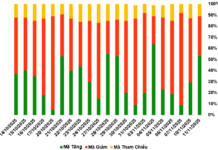

According to statistics from the Ho Chi Minh City Representative Office of the Banking Association, in the past three weeks (from August 19 to September 6, 2024), 9 out of 36 banks adjusted their personal deposit interest rates upwards, while 3 banks made downward adjustments. Some notable examples include:

DongABank adjusted interest rates on certain terms, such as: terms of 1-3 months with interest rates ranging from 3.8% to 4.0% per annum, an increase of about 0.5% compared to before; terms of 6-9 months with interest rates at 5.35% – 5.65% per annum, an increase of 0.7% – 0.8%; and terms of 18-36 months with an interest rate of 6.0% per annum. Notably, for savings deposits of VND 200 billion or more at a term of 13 months with interest payable at maturity, the interest rate is 7.5% per annum. This is also the highest deposit interest rate recorded at DongABank.

VPBank also increased rates by 0.5% for 1-month deposits, bringing the interest rate for this term to 3.5% per annum. Currently, the highest rate at this bank is 5.8% per annum for 24-36 months, applicable to online savings products.

Oceanbank increased rates by 0.4% for 1-3 month terms, offering rates of 3.8% – 4.2% per annum. The highest rate at this bank is currently 6.1% per annum for online savings deposits with terms of 24-36 months.

HDBank raised rates by 0.3% – 0.4% for 1-3 month terms, resulting in rates of 3.35% – 3.45% per annum. The highest savings deposit rate at this bank is 6.1% per annum for 18-month online savings deposits.

The remaining banks also made slight adjustments to their deposit interest rates, increasing them by 0.05% – 0.3% for terms ranging from 1 to 60 months, applicable to both over-the-counter and online savings deposits.

According to the same statistics, three banks made minor reductions in interest rates (by 0.05% – 0.2%) for both over-the-counter and online deposits. These banks include ABBank, Eximbank, and PVcombank.

Overall, in the past three weeks, after a number of banks made adjustments to their personal deposit interest rates (payable at maturity), as of now:

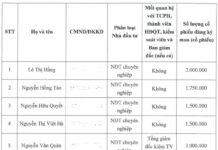

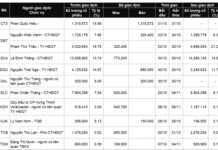

For deposits of VND 200 billion or more, there are four banks offering interest rates of 7.0% per annum or higher, including: MSB, with an interest rate of 7.0% per annum for deposits of VND 500 billion or more; DongABank, offering 7.5% per annum for deposits of VND 200 billion or more; HDBank, with an interest rate of 7.7% per annum for deposits of VND 500 billion or more; and PVcombank, providing an interest rate of 9.5% per annum for deposits of VND 2,000 billion or more. These rates are applicable to over-the-counter deposits with terms of 12-13 months.

For deposits below VND 200 billion: The highest deposit interest rate in the system is 6.1% per annum at five banks, including Saigonbank, Oceanbank, NCB, and SHB, applicable to online deposits with terms of 24-36 months; and HDBank, applicable to online deposits with an 18-month term.

For a 12-month term: The highest interest rate is 5.8% per annum offered by DongABank for over-the-counter deposits.

For a 9-month term: The highest interest rate is 5.5% per annum offered by DongABank for over-the-counter deposits.

For a 6-month term: The highest interest rate is 5.55% per annum offered by CBBank for online deposits.

Is Ho Chi Minh City’s Low Credit Growth a Concern?

As the economic powerhouse of Vietnam, Ho Chi Minh City usually sets the pace for the rest of the country. However, its credit growth rate is currently lagging, falling below the national average.

“Unraveling the Knot: Navigating through Ho Chi Minh City’s Land Price Conundrum”

On the morning of September 10, the Ministry of Natural Resources and Environment’s leadership is set to host a meeting to address pending issues regarding Ho Chi Minh City’s land price framework. The discussion aims to gather insights and reach a consensus, with the outcomes reported to the Prime Minister.