Despite the release of August macroeconomic figures earlier in the day, the market still experienced a significant downward slide in stock prices until the early afternoon session. The indices did not show a substantial drop thanks to some supportive factors, but the continuous discounting of stocks created attractive buying opportunities. As selling signals gradually faded, buying demand increased, leading to a decent market recovery.

The external factors that have been influencing the market started to wane today, giving way to emerging supportive information. An early indicator was the low liquidity in the afternoon session, with the HSX matching just over 5.1k billion, a significant decrease compared to the previous two panic-stricken sessions. The wide range of stock price declines was due to buyers continuing to await deeper price levels rather than excessive selling creating pressure.

Although the VNI and many stocks hit their lowest prices around the early afternoon session, quite a few stocks had already reached their lows in the morning. When prices stopped declining amidst very low liquidity, it indicated a temporary balance between supply and demand at that point. The overall breadth didn’t clearly show this, but a closer look at individual stocks did. Therefore, the bottom-fishing point for stocks didn’t coincide with the index’s low point. As the index turned upward, stocks that had bottomed out earlier started to rise first and more robustly.

The most critical question now is whether supply and demand have truly balanced out. Just one morning session of declining liquidity followed by a recovery towards the close isn’t a definitive signal. However, this perspective applies to the overall market, and for individual stocks, there is a high probability that today marked a bottom. Even if the market experiences some “test” sessions to gauge supply in the coming days, the strong stocks are very unlikely to break today’s lows. The next intraday declines following today’s session, if accompanied by low liquidity or narrow price ranges, will be strong signals. Searching for such stocks provides a safer approach to bottom-fishing instead of blindly following the index’s bottom signals.

On the other hand, this is the stage to gradually cover previously sold stocks, not to increase surplus. This buying-back process is usually done leisurely over several sessions, choosing moments when prices retreat instead of chasing them higher. A common effect is for prices to oscillate with fluctuating liquidity. Over several sessions, the bottom consolidation region will become more apparent.

In summary, today’s reversal signal is a positive indication, ending the short-term panic. The market will gradually shift its focus to the currently positive internal factors rather than external global fluctuations. When the market discovers new narratives to build expectations, sentiment will also stabilize.

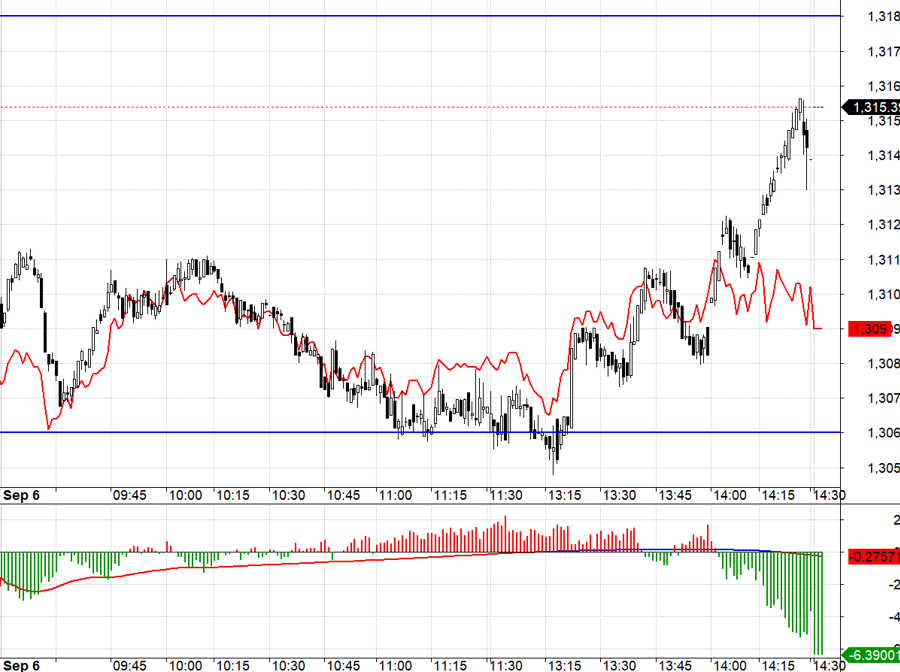

There was a significant change in the basis F1 in the derivatives market today, as it contracted and showed negligible deviation. VN30 still declined at the start of the session, but when the index approached 1306.xx, the basis became very tight. This was a good long opportunity, as the market was likely to react positively to the release of August macroeconomic information this morning. However, the subsequent recovery move was rather disappointing, and while longs initially made some gains, the subsequent slide meant that those who didn’t exit quickly didn’t profit much. The second time VN30 retested 1306.xx towards the end of the morning session and even slightly breached it at the start of the afternoon session, the basis turned positive. This was a strong signal indicating the entry of longs, and this time with more conviction than the early morning move. This setup was also favorable for going long. In this move, F1 rose nicely alongside VN30, but when the index surpassed the morning’s high and headed towards 1318.xx, the basis reversed again. A deviation of more than 5 points is quite uncomfortable, suggesting that the derivatives market also didn’t have much faith in this upward pull, opting to close positions prematurely.

Today’s bottom-fishing and recovery move was quite successful, especially for specific stocks. Therefore, there’s no need to be overly euphoric, as the market will likely undergo more supply-testing sessions. The strategy is to focus on stock-picking, adopt a flexible long/short approach with derivatives, and prioritize long positions.

VN30 closed today at 1315.39. The nearest resistance levels for the next session are 1318; 1327; 1336; 1346; 1350; 1358. Supports are at 1306; 1302; 1292; 1279.

“Stock Market Blog” reflects the personal views and opinions of the author and does not represent the views of VnEconomy. The opinions and assessments expressed are those of the individual investor, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the investment opinions and perspectives presented in this blog.

“I’d Still Buy Land If I Had the Money”

“I’m sitting on multiple real estate assets, but I’m struggling to sell them. It’s a challenging position to be in, and I know I’m not alone. The market is flooded with similar properties, and buyers have the upper hand. It’s a tricky situation, and I’m considering my options carefully.”

Home Buyers Seize the Long Weekend to House Hunt

With a knack for crafting compelling content, I am here to transform your introduction.

“Our savvy real estate agents in Ho Chi Minh City seize the holiday break to showcase houses, lands, and apartments to prospective buyers. This festive period also witnesses a surge in property viewings, making it an opportune time for both agents and clients alike.”