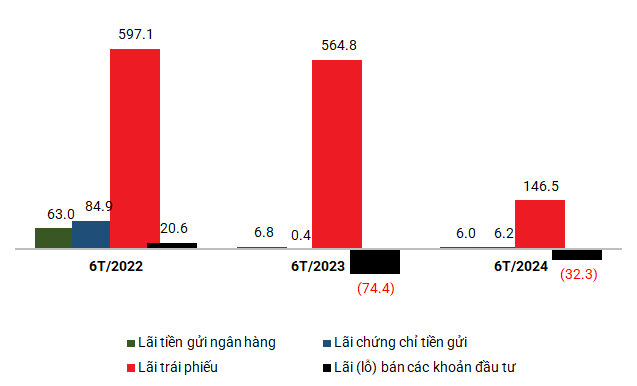

The main reason for the decline is the decrease in investment income, which stood at VND 291 billion, an 85% drop. Interest income for the period was VND 159 billion, a 72% decrease. Interest income from bonds was just over VND 146 billion, significantly lower than the VND 565 billion and VND 597 billion received in the same periods in 2023 and 2022, respectively. Interest from bank deposits and certificate of deposits amounted to nearly VND 6 billion and VND 6.2 billion, respectively.

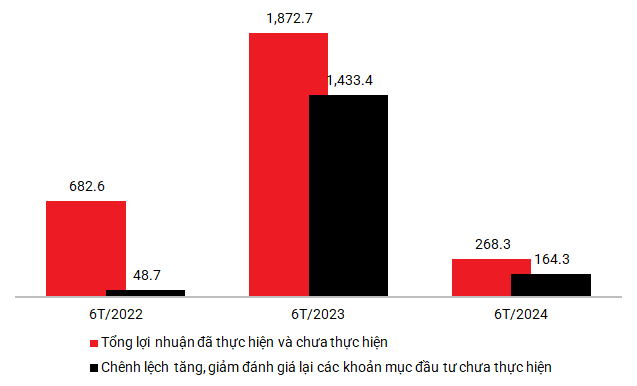

Notably, the unrealized investment gains for the first half of 2023 totaled VND 1,400 billion, while the figure for the same period this year was only VND 164 billion, making a significant difference in the final profit.

|

Changes in investment income and interest of TCBF fund (in VND billion)

Source: Author’s compilation

|

|

Changes in profit and unrealized investment gains of TCBF fund (in VND billion)

Source: Author’s compilation

|

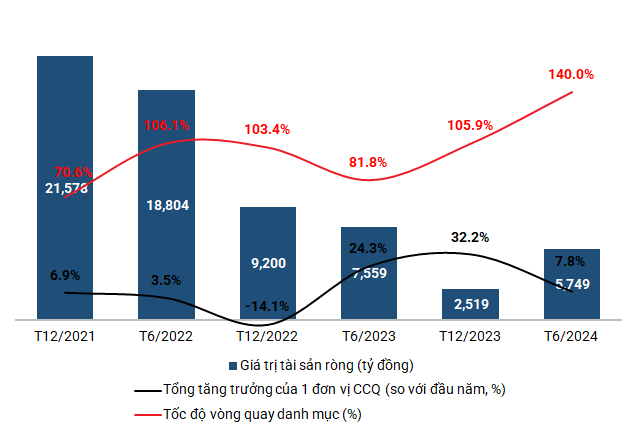

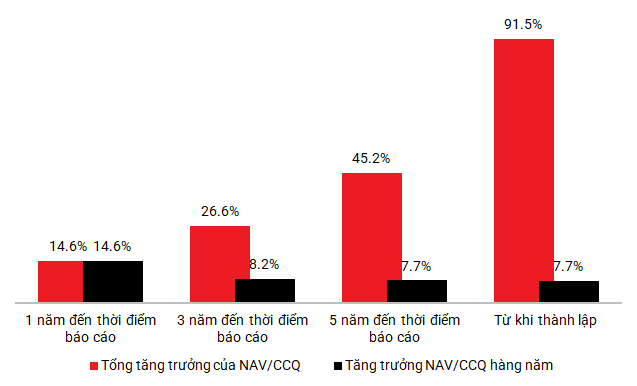

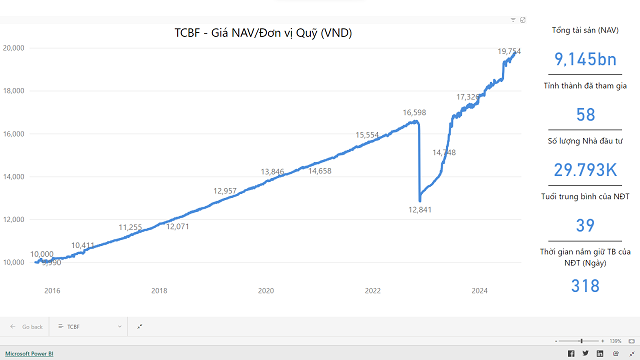

As of June 30, 2024, investor capital in TCBF reached approximately VND 3,000 billion (par value), equivalent to 300 million fund certificates (CCQ), and doubled since the beginning of the year. This brought the owner’s equity to over VND 5,700 billion, a 2.3 times increase. The net asset value per CCQ (NAV/CCQ) reached VND 19,151, a 7.7% increase.

Total fund assets amounted to VND 5,800 billion, a 2.3 times increase. Of this, 81% were pure investments, an increase of about VND 2,700 billion since the beginning of the year. Investments in bonds accounted for nearly VND 2,900 billion, an increase of VND 1,000 billion, representing nearly 48% of total fund assets.

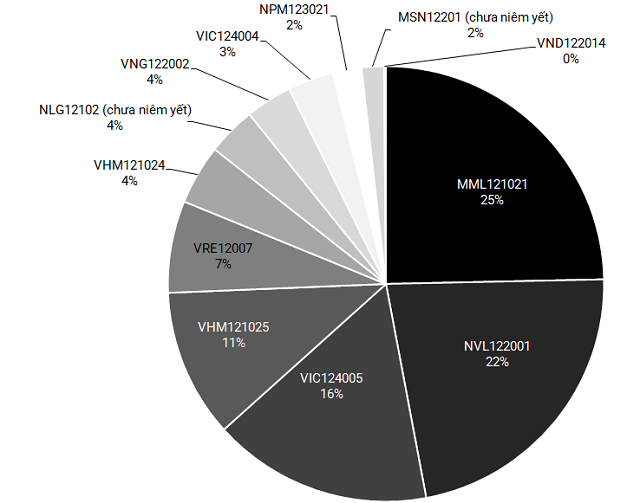

TCBF’s largest holding is the MML121021 bond of Masan MeatLife (UPCoM: MML), with a market value of approximately VND 728 billion (about VND 92,000/tp) as of June 30, 2024, representing 12.5% of the total fund assets. This is followed by the NVL122001 bond of No Va Real Estate Investment Group (HOSE: NVL) valued at VND 660 billion (about VND 72,500/tp), accounting for 11.3%. Other codes such as VIC124005, VHM121025, and VRE12007 had market values of VND 481 billion, VND 325 billion, and VND 201 billion, respectively.

|

Bond portfolio structure held by TCBF fund as of June 30, 2024

Source: Author’s compilation

|

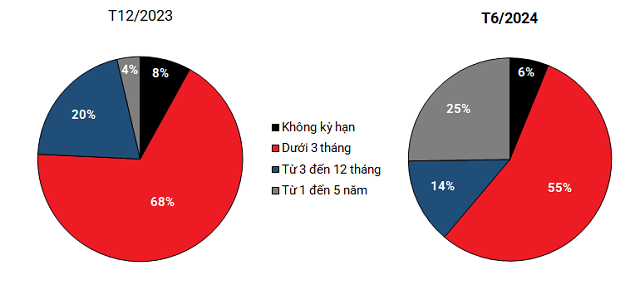

TCBF’s assets also included nearly VND 1,800 billion in certificate of deposits, while there were none at the beginning of the year. Term deposits with a maturity of less than three months reached VND 500 billion, a threefold increase.

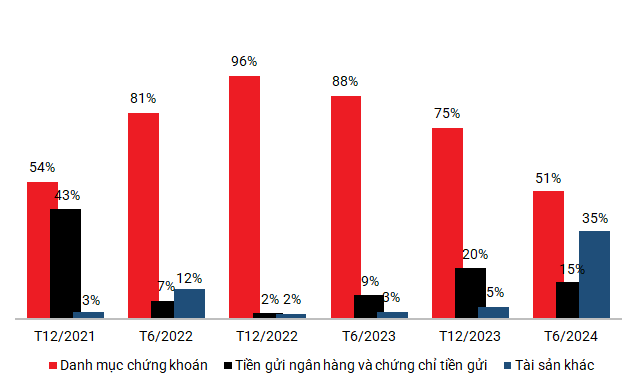

The securities portfolio at the end of the period was significantly reduced, accounting for 50.5% of the fund’s assets, compared to 87.8% a year earlier. In contrast, the proportion of bank deposits, certificate of deposits, and other assets increased substantially, accounting for 14.7% and 34.8%, respectively.

The growth rate of one CCQ increased by 7.8% compared to the beginning of the year and 14.6% compared to June 30, 2023. This is lower than the 24.3% growth rate in the first half of last year and the 32.2% growth for the full year 2023. The portfolio turnover rate for the first half of 2024 reached 140%, the highest since 2018. The operating expense ratio was 1.4%, slightly higher than the 1.3% in the same period last year.

TCBF fund was established in 2015 with an initial capital of approximately VND 60 billion raised through the initial public offering of fund certificates. The fund is managed by Techcom Capital Joint Stock Company. TCBF’s investment objective is to provide long-term profits through capital growth and income by primarily investing in bills, corporate bonds, government-guaranteed bonds, local government bonds, and other fixed-income instruments such as term deposits.

As of June 30, 2024, the fund had more than 26,300 investors, including nominee accounts. The top 10 investors held 5.8% of the total outstanding fund certificates, down from 7% in May. Foreign ownership stood at 1.2%.

|

Changes in net asset value and growth rate of TCBF from 2021 to present (in VND billion)

Source: Author’s compilation

|

|

Changes in asset portfolio of TCBF from 2021 to present

Source: Author’s compilation

|

|

Changes in TCBF’s asset structure by liquidity

Source: Author’s compilation

|

|

Growth rates of TCBF fund over different periods

Source: Author’s compilation

|

Changes in NAV/CCQ of TCBF fund from 2015 to present. Source: Techcom Capital

|

A Life Insurance Company Loses Nearly $250 Million

FWD Life Insurance Company Limited (FWD Vietnam) has released its financial report for the six-month accounting period ending June 30, 2024.

Which Lottery Company is Depositing Billions in the Bank?

In 2023, lottery companies across the nation collectively held an astonishing amount of money in their bank deposits, totaling thousands of billions of VND. These lottery companies typically opt for short-term deposits with maturities of less than 12 months, earning interest rates ranging from 3.7% to 7.25%.