**Interview with Mr. Sergey Chumakovskiy, Chairman of the Members’ Council of VRB**

As VRB approaches its 20th anniversary in Vietnam, VnEconomy had the pleasure of interviewing Mr. Sergey Chumakovskiy, Chairman of the Members’ Council of Vietnam-Russia Joint Stock Commercial Bank (VRB), to discuss the bank’s development strategy for the coming years.

Sir, over the past 18 years, VRB has established itself as a major financial institution in Vietnam, trusted by many Vietnamese and Russian businesses. In your opinion, what are the key factors behind VRB’s success?

VRB officially commenced its operations in November 2006. As a bank established through the cooperation between Vietnam and the Russian Federation, VRB carries a special mission to serve as a financial bridge between the two countries, facilitating payments and promoting economic, trade, and investment cooperation.

Over the past 18 years, VRB has expanded its network to all key provinces and cities in Vietnam, including Hanoi, Haiphong, Khanh Hoa, Danang, Ho Chi Minh City, and Vung Tau.

With the motto “Connecting Success, Accompanying Development,” VRB strives to support, connect, and provide financial services to intergovernmental cooperation projects while becoming a trusted partner for businesses and individuals with bilateral trade and investment activities between Vietnam and Russia.

Vietnam and the Russian Federation have always been important and promising partners. Understanding our mission, we have been dedicated to playing the role of a financial bridge, contributing to the economic, trade, and investment development between the two countries, and promoting bilateral trade growth.

Through seminars, conferences, and the Russian Export Center, VRB has provided consulting and connection support to businesses from both countries, opening doors for importers and exporters to access and penetrate each other’s markets and expand cooperation between Russian enterprises and the Vietnamese market, particularly the ASEAN market.

As a joint venture bank between the two countries and a financial institution, VRB has participated in interbank meetings between the two nations and their governments. We have addressed challenges in trade and investment activities and proactively proposed solutions to support businesses, aiming at increasing bilateral trade turnover.

As a financial bridge between the two countries, VRB offers convenient and secure payment solutions in local currencies, promoting the import and export of strong products from each country into the Vietnamese and Russian markets.

Additionally, VRB provides foreign exchange services in RUB, such as cash buying and selling and transfers. Enterprises can also seek advice on the most profitable foreign exchange business plans to minimize risks associated with exchange rates and interest rates in the market.

In your opinion, what are the current challenges facing the banking industry in general and VRB in particular?

The world and Vietnam are currently facing numerous fluctuations. Globally, there are geopolitical tensions, high-interest rates, and debt risks, along with energy, food, and climate security challenges.

Domestically, in addition to international risks and challenges, businesses are still facing difficulties due to the pandemic. Private consumption and investment demand remain low, while bad debt and exchange rate pressures have increased, although they are basically under control. The gold market is also experiencing fluctuations, and the restructuring of the economy is slow.

These factors pose significant challenges to the operations of the banking industry, including VRB. For VRB, disruptions in transportation and trade due to geopolitical conflicts impact import-export businesses, which indirectly affects VRB’s activities.

Despite these challenges, we are committed to achieving the significant goals set by VRB. We are developing specific products to serve the needs of individuals and import-export businesses.

With our extensive market experience and understanding of the Russian market, VRB offers tailored advice, products, and services to meet the needs of customers operating in or related to the Russian market.

In addition to our product and service offerings, our people are one of our key strengths. VRB boasts a dynamic and passionate young workforce, ensuring that customers have a satisfying experience when choosing VRB.

VRB focuses on two main areas: retail and small and medium-sized enterprises (SMEs). In the retail sector, we provide products that cater to the personal and business development needs of individuals and households, such as business household loans, home loans, auto loans, and overdraft facilities. For SMEs, VRB offers timely interest rate support packages, convenient payment solutions, and customized borrowing strategies.

With the governance of the State Bank and the government, along with the expected economic recovery, I am optimistic that the second half of 2024 will bring many opportunities for the banking industry and VRB.

I hope that 2024 will be a successful year for VRB, enabling us to excel in our business goals and continue supporting and accompanying businesses from both countries.

VRB will celebrate its 20th anniversary in two years. What are your plans for the bank’s future?

As we approach VRB’s 20th anniversary, our vision is to establish VRB as one of the leading banks in Vietnam and a trusted partner for all our clients. We aim to create a joyful and happy working environment for our employees.

To achieve these goals, VRB is committed to building a financial and lifestyle ecosystem that serves the diverse needs of our customers. We are focused on developing a digital banking strategy, expanding our customer base, and repositioning the bank according to Basel standards.

Sure, I can assist with that.

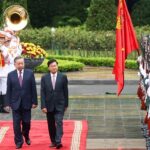

The President of Laos Welcomed by Vietnamese Counterpart, Mr. Tô Lâm

On the morning of September 10, a grand welcoming ceremony was held at the Presidential Palace for General Secretary and President of Laos, Thongloun Sisoulith, his wife, and the high-level delegation from the Lao People’s Democratic Republic. The event was conducted with the highest protocol afforded to a visiting head of state.

“Vietnamese Businesses Need to Ramp Up Investments in Russia to Match the Bilateral Relationship’s Potential”

The parliamentary leader encouraged the business community to remain united and law-abiding, adhering to Russian legal standards. He emphasized their role in fostering development within the Russian Federation and their native Vietnam, thus strengthening the bilateral comprehensive strategic partnership between the two nations.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)