The stock market map was painted green with financial stocks such as MBB, HCM, SSI, VIX, and FTS, among others, alongside real estate stocks like DXG, PDR, DIG, NVL, and the Vingroup trio of VIC, VHM, and VRE. While the gains were not significant, the uniformity in the increases, coupled with their high weights in the market, provided a substantial boost to the indices.

The total trading value of the market reached VND 6,247 billion, a noticeable increase from the previous session and slightly higher than the 5-session average.

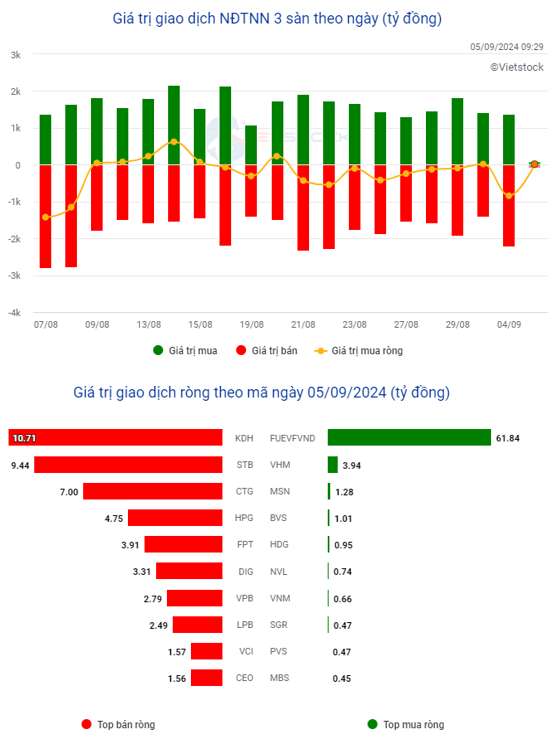

The “clique” buying trend by foreign investors continued, with strong purchases in VHM, exceeding VND 55 billion, and FUEVFVND, nearing VND 54 billion. On the opposite side, FPT witnessed the heaviest selling, with nearly VND 71 billion, followed by CTG, STB, HPG, KDH, and VPB, which experienced relatively uniform selling of around VND 30 billion each.

Open: Vingroup trio accelerates, and the market rebounds slightly after yesterday’s decline

After dropping more than 8 points, the VN-Index rebounded 2.88 points to 1,278.68 at the opening of September 5th, as of 9:30 am. The HNX and UPCoM also turned green, rising 0.44 points to 236.58 and 0.21 points to 93.96, respectively.

Overall, the market witnessed 278 advancing stocks, including 11 that hit the ceiling price, while 157 stocks declined, with 2 touching the floor price. Trading volume was higher than the previous session.

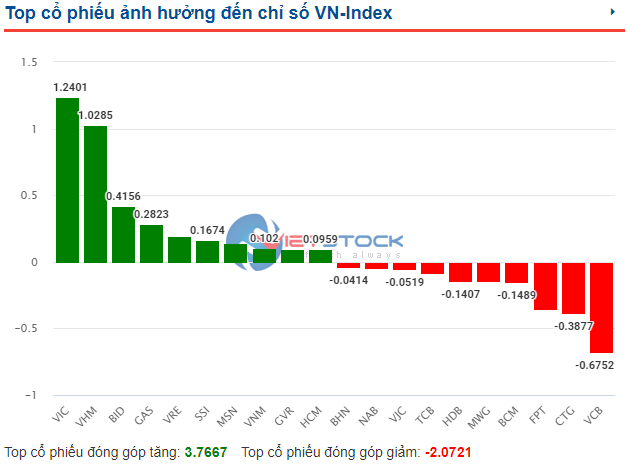

The Vingroup trio stood out in the market, particularly in the real estate industry. VIC climbed 2.84%, VHM rose 2.35%, and VRE gained 1.52%. All three were also among the top 10 stocks positively influencing the VN-Index, contributing 1.24 points, 1.03 points, and 0.2 points, respectively, out of the total 3.77-point increase of the top 10.

Source: VietstockFinance

|

Foreign investors are currently maintaining a balance between buying and selling, with periods of net buying. However, almost all purchases are concentrated in FUEVFVND, exceeding VND 60 billion, while selling pressure is evenly distributed across CTG, KDH, STB, and others.

Source: VietstockFinance

|

Huy Khải