Will the Fed Cut Rates in September?

Vo Kim Phung, Head of Analysis at BETA Securities, believes that the Fed will likely cut rates in September. However, the reduction might not be significant, and there could be a delay as the US economy still shows signs of strength, reflected in the GDP growth and core CPI for Q2 after reassessment.

The job market is also an essential factor influencing the rate cut decision, as it has cooled down recently but remains resilient, making a substantial cut this year less likely.

|

Dao Hong Duong, Director of Industry and Stock Analysis at VPBank Securities (VPBankS), shares a similar view, stating that the Fed is moving closer to a rate cut. Investors are betting on the first reduction in September, but whether it will be 0.25% or 0.5% could make a difference in market reaction.

Regarding the Vietnamese stock market, the Fed’s loosening policy could have a prolonged positive impact. The Fed’s move will influence the ECB’s monetary policy and curb the strength of the US dollar, reducing pressure on Vietnam’s exchange rate. With manageable exchange rates, Vietnam will have more room for monetary policy to continue promoting credit and economic growth goals in Q4/2024.

Reaching the 1,300-point mark again?

According to Mr. Duong, the stock market is likely to fluctuate with a positive sentiment if the Fed cuts rates as expected. The VN-Index has the opportunity to reconquer the 1,300-point threshold, with capital flowing into pivotal sectors such as banking, securities, steel, real estate, and retail.

From a technical analysis perspective, Mr. Phung assesses that the VN-Index maintains a positive trend in the short and medium term, staying above critical moving averages. Technical indicators like SAR, MACD, and DI+ and DI- pairs continue to signal optimism. However, trend strength is waning, shifting to a state of accumulation as it approaches the old peak of 1,290 – 1,300 points.

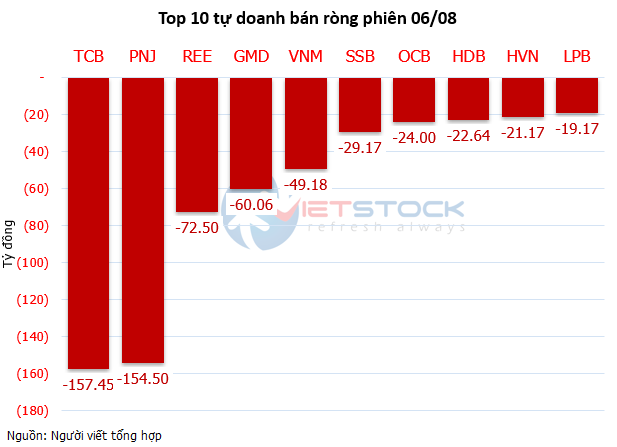

Mr. Phung predicts that the chance to conquer the old peak will become clearer in the second half of September, with supportive factors such as the Fed’s almost certain rate cut, easing exchange rate pressure, and attractive capital flows. Furthermore, if foreign investors return to stable net buying, it would be a significant boost for the VN-Index to break through the 1,300-point mark.

Numerous choices, but caution is necessary

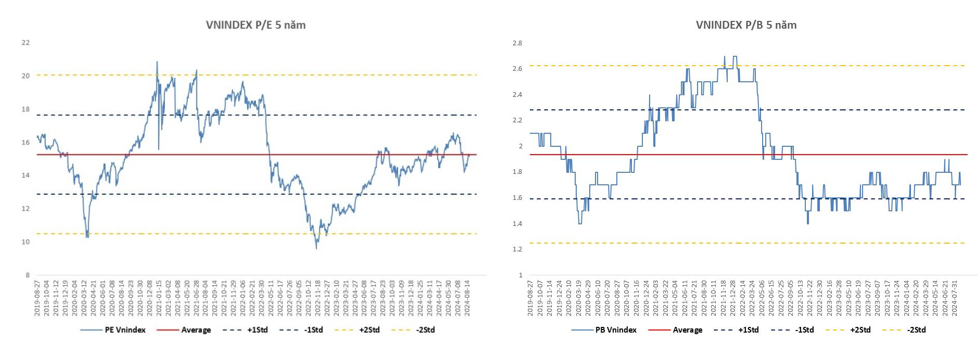

Mr. Phung analyzes that the market’s P/E and P/B ratios are slightly lower than the five-year average, indicating that the market is not cheap. Therefore, a selective approach is advisable, investing in stocks with solid growth potential, strong fundamentals, transparent governance, and reasonable valuations.

Source: BETA Research

|

For the second half of 2024, Mr. Phung maintains a positive outlook. Specifically, for September 2024, investors should pay attention to the FOMC meeting and the anticipated Fed rate cut. These are positive factors for the medium and long term, but short-term volatility cannot be ruled out. Thus, a prudent investment strategy entails realizing partial profits on stocks that have met their targets and waiting for opportune moments to accumulate shares of companies with promising prospects and robust recovery in the banking, retail (consumer goods), industrial parks, fertilizer, port, seafood, and textile sectors.

Mr. Duong suggests a strategy of value investing combined with flexible asset allocation to mitigate the impact of unpredictable international market fluctuations on the Vietnamese stock market. Portfolio diversification across sectors and stocks helps manage short-term risks.

In the banking sector, growth drivers include expectations of differentiation among banks in terms of credit growth and their pursuit of 2024 business targets. However, investors should be mindful of individual stock valuations.

The financial services sector, led by securities stocks, offers attractive valuations and promising profit and asset growth prospects in the context of monetary easing trends. Capital increases and dividend payments in the form of stock dividends will create supportive news flow, attracting capital inflows.

The industrial real estate sector will present exceptional growth opportunities due to reasonable valuations and unique revenue and profit recognition practices.

In the retail sector, besides the recovery in consumer demand, companies have restructured and established strategies and segments, and price wars have essentially cooled down. Retail profits are expected to continue surging in the second half of 2024 and maintain growth momentum over the long term.

The residential real estate sector is not expected to see significant breakthroughs due to the slow recovery of the real estate market, but there are optimistic signs as sales activities and revenue recognition tend to become more vibrant towards the year-end.

Additionally, sectors like oil and gas, electricity, transportation, construction, and building materials will offer numerous investment opportunities based on individual stock stories.

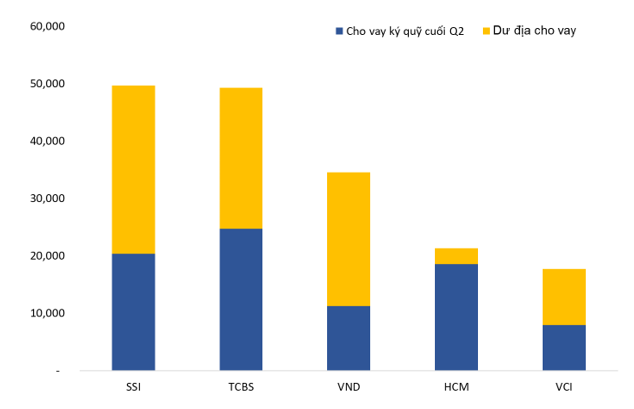

Implementing Pre-funding Products for Short-Term Psychology

Mr. Phung considers the removal of the Pre-funding (pre-trade funding) bottleneck as a short-term psychological effect, as the time from actual implementation to recognition by FTSE as an emerging market is still lengthy. Securities companies will introduce products to support settlement for foreign institutional investors, but they must consider the potential for failed trades when buyers cannot fulfill their payment obligations. Similar to margin lending, securities companies need to prepare countervailing capital to provide limits for each customer. This puts pressure on securities companies with a large number of foreign institutional investors, such as VCI, HCM, and SSI.

|

Capital Sources for Lending of Securities Companies with a Large Number of Foreign Investors

Unit: VND billion

Source: BETA Research

|

According to Mr. Phung, September 2024 is also when FTSE releases its market assessment report. After introducing new products, securities companies will need time to operate, fix issues, and this process could extend until March 2025. Subsequently, an evaluation will be necessary to determine the effectiveness of the products and the market’s ability to clearly anticipate the September 2025 assessment period.

Currently, the market is more focused on the four circulars of the Ministry of Finance regarding trading and information disclosure. The first draft was released in March 2024, and the final draft for feedback was published in August. The market awaits their approval.

Mr. Duong believes that the information surrounding the potential market upgrade and the Fed’s rate cut could positively influence the psychology of both domestic and foreign investors but may not create a surprise factor.

Tomorrow’s Stock Market Outlook: Will the Force of Bottom-Fishing Persist?

“The stock market witnessed a late surge of buying activity on September 4th, as bargain hunters stepped in to take advantage of the dip. This bottom-fishing pushed the market to trim its losses, instilling hope among investors that this trend could persist and potentially pave the way for a market rebound.”