Rising Interest Rates on Deposits

According to the latest deposit interest rate table from various banks as of the first day of September, many banks have adjusted their interest rates on deposits (for the tenors surveyed: 6, 9, 12, and 24 months) with fluctuations ranging from 0.1-0.8% depending on the tenor and the bank.

At MB, deposit interest rates for 6 and 9-month tenors increased by 0.1% to 4.0% annually. The 12-month tenor is listed at 4.8%/year, up 0.2%, and the 24-month tenor increased by 0.3% to 5.7%/year.

Sacombank raised its interest rates by 0.4% for 6 and 9-month tenors, resulting in a 6-month interest rate of 4.2%/year, a 9-month interest rate of 4.3%/year, and a 12-month interest rate of 4.9%/year.

Deposit interest rates are expected to continue rising slightly until the end of the year.

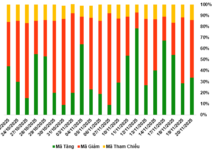

Previously, in August, a total of 15 banks increased their deposit interest rates, with increases ranging from 0.1-0.8%. These banks included Eximbank, HDBank, Sacombank, Saigonbank, TPBank, CB, VIB, Dong A Bank, Techcombank, VietBank, SHB, PVCombank, Cake by VPBank, and Nam A Bank. Notably, Sacombank, VietBank, Dong A Bank, and Techcombank have increased their interest rates twice.

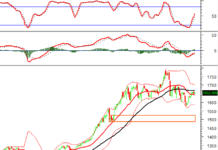

The wave of increasing deposit interest rates has been gaining momentum since the beginning of April this year. At that time, the highest interest rate in the system for a 12-month tenor was around 5%/year, and it has now increased to 6.2%/year. The number of banks offering interest rates of 5% or higher has also more than doubled, from 12 to 29.

Regarding the interest rate movements over the past time, MBS Research believes that the upward trend in deposit interest rates continued in August as credit growth regained its recovery momentum, prompting banks to adjust interest rates to attract deposits.

The increase in non-performing loans (NPL ratio of the entire system as of the end of June this year increased by 5.77% compared to the end of 2023) also contributed to the push for banks to step up new capital mobilization to ensure liquidity. Specifically, input interest rates for tenors below 6 months and 24 months were adjusted upward by 0.1%/year.

Affirming that credit demand will continue to increase more strongly from the middle of 2024 as production and investment accelerate in the last months of the year, MBS Research forecasts that the 12-month tenor deposit interest rate of large commercial banks may increase by another 0.5% by the end of the year. However, output interest rates will remain at the current level as regulatory authorities and commercial banks are making efforts to support businesses in accessing capital.

According to experts from Vietcombank Securities Joint Stock Company, although deposit interest rates are trending upward from their lows, the current interest rate level is still lower than the 3-year average before the COVID-19 pandemic, which was 5.05%/year. The pressure to increase interest rates may start in the fourth quarter, and it is expected that interest rates for the whole year may increase by 0.5-1%.

Credit Growth Resumes

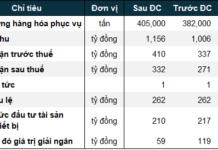

According to statistics from the State Bank of Vietnam, credit growth as of August 16 increased by 6.25% compared to the end of 2023. Previously, the credit growth of the entire banking system reached 6.1% at the end of the second quarter, but by the end of July, it had slowed down to 5.66% compared to the end of 2023. Thus, credit has recovered in the first half of August.

The State Bank of Vietnam stated that, in the market, some banks have made several adjustments to increase interest rates, but most of these increases are for short-term deposits, while medium and long-term interest rates remain very low. At the same time, lending rates are still kept at low levels following the direction of the State Bank of Vietnam to support businesses and individuals.

Mr. Nguyen Duc Do, Deputy Director of the Institute of Economics and Finance, said that in the context of the decreasing exchange rate pressure and the possibility of the State Bank of Vietnam reducing the operating interest rate in the near future, bank interest rates could continue to remain low, creating favorable conditions for borrowing. This not only supports businesses but also contributes to the promotion of economic growth.

“Credit growth in the coming months will likely approach the set targets, especially if economic conditions continue to improve,” predicted Mr. Do.

The Art of Optimizing: Crafting a Captivating Headline

The Fed Adjusts Credit Limits: Who Benefits the Banks?

In the first half of the year, several banks achieved remarkable loan growth rates, outperforming the industry average. LPBank took the lead with an impressive 15.2% growth, followed by ACB at 12.8%, HDBank at 12.5%, Techcombank at 11.6%, MB at 10.3%, and VPBank at 10.2%. These figures showcase the resilience and dynamism of Vietnam’s banking sector, even amidst global economic uncertainties.

The Ultimate Guide to HDBank’s Interest Rates: Maximize Your Savings with Online Deposits

In early September, HDBank offered an attractive interest rate bracket for individual customers, ranging from 0.5% to 8.1% per annum. The peak interest rate for regular savings accounts was set at 6.1% per annum, while deposits of 500 billion VND and above were eligible for an impressive maximum rate of 8.1% per annum.