessary to proactively restructure investment and development expenditure, especially in cases where land use levy and lottery revenue fluctuate greatly.

In the process of budget management, in case of temporary shortage of funds in the state budget at all levels, it is necessary to promptly report to the superior level for consideration and handling in accordance with the provisions of Article 58 of the Law on State Budget and Clause 1, Article 36 of the Government’s Decree No. 163/2016/ND-CP.

Ensuring reserve sources for natural disaster and epidemic prevention and control, salary payment, and social security policies

Second, the Ministry of Finance shall take the prime responsibility and coordinate with the Ministries, agencies and localities: Continue to implement an open, reasonable, focused and effective fiscal policy, coordinate closely and harmoniously with monetary policy to promote growth, stabilize the macro-economy, control inflation, and ensure the major balances of the economy. Control the state budget overspending and public debt within the permitted limit.

More drastic implementation of digital transformation, regulations on e-invoices, especially the promotion of digital transformation in budget collection and expenditure, improving the effectiveness and efficiency of state budget collection and expenditure management; ensure the right collection, sufficient collection, timely collection, expansion of revenue sources and prevention of revenue loss, especially from e-commerce to make up for the reduction in revenue due to the implementation of support policies.

Managing the budget to ensure reserve sources for natural disaster and epidemic prevention and control, salary payment, social security policies and other important and urgent political tasks arising.

Absorb the opinions of the National Assembly Standing Committee, complete and submit to the Government before September 15, 2024, the draft Decree prescribing the formulation of estimates, management and use of regular state budget expenditures for the purchase of assets, equipment; renovation, upgrading, expansion and new construction of works in projects that have been invested in construction as a basis for submitting to the competent authority for implementation of the allocation of the remaining regular expenditure estimate in 2024.

Summarize the amount of reduction and saving of 5% of the regular expenditure estimate of the Ministries, central agencies and localities to report to the Government and report to the competent authority for consideration and decision according to Resolution No. 119/NQ-CP dated August 7, 2024 of the Government.

Urging, timely guiding the handling of arising issues to speed up the progress of public investment capital disbursement

Third, the Ministry of Planning and Investment shall take the prime responsibility and coordinate with the ministries, central agencies and localities to urgently review and report to the competent authority for amendment of the law on public investment to remove difficulties and obstacles in the mechanism; urge, timely guide the handling of arising issues to speed up the progress of public investment capital disbursement.

Promptly submit to the competent authority for adjustment of the plan for medium-term public investment capital from the state budget for 2024 among the Ministries, central agencies and localities according to the regulations and direction of the Government and the Prime Minister.

Fourth, the Prime Minister assigns Deputy Prime Minister Ho Duc Phoc to direct, urge and organize the effective implementation of this Official Dispatch; report to the Prime Minister the issues exceeding his competence.

Fifth, the Government Office shall monitor and urge the implementation of this Official Dispatch according to its functions and tasks./.

The Quest for Efficient Land Clearance: Unlocking Success

With strong and unified leadership from various sectors and functional units, along with the dedication, creativity, and hard work of the officials involved, the land clearance process for investment projects requiring land in Thanh Hoa province has seen significant positive changes since 2023. These efforts have greatly contributed to attracting investments and boosting the province’s economic and social development.

“Leading the Way: Danang’s Trailblazing Spirit in Three Key Areas”

Working with the Danang Municipal Party Committee, Prime Minister Pham Minh Chinh expects Danang to be a pioneer and breakthrough city, “leading the way” in important areas and new driving forces for rapid, comprehensive, harmonious, and sustainable development. Danang is envisioned to excel as a key growth and development hub, not just for Central Vietnam but for the entire country.

Unlocking the Secrets to Effective Public Investment: Holding Accountability at Bay

As of the end of July, the disbursement of public investment capital in the country reached only 32%, lower than the same period last year, and significantly below the Government’s target of over 95% of the plan. Reprimands and demands for accountability from organizations and individuals responsible for the slow disbursement of public investment have been continuously emphasized in directives by those in charge. So, who has been held accountable, and what actions have been taken to address this issue?

The Mastermind Behind the Scenes: CEO Nam Huynh

On August 17, 2024, at the prestigious Green Economy Excellence Awards, Norbreeze Collective Asia made a remarkable impression by bagging three esteemed awards for their contributions to the Vietnamese economy.