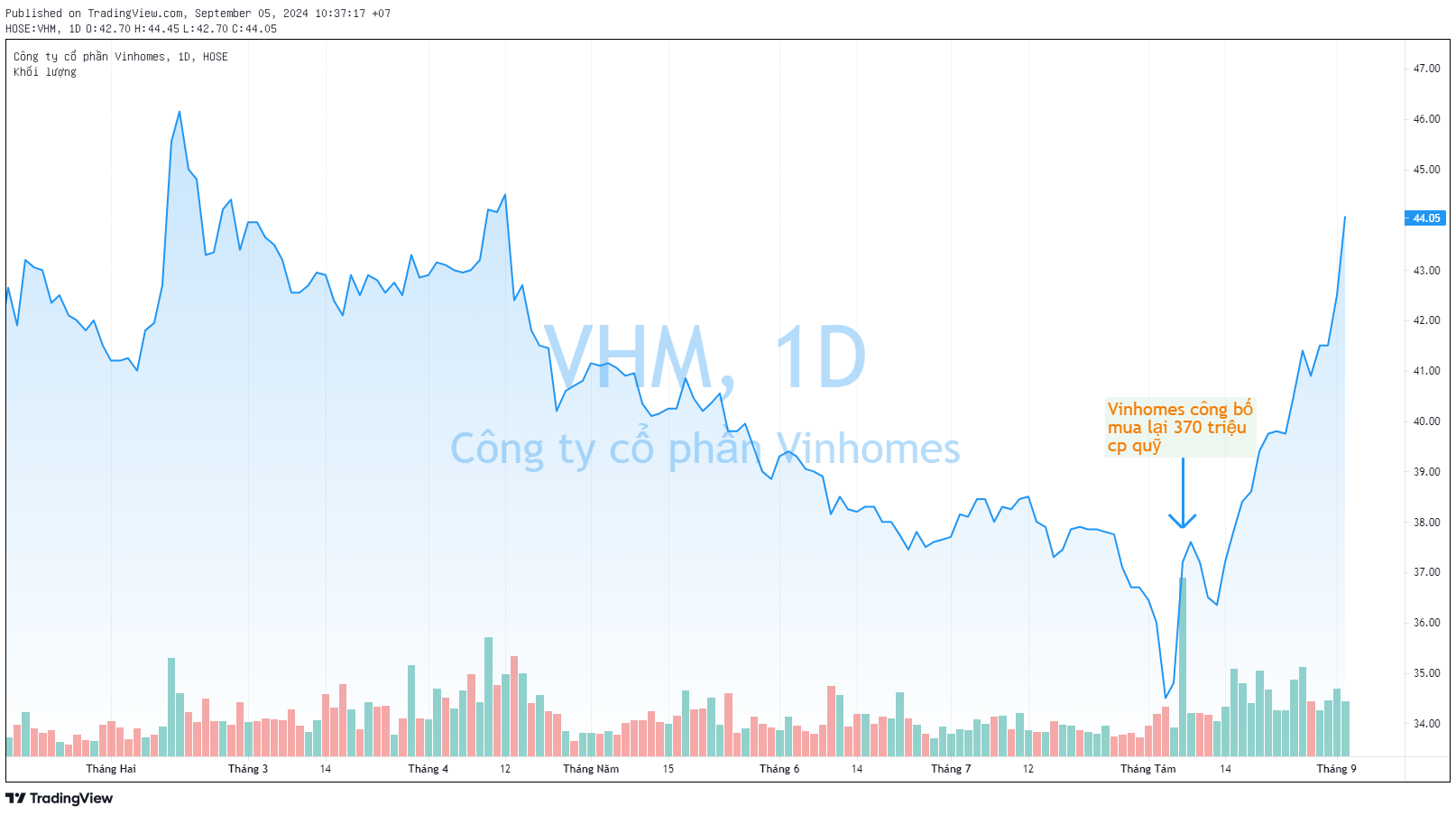

The Vietnamese stock market opened on September 5th with a burst of enthusiasm, led by the ‘Vingroup family’ of stocks. VHM shares of Vinhomes, VIC of Vingroup, and VRE of Vincom Retail all saw significant gains, with increases ranging from 2% to nearly 4%, largely contributing to the upward momentum of the VN-Index. VHM stood out with its share price surging by nearly 5% at one point before narrowing slightly, pushing it above the 5-month peak.

Trading in these three stocks was also lively, with the matched order volume for the morning session of September 5th reaching several million to over ten million units, matching the liquidity of the previous session.

It’s important to note that the aforementioned ‘Vingroup family’ of stocks have experienced a deep decline since the beginning of the year, hitting historical lows before rebounding starting in early August.

The ‘Vin family’ of stocks have shown a recent upturn following the announcement by Vinhomes that it will purchase 370 million treasury shares, equivalent to 8.5% of the circulating shares, on August 7th. Vinhomes emphasized that this move aims to safeguard the interests of both the company and its shareholders, given that the share price is significantly lower than the company’s actual value.

According to a recent report by Mirae Asset, Vinhomes’ treasury stock buyback process is expected to commence in mid-September 2024. Based on the stock’s trading range over the past 30 days, it is estimated that Vinhomes will need to spend between VND 12,700 and 14,800 billion on this buyback. As per Vinhomes’ consolidated audited financial statements for the first half of 2024, the company currently holds VND 17,200 billion in cash and short-term investments.

Mirae Asset shared that in a recent discussion with the Investor Relations (IR) team, Vinhomes confirmed that the share repurchase plan would be financed by available cash and operating cash flow from the sale of certain projects. As a result, Vinhomes stated that the buyback would have only a limited impact on the company’s liquidity and debt ratios.

Since the announcement of the share repurchase plan, VHM’s stock has reacted positively, climbing over 27% to more than VND 44,000 per share, the highest in five months. Its market capitalization also surpassed VND 191,000 billion (USD 7.75 billion), outpacing other prominent names such as Vietinbank, Hoa Phat, Vinamilk, and even its parent company, Vingroup.

In a report from late July 2024, An Binh Securities (ABS) shared its positive outlook on Vinhomes’ growth prospects for the second half of the year. Firstly, they attributed it to the high level of “Cumulative unrecorded sales,” which ensures profits for the company. With a cumulative unrecorded sales value of VND 118,700 billion at the end of Q2 2024, this provides a guarantee for Vinhomes’ future revenue and profits, helping them achieve their business targets for 2024.

Secondly, ABS expects Vinhomes’ sales to continue rising with the upcoming launch of major projects. The company also mentioned being in the final stages of completing two bulk sales transactions totaling approximately VND 40,000 billion.

ABS highlighted that the focus for the second half of 2024 will be on the handover of projects such as Vinhomes Ocean Park 3, Sky Park, Golden Avenue, and Royal Island, as well as recognizing revenue from bulk sales.

Lastly, the securities firm believes that the trio of laws related to the real estate industry, which came into effect on August 1, 2024 (the 2023 Real Estate Business Law, the 2023 Housing Law, and the 2024 Land Law), will positively impact the real estate market. Vinhomes, as a leading real estate developer in Vietnam with a vast and clean land bank and strong financial capabilities, is well-positioned to benefit significantly from these new regulations.