Antimony is a critical component in a variety of products, from pins to solar panels and weapons. With China tightening its grip on rare earth materials in retaliation for trade restrictions and tariffs on Chinese-made products, the global supply chain is bound to feel the impact.

The price of rare metals has soared in recent months as China began to impose stricter restrictions on the export of critical materials, but none have seen as drastic a surge as antimony. Last month, China announced tightened export licensing for antimony, effective September 15th.

The price of antimony has skyrocketed, starting in Q3 of this year.

Antimony’s fire-resistant and heat-resistant properties make it crucial in battery manufacturing, especially for lead-acid and automotive batteries. It is also used in other automotive parts, including brake pads. The global shift towards green energy has created a new demand for antimony in recent years. The material can improve the transparency of the coating on solar panels, increasing their efficiency, and is also used in smartphone screens.

More importantly, a prolonged shortage of antimony could pose risks to national security. It is a critical material in the defense supply chain, used in everything from weapons production to night-vision goggles, ammunition, and infrared sensors.

While the export restrictions have not yet taken effect, antimony prices have already reached record highs. Spot prices in China have surpassed $25,000 per ton, double what they were at the end of last year.

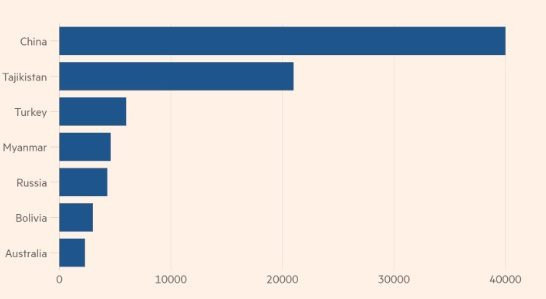

Global antimony mine production in 2023. Source: United States Geological Survey.

For consumers, finding an alternative supplier won’t be easy. China is the largest producer of antimony, accounting for nearly half of the global market share, according to the United States Geological Survey.

In contrast, the United States has not produced any marketable antimony since 1997. Production from countries like Russia and Myanmar only further complicates the global supply chain due to sanctions. Even the mines in these countries are often only partially operated as they are mostly owned by Chinese companies. These companies typically maintain a dominant position in the processing and refining of the material after extraction.

Shares of Hunan Gold Corporation, one of the largest antimony producers, have risen 35% this year. Until the supply chain finds an alternative to Chinese-controlled antimony, prices will only continue to rise.

Spending More Than the US and South Korea Combined: China’s Buying Spree of a ‘Game-Changing’ Commodity in the Semiconductor Industry

In a bid to bolster its domestic chip supply chain, China is estimated to have spent a whopping $25 billion in the first half of 2024. This substantial investment underscores the country’s commitment to fostering self-reliance in the semiconductor industry and reducing its dependence on foreign suppliers.

Unveiling the Deceit: Capturing Two Foreigners Impersonating Bank Officials to Defraud Victims of their Assets

Two foreign nationals posed as bank employees, phoning and requesting confidential information. They then fraudulently obtained and used Mr. T.’s credit card details.