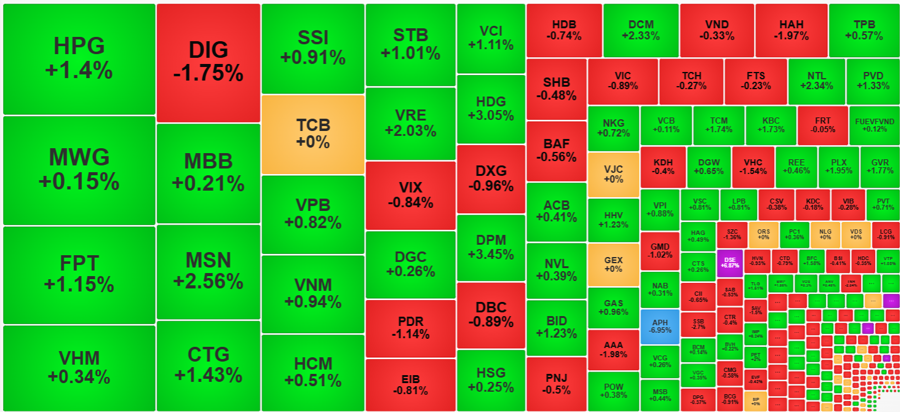

The positive macroeconomic data released this morning had a delayed positive impact on the market. Bottom-fishing funds actively pushed up stock prices, with the matched transaction value on the two exchanges increasing by over 39% compared to the morning session. This was accompanied by a quick rebound of many large-cap stocks, leading the VN-Index to climb continuously and close at the highest level of the day.

From a deep loss of more than 5 points in the early afternoon session, the VN-Index recovered quite dramatically, closing with a gain of 5.75 points (+0.45%). The recovery margin was not large, partly due to a lack of clear consensus among large-cap stocks.

The VN30-Index also closed up 0.48% with 22 gainers and 6 losers. This was a reversal from the morning session, which had 9 gainers and 14 losers. Statistics showed that 20 out of 30 blue-chip stocks improved their prices in the afternoon, with only 8 stocks falling further. Among these 8 stocks, only SSB was notable, falling by 1.1% compared to the morning session and closing down by 2.7% compared to the reference price. SSB had a relatively small impact, causing the VN-Index to lose 0.3 points and the VN30-Index to lose 0.8 points.

On the other hand, several stocks recorded good gains. CTG, for instance, rose by 2.31% in the afternoon alone, reversing its fortunes to end the day 1.43% higher than the reference price. MSN, which had already gained 0.27% in the morning, added another 2.29% in the afternoon to close 2.56% higher. VHM also staged a successful comeback, rising by 1.39% in the afternoon and ending the day 0.34% above the reference price. VRE, BCM, GVR, MWG, PLX, POW, SSI, and STB were other stocks that traded robustly in the afternoon.

However, it is worth noting that the strongest stocks in the afternoon were not all top large-cap stocks. Out of the 10 largest stocks by market capitalization, only BID rose by 1.23%, FPT by 1.15%, CTG by 1.43%, and HPG by 1.4%. VCB, GAS, and VHM posted limited gains, while TCB remained unchanged and VIC fell by 0.89%. The lack of consensus among these large-cap stocks resulted in a somewhat limited recovery for the VN-Index.

Moreover, the positive impact of the large-cap stocks’ rebound did not spread widely. While the market breadth improved significantly from the morning session, with 192 gainers and 212 losers (compared to 73 gainers and 287 losers in the morning), the number of losers still outnumbered the gainers. Among the gainers, 64 stocks rose by more than 1%, and the most liquid stocks were mostly large-cap stocks such as HPG, FPT, CTG, STB, VRE, and BID. Mid-cap stocks with notable gains included VCI, up 1.11%; HDG, up 3.05%; DPM, up 3.45%; DCM, up 2.33%; and NTL, up 2.34%, all with high liquidity. The concentration of capital was very high, with these 64 strong performers accounting for approximately 3,600 billion VND in total transaction value, of which nearly 80% was concentrated in the top 10 stocks.

With the market breadth just reaching a balanced level, the recovery in the afternoon was notable for the ability of stocks to rise in price. The stronger the upward movement, the better, especially since the vast majority of stocks formed a deep bottom at the beginning of the afternoon session, before the upward climb began. Statistics showed that 180 stocks on the HoSE recorded a recovery of at least 1% from their intraday lows, equivalent to 49.5% of the total number of stocks traded. This high proportion indicates that bottom-fishers made good profits, regardless of whether stock prices closed in the green or red.

On the downside, while there were still 212 stocks in the red, only 53 stocks fell by more than 1%. Moreover, the liquidity of this group accounted for less than 10% of the total matched transaction value on the HoSE. A few stocks experienced notable selling pressure and continued to face strong downward pressure, including DIG, which fell by 1.75% with a matched value of 417 billion VND; PDR, down 1.14% with 178.6 billion VND; HAH, down 1.97% with 133.9 billion VND; AAA, down 1.98% with 73 billion VND; and VHC, down 1.54% with 61.5 billion VND…