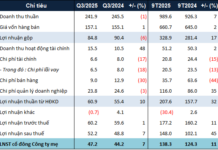

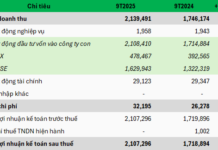

Vietnam Machinery for Industry and Agriculture Corporation (VEAM, stock code: VEA) has just announced its reviewed consolidated financial statements for the first six months of 2024. Accordingly, in the first half of the year, VEAM’s net revenue reached nearly VND 1,923 billion, a 2.8% decrease compared to the same period.

Thanks to a 4.4% increase in profit from joint ventures and associates, amounting to VND 2,865 billion, along with reduced expenses, VEAM’s post-tax profit reached VND 3,257 billion, a 2.3% increase compared to the previous year.

Notably, VEAM’s profits remain in the thousands of billions and continue to grow slightly despite successive prosecutions of high-ranking personnel.

Specifically, in June 2024, Hanoi Police arrested and prosecuted Mr. Phan Pham Ha, VEAM’s CEO, for “Abusing position and power while performing official duties.”

In early October 2023, Mr. Nguyen Thanh Giang, former CEO of VEAM, and Ho Manh Tuan, VEAM’s deputy CEO, were also prosecuted by Hanoi Police for “Violation of regulations on the management and use of state assets, causing waste and loss.”

However, despite earning thousands of billions in profits, VEAM has been subject to numerous exceptions by its auditor, UHY Audit and Consulting Company. Specifically, the auditor noted that as of June 30, VEAM had not assessed the recoverability of receivables that were past due, totaling nearly VND 46 billion.

In addition, VEAM has not evaluated the net realizable value of slow-moving inventory at the company, amounting to nearly VND 72 billion.

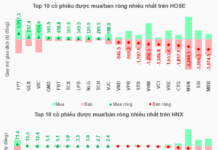

VEA shares surged from the beginning of June 2024 but then adjusted and fell to VND 43,900 per share, up 28% compared to the beginning of 2024. Source: Fireant

Certain expenses were suspended pending treatment as of June 30, valued at VND 466 billion (including interest expense, depreciation, land rent for the foam factory that ceased operations in 2015, and Bac Kan branch of Matexim Joint Stock Company, which are reflected in prepayments and production and business expenses).

In this financial statement, the auditor emphasizes to readers the issue of the stalled medium-sized tractor production project, where the value of unfinished capital construction may depend on the judgment of competent authorities in the future.

In addition, the “Project to relocate and rebuild the small tractor factory,” approved on July 31, 2024, with an implementation period from Q4/2016 to Q1/2023, has not been completed by VEAM in terms of project extension procedures…

As of the end of June 2024, VEAM’s total assets were valued at VND 30,040 billion, a 10% increase from the beginning of the year, of which cash and cash equivalents accounted for only 1.2% (equivalent to VND 370 billion).

VEAM’s payables decreased by 16% compared to the beginning of 2024, to VND 1,173 billion, including short-term loans and finance leases of VND 137 billion, a decrease of VND 5 billion compared to the beginning of 2024.

The Auditors’ Report: Unraveling VEAM’s Web of Issues

At the reviewed consolidated financial statements for the first half of 2024, VEAM was subject to exceptions and notes by the auditing firm on a range of issues.

The Watchdog Member Studying a Different Major, Cencon Vietnam, Heavily Fined.

The SSC has imposed administrative sanctions on Cencon Vietnam for multiple violations, including failing to ensure that the members of the Supervisory Board meet the required standards and conditions and are not subject to legal restrictions.