Source: VietstockFinance

|

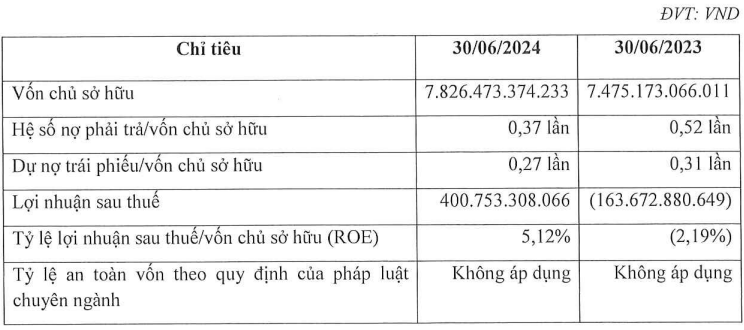

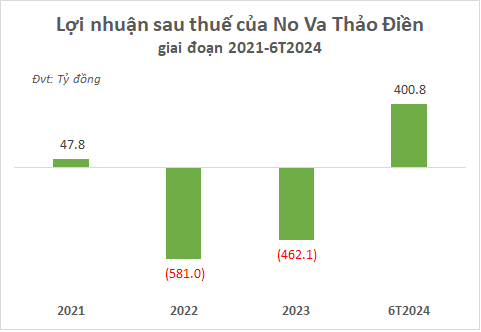

As of June 31, 2024, No Va Thao Dien’s total assets amounted to over VND 10.7 trillion, a nearly 6% decrease compared to the previous year. Its liabilities also witnessed a 26% reduction, standing at nearly VND 2.9 trillion.

|

Financial Overview of No Va Thao Dien as of June 30, 2024

Source: HNX

|

No Va Thao Dien currently has only one bond issue in circulation, NTDCH2227001, with a value of VND 2.3 trillion. It was issued on September 5, 2022, and will mature on September 5, 2027, carrying an interest rate of 10.5% per annum. According to the company’s disclosure, the outstanding balance of this bond issue stood at over VND 2.1 trillion as of June 30, 2024.

In relation to this bond, Novaland’s Board of Directors approved a resolution in August 2022 to utilize the company’s assets as collateral for No Va Thao Dien’s capital mobilization efforts.

NVL pledged 54 land-use right certificates covering a total area of 93,240 square meters in Thanh My Loi Ward, Thu Duc City, Ho Chi Minh City, to guarantee the payment and other obligations related to the bond issue of up to VND 2.3 trillion and a credit facility of VND 100 million from SCB extended to No Va Thao Dien.

Why is the disbursement of the VND120 trillion package for social housing construction still slow?

The Ministry of Construction has reported to the Prime Minister on the progress of the proposal to develop and invest in the construction of at least one million social housing units during the period of 2021 to 2030.