HPG Stock Plunge: Unraveling the Seven-Session Slump

HPG stock closed the trading session on September 5th with a nearly 1% decline, settling at 25,050 VND per share. This marked the seventh consecutive session of losses for the stock. Over the past three months, since reaching a two-year peak in mid-June, HPG’s market price has dropped by nearly 15%.

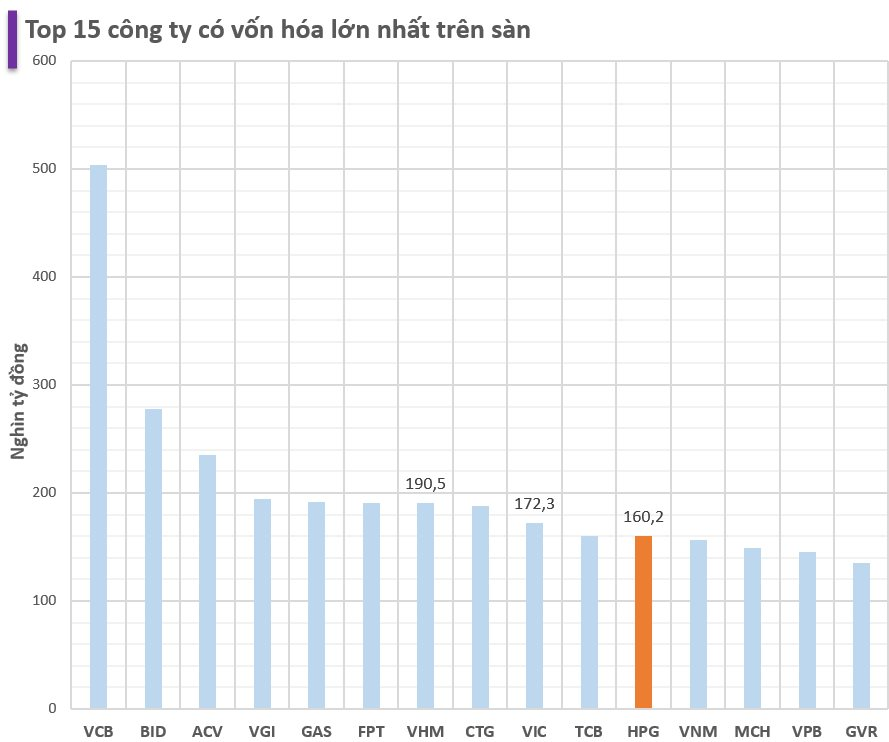

With the current price, Hoa Phat’s market capitalization stands at 160,226 billion VND (approximately 6.3 billion USD). Consequently, Hoa Phat has officially dropped out of the top 10 most valuable companies on the stock market.

The decline in stock price recently is one of the reasons why Hoa Phat is no longer among the top 10 most valuable companies on the stock market. However, companies owned by billionaire Pham Nhat Vuong, such as Vingroup and Vinhomes, have recently witnessed a resurgence in their market capitalization.

Since Vinhomes announced its plan to repurchase 370 million treasury shares in early August, VHM stock has surged by nearly 26%, with a current market cap of 190,600 billion VND. VIC stock has also climbed by about 9%, resulting in a market cap of 172,300 billion VND, an increase of 14,800 billion VND in just one month. Both entities have reclaimed their spots in the top 10 largest companies by market capitalization after a brief hiatus.

FACTORS BEHIND THE RECENT DOWNTURN OF HPG STOCK

Numerous factors have contributed to the decline of HPG stock in recent times. Firstly, foreign investors have been net sellers of HPG stock for 22 consecutive sessions, offloading nearly 2,600 billion VND worth of shares as of the close on September 5th. This marks an unprecedented level of foreign selling in HPG.

Additionally, the global steel industry is experiencing a significant downturn, impacting major steel producers like Hoa Phat. According to data from trading economics, the price of steel rebar futures has dipped below 3,000 CNY per ton, the lowest level in eight years. Similarly, HRC prices have plummeted to a four-year low, falling below 700 USD per ton.

The plunge in global steel prices can be attributed to weak demand coupled with ample supply from China. The widespread oversupply of housing has prompted the Chinese government to curb support for major real estate developers, significantly impacting steel consumption prospects. Chinese mills have turned to overseas customers to offset weak domestic demand. Moreover, the introduction of new quality standards for steel bars in September last year led to a market glut of old inventory, further exacerbating the downward pressure on prices.

In addition to the aforementioned factors, Hoa Phat is facing another challenge as the Vietnamese steel industry receives some unfavorable news. The European Commission (EC) and India’s Directorate General of Trade Remedies (DGTR) have initiated anti-dumping investigations into certain hot-rolled steel products originating from or exported from Vietnam.

HOA PHAT’S FUTURE PROSPECTS

In a recent report, Rong Viet Securities (VDSC) anticipates that the domestic steel market will maintain its recovery momentum, supporting the sales volume of steel companies in the second half of 2024. This is particularly true as construction activity intensifies, the real estate market rebounds, and the peak construction season in Q4 approaches.

Regarding the export market (mainly for HRC products), despite the European Union’s anti-dumping investigation into HRC products originating from Vietnam, VDSC believes that Hoa Phat will proactively redirect orders to meet the demands of domestic coated steel companies. As a result, Hoa Phat’s sales volume in the latter half of 2024 is expected to reach 4.5 million tons, marking a 7% increase compared to the same period last year. This figure comprises 2.4 million tons of construction steel (a 13% year-over-year increase) and 1.5 million tons of HRC (unchanged from 2023).

Furthermore, while the average selling price is projected to decrease by 10% compared to the first half due to China’s influence, the corresponding decline in the cost of raw materials will enable Hoa Phat to maintain a gross profit margin of 13%, consistent with the first six months of 2024.

VDSC forecasts that Hoa Phat’s revenue and gross profit for the last six months of 2024 will reach 67,800 billion VND and 8,800 billion VND, respectively, representing an 8% and 10% year-over-year increase. In terms of profitability, the analyst team expects a net profit of 5,800 billion VND for the second half, indicating a 16% year-over-year improvement.

For the full year 2024, VDSC projects that HPG’s net profit will reach 12,000 billion VND, a substantial increase of 77% compared to the previous year. The corresponding EPS is expected to be 1,775 VND.

Regarding the progress of the Hoa Phat Dung Quat 2 steel complex project, Mr. Mai Van Ha, Director of Hoa Phat Dung Quat Steel, shared that the project has completed 80% of the first phase and 50% of the second phase. The first phase is expected to finish the installation of equipment for the hot-rolled steel production line in mid-September 2024, followed by cold testing and equipment calibration. According to the current progress, the first phase is anticipated to produce the first trial heat by the end of 2024.

VDSC assesses that the project’s construction progress aligns with expectations, and Dung Quat 2 is on track to commence commercial production in Q1/2025. The plant is expected to operate at a relatively high efficiency in 2025 (80% for phase 1, equivalent to 2.2 million tons), with HPG’s HRC output potentially reaching 5 million tons in 2025, a 67% year-over-year increase. This will meet approximately 40% of Vietnam’s HRC demand.

Is the Steel Industry Losing its Shine?

The HPG stock has witnessed a net foreign selling streak for 13 consecutive sessions, amounting to a substantial net sell-off value of VND 1,419 billion. Likewise, the HSG stock has endured a similar fate, facing consistent net selling for 10 sessions, resulting in a notable net sell-off value of VND 264 billion.