Vietnam’s stock market witnessed a brief surge of green in the opening minutes of the September 5 session, only to be met with intense selling pressure that pushed the VN-Index below the 1,270 threshold. The main index closed 7.59 points lower at 1,268.21, with foreign transaction remaining a detractor as they aggressively sold off over VND 668 billion.

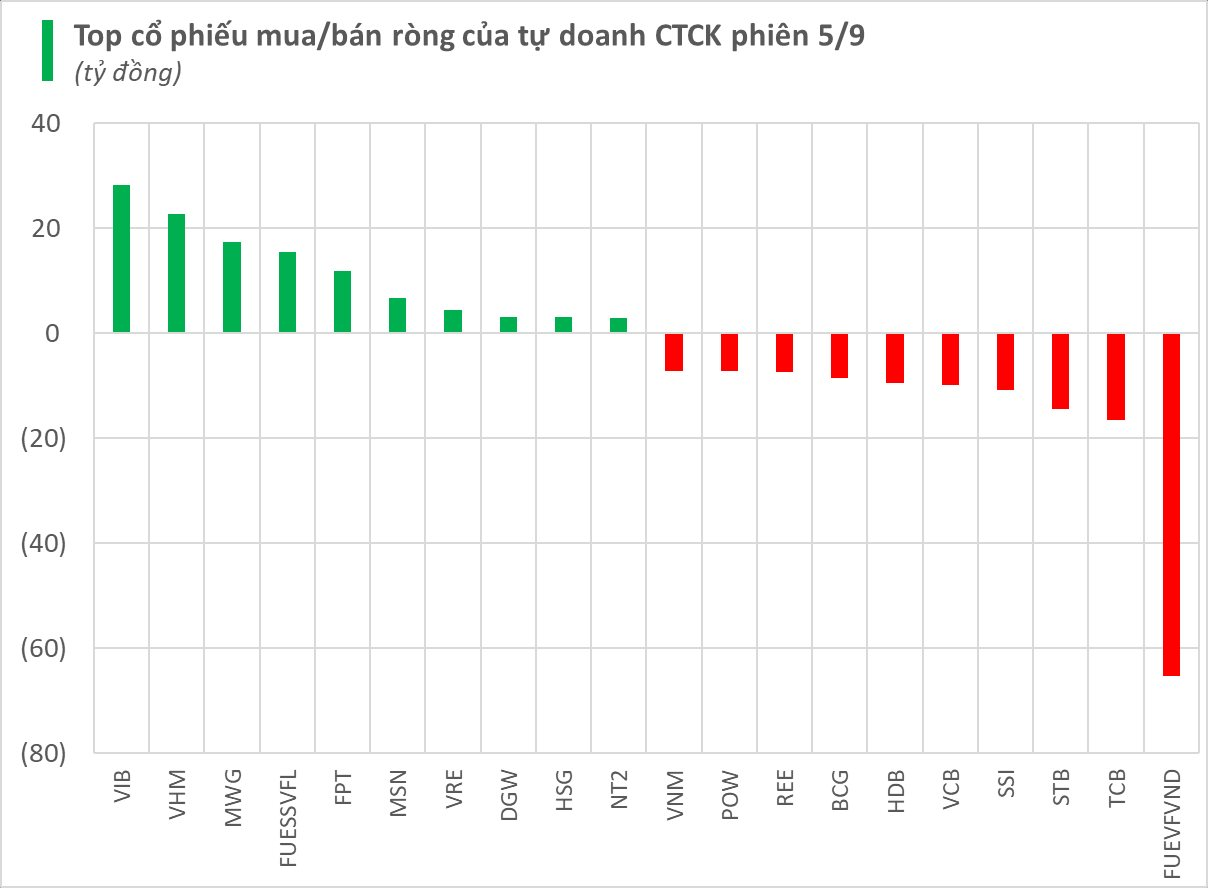

Securities companies’ proprietary trading recorded a net sell-off of VND 130 billion in the market.

On the HoSE, securities companies’ proprietary trading recorded a net sell-off of VND 127 billion, with VND 108 billion sold on the matching order channel and VND 19 billion on the negotiated deal channel.

Specifically, the securities companies with the highest net selling were recorded at FUEVFVND with VND 65 billion, while TCB and STB were also net sold off at VND 17 billion and VND 14 billion, respectively. Additionally, SSI, VCB, HDB, BCG, and others experienced net selling during the September 5 session.

Conversely, the securities companies with the highest net buying were recorded at VIB with VND 28 billion. Two other stocks, MWG and VHM, were also net bought with VND 17 billion and VND 23 billion, respectively. FPT, MSN, VRE, and FUESSVFL were among the stocks that were net bought during today’s session.

On the UPCoM, securities companies’ proprietary trading recorded a net sell-off of VND 2 billion, with BCR being the focal point as it experienced a net sell-off of over VND 1 billion, while QTP also witnessed a mild net sell-off.

Tomorrow’s Stock Market Outlook: Will the Force of Bottom-Fishing Persist?

“The stock market witnessed a late surge of buying activity on September 4th, as bargain hunters stepped in to take advantage of the dip. This bottom-fishing pushed the market to trim its losses, instilling hope among investors that this trend could persist and potentially pave the way for a market rebound.”